Intro

Determining whether a salary of $26 an hour is good for you depends on several factors, including your location, industry, level of experience, and personal financial goals. To help you decide, let's break down the key considerations.

First, it's essential to understand that $26 an hour translates to an annual salary of around $54,000, assuming a 40-hour workweek and 52 weeks of work per year. While this may seem like a decent income, its purchasing power varies significantly depending on where you live. For instance, $54,000 can go a long way in some parts of the Midwest or the South, but it may not be enough to cover the high cost of living in cities like New York or San Francisco.

Another crucial factor to consider is your industry and level of experience. In some fields, $26 an hour may be an excellent starting point for entry-level positions, while in others, it may be below the average salary for someone with several years of experience.

To give you a better idea, here are some average hourly wages in the United States for different industries:

- Healthcare: $25-$40 per hour

- Technology: $30-$60 per hour

- Finance: $25-$50 per hour

- Education: $20-$40 per hour

- Manufacturing: $20-$35 per hour

As you can see, $26 an hour falls within the average range for many industries, but it's essential to research the specific market conditions in your area to determine if it's a competitive salary.

Cost of Living and Personal Finances

Your personal financial situation and cost of living also play a significant role in determining whether $26 an hour is a good salary for you. If you have high expenses, such as student loans, credit card debt, or a mortgage, you may need a higher salary to cover your costs.

On the other hand, if you're frugal and have a low cost of living, $26 an hour may be sufficient to support your lifestyle. Consider factors like your housing costs, transportation expenses, and food budget to determine if this salary will allow you to meet your financial goals.

Benefits and Perks

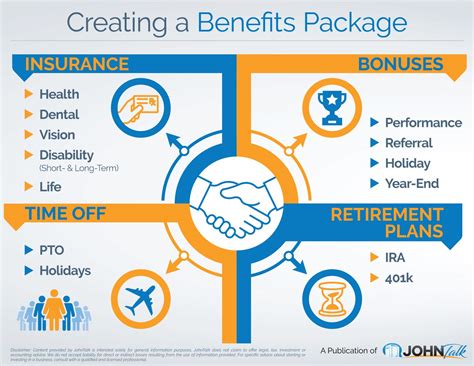

In addition to your hourly wage, consider the benefits and perks that come with your job. Do you receive health insurance, retirement contributions, or paid time off? These benefits can significantly impact your overall compensation package and may make a lower hourly wage more attractive.

Industry Standards and Growth Opportunities

Finally, consider the industry standards and growth opportunities in your field. If you're in a rapidly growing industry with a high demand for skilled workers, you may be able to negotiate a higher salary or expect regular raises.

On the other hand, if you're in a slow-growing industry with limited job opportunities, you may need to be more flexible with your salary expectations.

Negotiating Your Salary

If you're considering a job offer with a salary of $26 an hour, don't be afraid to negotiate. Research the market conditions, highlight your skills and experience, and make a strong case for why you deserve a higher salary.

Remember, your salary is just one aspect of your overall compensation package. Consider the benefits, perks, and growth opportunities when evaluating a job offer.

Conclusion

Whether $26 an hour is a good salary for you depends on various factors, including your location, industry, experience, and personal financial goals. By considering these factors and researching the market conditions, you can make an informed decision about whether this salary is sufficient for your needs.

Remember to also consider the benefits, perks, and growth opportunities that come with your job, and don't be afraid to negotiate your salary if you feel it's necessary.

What is the average hourly wage in the United States?

+The average hourly wage in the United States varies depending on the industry, location, and level of experience. However, according to the Bureau of Labor Statistics, the average hourly wage for all occupations was $25.72 in May 2020.

How do I negotiate my salary?

+To negotiate your salary, research the market conditions, highlight your skills and experience, and make a strong case for why you deserve a higher salary. Be confident and assertive, but also be respectful and open to compromise.

What benefits should I consider when evaluating a job offer?

+When evaluating a job offer, consider the benefits, perks, and growth opportunities that come with the job. This may include health insurance, retirement contributions, paid time off, and opportunities for professional development and advancement.