Intro

Calculate your annual salary with ease! Discover how much $29/hour translates to in yearly earnings, including overtime pay and deductions. Learn how to convert hourly wages to annual salary, and explore the impact of taxes, benefits, and deductions on your take-home pay. Get the exact figures you need to plan your finances.

If you're wondering how much $29 an hour is per year, you're not alone. Many people struggle to calculate their hourly wage into an annual salary. Understanding your hourly wage and how it translates to a yearly income is crucial for budgeting, financial planning, and even negotiating salary raises. In this article, we'll explore the calculations behind converting an hourly wage to an annual salary, and provide examples to help you better understand the process.

Calculating Annual Salary from Hourly Wage

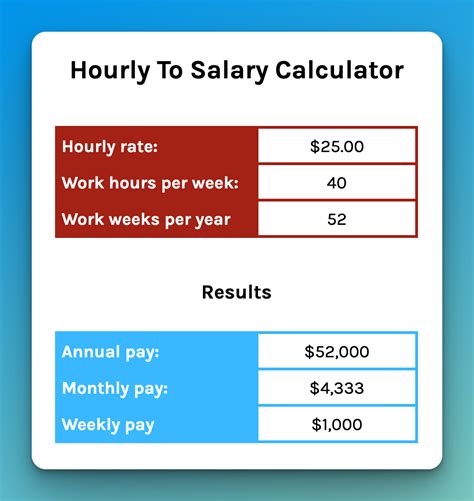

To calculate an annual salary from an hourly wage, you need to know how many hours you work per week and how many weeks you work per year. Most full-time employees work 40 hours a week and 52 weeks a year. However, this can vary depending on your job, industry, and location.

Assuming a standard full-time schedule, here's the calculation:

- Hourly wage: $29

- Hours worked per week: 40

- Weeks worked per year: 52

Annual salary = Hourly wage x Hours worked per week x Weeks worked per year Annual salary = $29 x 40 x 52 Annual salary = $60,320

So, if you make $29 an hour, your annual salary would be approximately $60,320.

Factors Affecting Annual Salary Calculations

Keep in mind that this calculation is based on a standard full-time schedule. However, many jobs have varying schedules, overtime, or part-time hours, which can impact the annual salary calculation. Some factors to consider:

- Overtime pay: If you work overtime, you may earn a higher hourly wage, which can increase your annual salary.

- Part-time hours: If you work part-time, you may work fewer hours per week, which can decrease your annual salary.

- Vacation time: If you take paid vacation time, you may not work a full 52 weeks per year, which can affect your annual salary.

- Bonuses or commissions: If you earn bonuses or commissions, these can increase your annual salary.

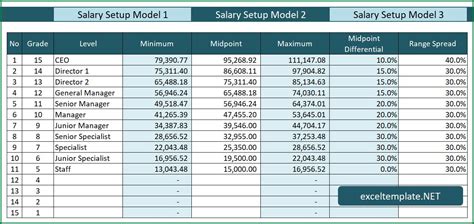

Annual Salary Ranges for $29/Hour

To give you a better idea of the annual salary range for $29 an hour, let's consider different scenarios:

- Part-time (20 hours/week): $29 x 20 x 52 = $30,160 per year

- Full-time (40 hours/week): $29 x 40 x 52 = $60,320 per year

- Overtime (50 hours/week): $29 x 50 x 52 = $75,400 per year

As you can see, the annual salary range for $29 an hour can vary significantly depending on the number of hours worked per week.

Benefits and Taxes

When calculating your annual salary, it's essential to consider benefits and taxes. Benefits, such as health insurance, retirement plans, and paid time off, can increase your overall compensation package. Taxes, on the other hand, can reduce your take-home pay.

- Benefits: If your employer offers benefits, such as health insurance or a 401(k) match, these can add to your overall compensation package.

- Taxes: Federal, state, and local taxes can reduce your take-home pay. The amount of taxes you pay will depend on your income level, filing status, and location.

Conclusion

Calculating your annual salary from an hourly wage is a straightforward process. However, it's essential to consider factors like overtime, part-time hours, and benefits to get an accurate picture of your compensation package. By understanding your hourly wage and how it translates to an annual salary, you can better budget, plan for the future, and negotiate salary raises.

Now, take a moment to share your thoughts! Do you have any questions about calculating annual salary from hourly wage? Share your experiences or ask questions in the comments below.

How do I calculate my annual salary if I work part-time?

+To calculate your annual salary if you work part-time, multiply your hourly wage by the number of hours you work per week, and then multiply that result by the number of weeks you work per year.

What factors can affect my annual salary calculation?

+Factors that can affect your annual salary calculation include overtime pay, part-time hours, vacation time, bonuses, and commissions.

How can I calculate my take-home pay after taxes?

+To calculate your take-home pay after taxes, you'll need to know your income tax rate and any other deductions, such as health insurance premiums or retirement contributions.