Intro

Discover how to calculate your hourly wage from a 32-hour workweek. Learn the 5 simple ways to convert 32 hours to salary, including annual salary, monthly salary, and daily wage. Get the inside scoop on hourly to salary conversion, salary calculations, and hourly wage rates to boost your financial literacy.

Converting 32 hours to a salary can be a bit tricky, as it depends on various factors such as the hourly wage, pay frequency, and benefits. However, understanding how to make this conversion is essential for employees, employers, and freelancers alike. In this article, we will explore five different ways to convert 32 hours to a salary, taking into account different scenarios and variables.

The Importance of Accurate Conversions

Accurate conversions are crucial in ensuring fair compensation and budgeting. For employees, knowing how their hourly wage translates to a monthly or annual salary can help them plan their finances and make informed decisions. For employers, accurate conversions are necessary for budgeting, payroll processing, and compliance with labor laws. Freelancers and independent contractors also need to understand how to convert their hourly rates to a salary to negotiate fair contracts and manage their finances effectively.

Method 1: Simple Hourly Wage Conversion

One of the simplest ways to convert 32 hours to a salary is to multiply the hourly wage by the number of hours worked. For example, if the hourly wage is $25, the weekly salary would be:

32 hours x $25/hour = $800 per week

To convert this to a monthly or annual salary, we can multiply the weekly salary by the number of weeks worked in a month or year:

$800 per week x 4 weeks per month = $3,200 per month $800 per week x 52 weeks per year = $41,600 per year

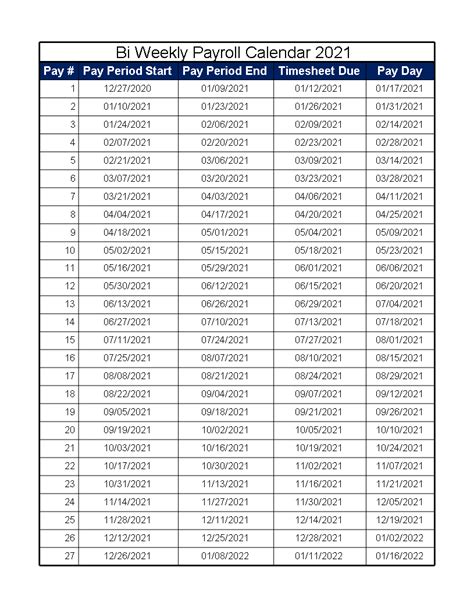

Method 2: Bi-Weekly Pay Conversion

Some employers pay their employees bi-weekly, which means they receive a paycheck every two weeks. To convert 32 hours to a bi-weekly salary, we can multiply the hourly wage by the number of hours worked and then divide by 2:

32 hours x $25/hour = $800 per week $800 per week / 2 = $400 per bi-weekly pay period

To convert this to a monthly or annual salary, we can multiply the bi-weekly salary by the number of bi-weekly pay periods in a month or year:

$400 per bi-weekly pay period x 2 bi-weekly pay periods per month = $800 per month $400 per bi-weekly pay period x 26 bi-weekly pay periods per year = $10,400 per year

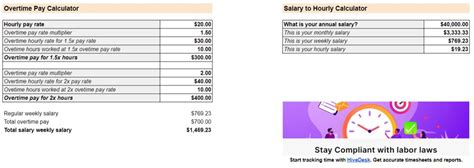

Method 3: Overtime Conversion

Some employees may work overtime, which can affect their salary. To convert 32 hours to a salary with overtime, we need to calculate the regular hours and overtime hours separately. For example, if the hourly wage is $25 and the overtime rate is 1.5 times the regular rate, we can calculate the salary as follows:

Regular hours: 32 hours x $25/hour = $800 Overtime hours: 8 hours x $37.50/hour (1.5 x $25) = $300 Total salary: $800 + $300 = $1,100 per week

To convert this to a monthly or annual salary, we can multiply the weekly salary by the number of weeks worked in a month or year:

$1,100 per week x 4 weeks per month = $4,400 per month $1,100 per week x 52 weeks per year = $57,200 per year

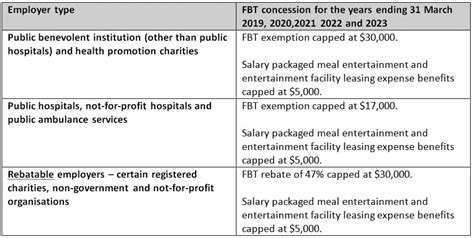

Method 4: Benefits and Taxes Conversion

In addition to the hourly wage, employees may also receive benefits such as health insurance, retirement plans, and paid time off. These benefits can affect the take-home pay and should be factored into the conversion. For example, if the hourly wage is $25 and the employee receives $500 per month in benefits, we can calculate the salary as follows:

Gross salary: 32 hours x $25/hour = $800 per week Benefits: $500 per month / 4 weeks per month = $125 per week Total salary: $800 per week + $125 per week = $925 per week

To convert this to a monthly or annual salary, we can multiply the weekly salary by the number of weeks worked in a month or year:

$925 per week x 4 weeks per month = $3,700 per month $925 per week x 52 weeks per year = $48,100 per year

Method 5: Freelance Conversion

Freelancers and independent contractors may need to convert their hourly rate to a salary to negotiate fair contracts and manage their finances effectively. To convert 32 hours to a salary as a freelancer, we can multiply the hourly rate by the number of hours worked and then add any additional fees or expenses:

Hourly rate: $50/hour Total hours: 32 hours Total salary: 32 hours x $50/hour = $1,600 per week

To convert this to a monthly or annual salary, we can multiply the weekly salary by the number of weeks worked in a month or year:

$1,600 per week x 4 weeks per month = $6,400 per month $1,600 per week x 52 weeks per year = $83,200 per year

Conclusion

Converting 32 hours to a salary can be complex and depends on various factors such as the hourly wage, pay frequency, benefits, and taxes. By using the five methods outlined above, employees, employers, and freelancers can accurately convert their hourly rate to a salary and make informed decisions about their finances. Whether you're negotiating a contract, budgeting for payroll, or planning your finances, understanding how to convert 32 hours to a salary is essential.

Call to Action

We hope this article has helped you understand the different ways to convert 32 hours to a salary. Whether you're an employee, employer, or freelancer, we encourage you to share your experiences and tips for converting hourly rates to salaries in the comments below. Don't forget to share this article with your colleagues and friends who may find it helpful.

FAQs

What is the simplest way to convert 32 hours to a salary?

+The simplest way to convert 32 hours to a salary is to multiply the hourly wage by the number of hours worked.

How do I convert 32 hours to a salary with overtime?

+To convert 32 hours to a salary with overtime, calculate the regular hours and overtime hours separately and then add them together.

What benefits should I include when converting 32 hours to a salary?

+Benefits such as health insurance, retirement plans, and paid time off should be factored into the conversion.