Intro

Learn how to convert 35 hourly to salary with our simple guide. Discover the formula to calculate annual salary from hourly wage, and understand the implications of benefits and taxes. Get the inside scoop on hourly to salary conversions and make informed decisions about your compensation package.

Converting an hourly wage to a salary can be a bit tricky, but it's a crucial step in understanding your overall compensation package. Whether you're a job seeker, an employee, or an employer, knowing how to convert hourly to salary is essential for making informed decisions. In this article, we'll explore the importance of converting hourly to salary, the benefits of doing so, and provide a step-by-step guide on how to do it.

The Importance of Converting Hourly to Salary

Converting hourly to salary is essential for several reasons. Firstly, it helps you understand your total annual compensation, which is critical for budgeting, financial planning, and making informed decisions about your career. Secondly, it enables you to compare your salary with industry standards, ensuring you're fairly compensated for your work. Lastly, it's a crucial step in negotiating salary increases or benefits with your employer.

Benefits of Converting Hourly to Salary

Converting hourly to salary has several benefits, including:

- Accurate budgeting: Knowing your annual salary helps you create a realistic budget, ensuring you can manage your finances effectively.

- Informed career decisions: Understanding your total compensation enables you to make informed decisions about your career, including whether to take a new job or negotiate a raise.

- Fair compensation: Converting hourly to salary helps you compare your compensation with industry standards, ensuring you're fairly paid for your work.

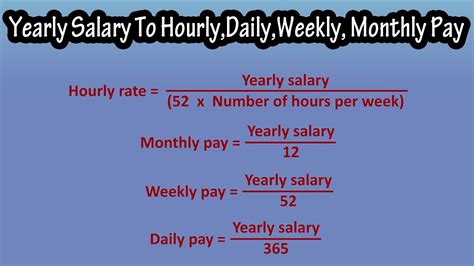

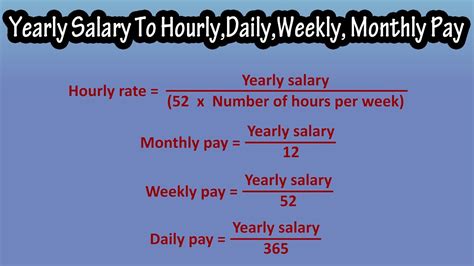

How to Convert Hourly to Salary: A Step-by-Step Guide

Converting hourly to salary is a simple process that requires just a few steps. Here's a step-by-step guide:

Step 1: Determine Your Hourly Wage

Start by determining your hourly wage. This is the amount you earn per hour, before taxes or other deductions.

Step 2: Determine Your Work Hours

Next, determine your work hours per week. This is the number of hours you work per week, on average.

Step 3: Calculate Your Weekly Salary

Multiply your hourly wage by your work hours per week to calculate your weekly salary.

Step 4: Calculate Your Annual Salary

Multiply your weekly salary by the number of weeks you work per year to calculate your annual salary.

Step 5: Consider Overtime and Bonuses

If you receive overtime pay or bonuses, factor these into your annual salary calculation.

Example: Converting 35 Hourly to Salary

Let's use an example to illustrate the process. Suppose you earn $35 per hour and work 40 hours per week.

- Step 1: Determine your hourly wage: $35 per hour

- Step 2: Determine your work hours: 40 hours per week

- Step 3: Calculate your weekly salary: $35 per hour x 40 hours per week = $1,400 per week

- Step 4: Calculate your annual salary: $1,400 per week x 52 weeks per year = $72,800 per year

In this example, your annual salary would be $72,800.

Converting Hourly to Salary: Tips and Considerations

When converting hourly to salary, keep the following tips and considerations in mind:

- Overtime pay: Factor in overtime pay, if applicable, to ensure an accurate annual salary calculation.

- Bonuses: Include bonuses, if applicable, to ensure an accurate annual salary calculation.

- Taxes and deductions: Remember that your take-home pay will be lower than your annual salary, due to taxes and other deductions.

- Industry standards: Research industry standards to ensure you're fairly compensated for your work.

Common Mistakes to Avoid

When converting hourly to salary, avoid the following common mistakes:

- Forgetting overtime pay: Failing to factor in overtime pay can result in an inaccurate annual salary calculation.

- Ignoring bonuses: Failing to include bonuses can result in an inaccurate annual salary calculation.

- Not considering taxes and deductions: Failing to consider taxes and deductions can result in an unrealistic take-home pay.

Converting Hourly to Salary: Frequently Asked Questions

Here are some frequently asked questions about converting hourly to salary:

What is the difference between hourly and salary?

Hourly pay refers to the amount you earn per hour, while salary refers to your annual compensation.

How do I calculate my annual salary from my hourly wage?

To calculate your annual salary from your hourly wage, multiply your hourly wage by your work hours per week, then multiply by the number of weeks you work per year.

Do I need to consider overtime pay when converting hourly to salary?

Yes, you should factor in overtime pay, if applicable, to ensure an accurate annual salary calculation.

What is the importance of converting hourly to salary?

+Converting hourly to salary is essential for understanding your total annual compensation, comparing your salary with industry standards, and making informed decisions about your career.

How do I calculate my weekly salary from my hourly wage?

+Multiply your hourly wage by your work hours per week to calculate your weekly salary.

What are some common mistakes to avoid when converting hourly to salary?

+Common mistakes to avoid include forgetting overtime pay, ignoring bonuses, and not considering taxes and deductions.

In conclusion, converting hourly to salary is a straightforward process that requires just a few steps. By following this guide, you can ensure an accurate annual salary calculation and make informed decisions about your career. Remember to consider overtime pay, bonuses, and taxes and deductions to ensure a realistic take-home pay.