Intro

Earning a salary of $35 per hour can be a significant milestone for many individuals. However, understanding how this hourly wage translates into a yearly salary can be a bit tricky. In this article, we'll break down the math behind calculating a yearly salary based on an hourly wage, explore the factors that can impact take-home pay, and discuss the implications of earning $35 per hour.

Calculating Yearly Salary from Hourly Wage

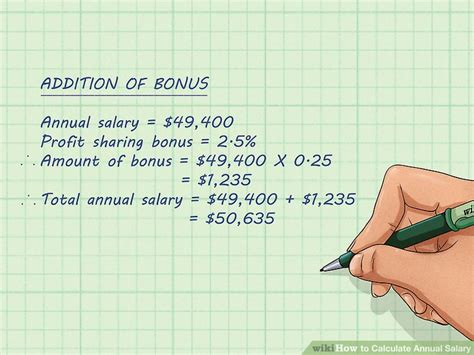

To calculate a yearly salary from an hourly wage, we need to make a few assumptions. Let's assume a standard full-time schedule of 40 hours per week and 52 weeks per year. This translates to a total of 2,080 hours worked per year (40 hours/week x 52 weeks/year).

Now, let's do the math:

$35/hour x 2,080 hours/year = $72,800 per year

So, earning $35 per hour would result in a yearly salary of $72,800, assuming a standard full-time schedule.

Factors That Impact Take-Home Pay

While calculating a yearly salary from an hourly wage is relatively straightforward, there are several factors that can impact take-home pay. These include:

- Taxes: Federal, state, and local taxes can significantly reduce take-home pay. The amount of taxes withheld will depend on individual circumstances, such as filing status, number of dependents, and tax deductions.

- Benefits: Employer-sponsored benefits, such as health insurance, retirement plans, and paid time off, can also impact take-home pay.

- Overtime: Working overtime can increase earnings, but may also impact take-home pay due to higher tax rates.

- Deductions: Other deductions, such as student loan payments, union dues, or charitable donations, can also reduce take-home pay.

Implications of Earning $35 Per Hour

Earning $35 per hour can have significant implications for individuals and households. Here are a few:

- Increased purchasing power: A higher hourly wage can result in increased purchasing power, allowing individuals to afford more goods and services.

- Improved financial stability: A stable income of $72,800 per year can provide a sense of security and stability, making it easier to budget and plan for the future.

- Career advancement: Earning a higher hourly wage can also lead to career advancement opportunities, as individuals may be more competitive in the job market.

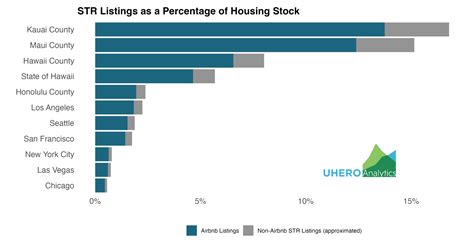

Comparing $35 Per Hour to National Averages

According to data from the Bureau of Labor Statistics, the median hourly wage in the United States is around $25 per hour. Earning $35 per hour is significantly higher than the national average, placing individuals in a relatively high-income bracket.

Conclusion

Earning $35 per hour can result in a yearly salary of $72,800, assuming a standard full-time schedule. However, take-home pay can be impacted by various factors, including taxes, benefits, and deductions. Understanding the implications of earning $35 per hour can help individuals better plan their finances and make informed decisions about their careers.

We hope this article has provided valuable insights into the world of hourly wages and yearly salaries. If you have any questions or comments, please don't hesitate to share them below.

How much is $35 per hour per year?

+$35 per hour translates to a yearly salary of $72,800, assuming a standard full-time schedule of 40 hours per week and 52 weeks per year.

What factors impact take-home pay?

+Take-home pay can be impacted by taxes, benefits, overtime, and deductions, among other factors.

How does $35 per hour compare to national averages?

+Earning $35 per hour is significantly higher than the national average of $25 per hour, according to data from the Bureau of Labor Statistics.