Intro

Converting an hourly wage to a salary can be a daunting task, especially for those who are new to the workforce or are switching from an hourly to a salaried position. Understanding the intricacies of this conversion is crucial to ensure that you are fairly compensated for your work. In this article, we will delve into the world of hourly to salary conversions, exploring the essential tips and tricks to help you navigate this process with ease.

The importance of understanding hourly to salary conversions cannot be overstated. Not only does it impact your take-home pay, but it also affects your benefits, taxes, and overall job satisfaction. With the rise of the gig economy and non-traditional work arrangements, the need for a clear understanding of hourly to salary conversions has never been more pressing.

Understanding the Basics of Hourly to Salary Conversions

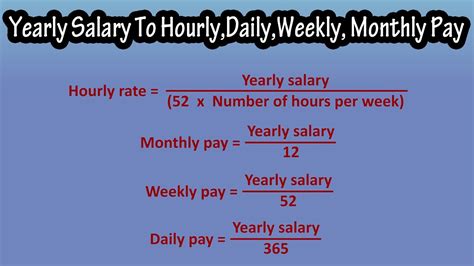

Before we dive into the nitty-gritty of hourly to salary conversions, it's essential to understand the basics. An hourly wage is the amount of money you earn per hour of work, whereas a salary is the total amount of money you earn per year, typically paid bi-weekly or monthly. To convert an hourly wage to a salary, you need to multiply the hourly wage by the number of hours worked per year.

Calculating the Number of Hours Worked per Year

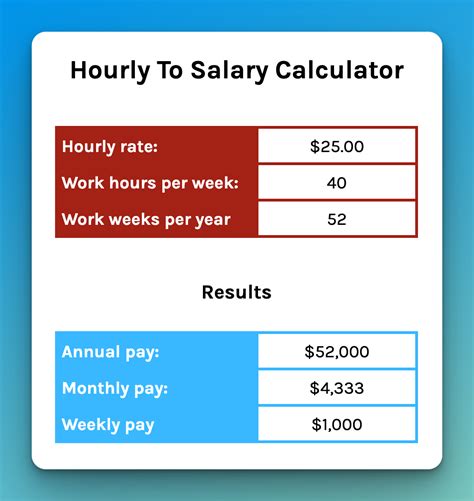

To calculate the number of hours worked per year, you need to consider the number of hours worked per week and the number of weeks worked per year. A standard full-time schedule is 40 hours per week, with 52 weeks per year. However, this can vary depending on the company, industry, and job requirements.

Tips for Converting Hourly to Salary

Now that we've covered the basics, let's dive into the essential tips for converting hourly to salary:

1. Understand Your Hourly Wage

Before you can convert your hourly wage to a salary, you need to know your hourly wage. This may seem obvious, but it's essential to ensure that you're using the correct hourly wage for your calculations.

2. Calculate Your Annual Hours

As mentioned earlier, calculating your annual hours is crucial for converting your hourly wage to a salary. Make sure to consider any overtime, holidays, or vacation time that may impact your annual hours.

3. Consider Benefits and Taxes

When converting your hourly wage to a salary, it's essential to consider benefits and taxes. Benefits, such as health insurance and retirement plans, can impact your take-home pay, while taxes can vary depending on your location and income level.

4. Use a Salary Calculator

To simplify the conversion process, consider using a salary calculator. These calculators can help you convert your hourly wage to a salary, taking into account benefits, taxes, and other factors.

5. Review and Negotiate Your Salary

Finally, review and negotiate your salary to ensure that you're fairly compensated for your work. Consider factors such as industry standards, job requirements, and company budgets when negotiating your salary.

Common Mistakes to Avoid

When converting your hourly wage to a salary, there are several common mistakes to avoid:

Not Considering Overtime

Failing to consider overtime can significantly impact your annual hours and salary.

Not Accounting for Benefits

Benefits, such as health insurance and retirement plans, can impact your take-home pay and overall compensation.

Not Negotiating Your Salary

Failing to negotiate your salary can result in underpayment and undervaluation of your work.

Conclusion: Taking Control of Your Salary Conversion

Converting an hourly wage to a salary can be a complex process, but with the right tools and knowledge, you can take control of your salary conversion. By understanding the basics, using salary calculators, and avoiding common mistakes, you can ensure that you're fairly compensated for your work.

What's Next?

Now that you've learned the essential tips for converting hourly to salary, it's time to take action. Review your hourly wage, calculate your annual hours, and negotiate your salary to ensure that you're fairly compensated for your work. Share your experiences and tips in the comments below, and don't forget to share this article with your friends and colleagues.

How do I calculate my annual hours?

+To calculate your annual hours, multiply the number of hours worked per week by the number of weeks worked per year. For example, if you work 40 hours per week and 52 weeks per year, your annual hours would be 2,080.

What benefits should I consider when converting my hourly wage to a salary?

+When converting your hourly wage to a salary, consider benefits such as health insurance, retirement plans, and paid time off. These benefits can impact your take-home pay and overall compensation.

How do I negotiate my salary?

+To negotiate your salary, research industry standards, job requirements, and company budgets. Prepare a solid case for your desired salary, and be confident and assertive during negotiations.