Intro

Discover how much $45/hour translates to annually. Learn the calculation behind converting hourly wages to yearly salary, including factors like full-time vs. part-time work, overtime, and benefits. Get a clear understanding of your take-home pay and make informed decisions about your career and financial goals.

Making a good income is essential for achieving financial stability and security. One of the most common ways to measure income is by hourly wage. But have you ever wondered how much a certain hourly wage translates to in terms of annual salary? In this article, we'll explore how much $45 an hour is per year, and what that means for your financial situation.

Understanding the importance of knowing your annual salary is crucial for planning your finances, making smart investments, and achieving your long-term goals. Whether you're an employee, freelancer, or entrepreneur, knowing how much you earn per year can help you make informed decisions about your career and financial future.

In this article, we'll delve into the details of how to calculate your annual salary based on your hourly wage, and what factors can affect your take-home pay. We'll also provide examples and statistics to help you better understand the value of your hourly wage.

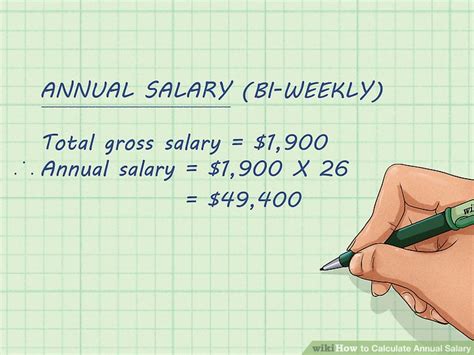

Calculating Annual Salary from Hourly Wage

To calculate your annual salary from your hourly wage, you need to know how many hours you work per year. This can vary depending on your job, industry, and location. However, a standard full-time schedule typically consists of 2,080 hours per year, assuming a 40-hour workweek and 52 weeks per year.

Using this information, you can calculate your annual salary as follows:

Annual Salary = Hourly Wage x Number of Hours Worked per Year

For example, if you earn $45 per hour and work 2,080 hours per year, your annual salary would be:

Annual Salary = $45 x 2,080 = $93,600

Factors Affecting Take-Home Pay

While calculating your annual salary is straightforward, there are several factors that can affect your take-home pay. These include:

- Taxes: Federal, state, and local taxes can significantly reduce your take-home pay.

- Benefits: Health insurance, retirement plans, and other benefits can impact your take-home pay.

- Overtime: Working overtime can increase your annual salary, but may also affect your take-home pay due to taxes and benefits.

- Time off: Vacation days, sick leave, and other time off can reduce your annual salary.

How Much is $45 an Hour Per Year?

Based on our previous calculation, $45 an hour translates to an annual salary of $93,600, assuming a standard full-time schedule. However, this amount can vary depending on the factors mentioned earlier.

To give you a better idea, here are some examples of annual salaries based on different hourly wages:

- $40 an hour: $83,200 per year

- $50 an hour: $104,000 per year

- $60 an hour: $124,800 per year

Industry and Location Variations

Hourly wages can vary significantly depending on the industry and location. For example:

- Software engineers in San Francisco may earn $100 an hour or more, while those in other parts of the country may earn significantly less.

- Nurses in New York City may earn $50 an hour or more, while those in rural areas may earn less.

It's essential to research the average hourly wages in your industry and location to get a better understanding of your earning potential.

Financial Planning and Budgeting

Knowing your annual salary is crucial for financial planning and budgeting. Here are some tips to help you make the most of your income:

- Create a budget: Track your income and expenses to understand where your money is going.

- Invest wisely: Consider investing in a retirement plan, stocks, or other investment vehicles.

- Save for emergencies: Set aside a portion of your income for unexpected expenses.

- Plan for taxes: Understand how taxes affect your take-home pay and plan accordingly.

Conclusion

In conclusion, $45 an hour is a significant income that can provide financial stability and security. By understanding how to calculate your annual salary from your hourly wage, you can make informed decisions about your career and financial future. Remember to consider factors that affect your take-home pay, and plan your finances wisely to achieve your long-term goals.

What is the average hourly wage in the United States?

+The average hourly wage in the United States varies depending on the industry and location. However, according to the Bureau of Labor Statistics, the average hourly wage for all occupations was $25.72 in May 2020.

How do I calculate my annual salary from my hourly wage?

+To calculate your annual salary from your hourly wage, multiply your hourly wage by the number of hours you work per year. For example, if you earn $45 per hour and work 2,080 hours per year, your annual salary would be $93,600.

What factors affect my take-home pay?

+Taxes, benefits, overtime, and time off can all affect your take-home pay. It's essential to understand how these factors impact your income to make informed decisions about your finances.

We hope this article has helped you understand how much $45 an hour is per year. If you have any questions or comments, please feel free to share them below.