Intro

Discover how to convert an hourly wage of $45 to a salary with our simple guide. Learn the importance of understanding hourly vs. salary pay, annual salary calculations, and benefits considerations. Get the inside scoop on converting hourly to annual salary, including taxes and deductions, to make informed decisions about your compensation package.

Converting an hourly wage to a yearly salary can be a bit tricky, but it's essential to understand the math behind it, especially when negotiating a job offer or evaluating a new career opportunity. An hourly wage of $45 can translate to a significant annual salary, but the exact amount depends on the number of hours worked per week and the number of weeks worked per year.

In this article, we'll break down the calculation to convert $45 hourly to a salary, explore the factors that affect the conversion, and provide examples to help you better understand the process.

Converting $45 Hourly to Salary: The Basics

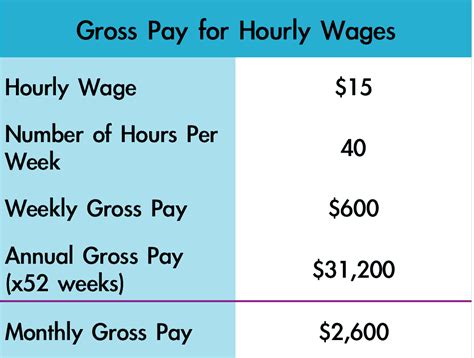

To convert an hourly wage to a salary, you need to multiply the hourly wage by the number of hours worked per week and then multiply the result by the number of weeks worked per year. The general formula is:

Salary = Hourly Wage x Hours Worked per Week x Weeks Worked per Year

Assumptions and Variables

When converting $45 hourly to a salary, we'll assume a standard full-time schedule with 40 hours worked per week and 52 weeks worked per year. However, these variables can affect the calculation:

- Hours worked per week: Part-time or overtime schedules can impact the total hours worked per week.

- Weeks worked per year: Some industries or jobs may have varying numbers of weeks worked per year, such as teachers or freelancers.

The Calculation: $45 Hourly to Salary

Using the formula and assumptions above, let's calculate the salary:

Salary = $45/hour x 40 hours/week x 52 weeks/year = $45 x 40 x 52 = $93,600 per year

So, an hourly wage of $45 translates to a yearly salary of approximately $93,600, assuming a standard full-time schedule.

Factors Affecting the Conversion

Keep in mind that the conversion from hourly to salary can be influenced by various factors, including:

- Overtime pay: If you work overtime, your hourly wage may increase, affecting your total salary.

- Bonuses and benefits: Additional forms of compensation, such as bonuses or benefits, can impact your total annual salary.

- Taxes and deductions: Federal, state, and local taxes, as well as deductions for health insurance, retirement plans, and other benefits, can reduce your take-home pay.

Examples and Variations

To illustrate the impact of different variables, let's consider some examples:

- Part-time schedule: If you work 30 hours per week instead of 40, your salary would be: = $45/hour x 30 hours/week x 52 weeks/year = $70,200 per year

- Overtime pay: If you work 10 hours of overtime per week at a rate of 1.5 times your regular hourly wage, your salary would be: = $45/hour x 40 hours/week x 52 weeks/year + (10 hours/week x $67.50/hour x 52 weeks/year) = $93,600 per year + $35,100 per year = $128,700 per year

Conclusion and Next Steps

Converting an hourly wage to a salary requires careful consideration of the number of hours worked per week and the number of weeks worked per year. By understanding the calculation and factors that affect it, you can make informed decisions about your career and compensation.

If you have any questions or concerns about converting your hourly wage to a salary, feel free to ask in the comments below. Share this article with others who may find it helpful, and don't hesitate to reach out to a financial advisor for personalized guidance.

How do I calculate my salary if I work a non-standard schedule?

+To calculate your salary with a non-standard schedule, you'll need to adjust the number of hours worked per week and/or the number of weeks worked per year. Use the formula: Salary = Hourly Wage x Hours Worked per Week x Weeks Worked per Year. For example, if you work 30 hours per week for 48 weeks per year, your calculation would be: Salary = $45/hour x 30 hours/week x 48 weeks/year.

How do bonuses and benefits affect my take-home pay?

+Bonuses and benefits can impact your take-home pay by increasing your total compensation. However, taxes and deductions may reduce the amount you receive. Consider consulting with a financial advisor to understand how bonuses and benefits affect your overall compensation package.

Can I use this calculation for other hourly wages?

+Yes, you can use this calculation for other hourly wages. Simply replace the $45 hourly wage with the desired hourly wage and adjust the number of hours worked per week and weeks worked per year as needed.