Intro

Discover how much $65,000 a year translates to per hour, and explore the breakdown of annual salary to hourly wage. Learn about the factors affecting hourly pay, such as taxes, benefits, and overtime. Get a clear understanding of your take-home pay and make informed decisions about your career and finances.

Earning a salary of $65,000 a year is a significant milestone for many individuals. However, have you ever stopped to think about how much that translates to per hour? Understanding your hourly wage can help you better appreciate the value of your time and make more informed financial decisions.

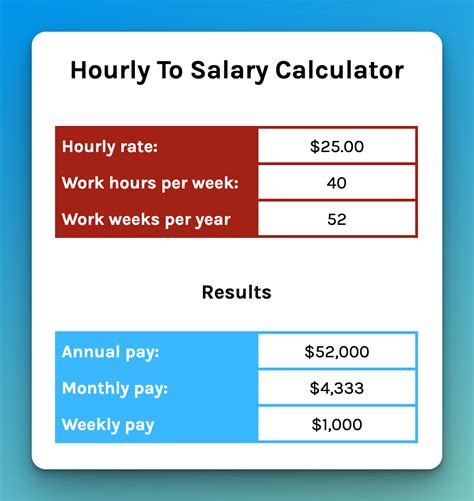

To calculate your hourly wage, you need to consider the number of hours you work per year. Assuming a standard full-time schedule of 40 hours per week and 52 weeks per year, the total number of hours worked per year is 2,080. Now, let's do the math:

$65,000 per year ÷ 2,080 hours per year = approximately $31.25 per hour

This calculation provides a general idea of your hourly wage, but it's essential to note that it may vary depending on your specific work schedule, overtime, and other factors.

Factors That Affect Your Hourly Wage

Several factors can influence your hourly wage, including:

1. Overtime

If you work overtime, your hourly wage will increase accordingly. However, it's crucial to consider the overtime pay rate, which may be 1.5 times your regular hourly rate.

2. Bonuses and Benefits

Bonuses, commissions, and benefits like health insurance, retirement plans, or paid time off can impact your overall compensation package. While these perks don't directly affect your hourly wage, they contribute to your total remuneration.

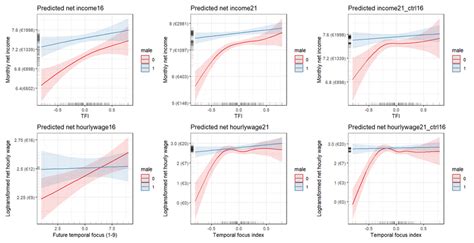

3. Taxes and Deductions

Taxes, deductions, and other withholdings can reduce your take-home pay, affecting your net hourly wage. It's essential to factor in these deductions when calculating your hourly wage.

4. Vacation Time and Holidays

Paid vacation time and holidays can reduce the number of hours you work per year, which may affect your hourly wage calculation.

How to Calculate Your Net Hourly Wage

To calculate your net hourly wage, you need to consider the taxes, deductions, and other withholdings that reduce your take-home pay. Here's a step-by-step guide:

- Determine your gross hourly wage (as calculated earlier).

- Estimate your annual taxes, deductions, and withholdings.

- Subtract these deductions from your gross annual income.

- Divide the result by the total number of hours worked per year.

For example, if your gross hourly wage is $31.25 and you estimate annual taxes and deductions of $10,000, your net hourly wage would be:

$65,000 (gross annual income) - $10,000 (taxes and deductions) = $55,000 (net annual income) $55,000 ÷ 2,080 hours per year = approximately $26.44 per hour (net hourly wage)

What Can You Do with Your Hourly Wage Information?

Understanding your hourly wage can help you make more informed financial decisions, such as:

1. Budgeting

Knowing your hourly wage can help you create a more accurate budget, ensuring you allocate your income effectively.

2. Time Management

Recognizing the value of your time can encourage you to prioritize tasks, manage your workload more efficiently, and make the most of your time.

3. Salary Negotiations

Armed with your hourly wage information, you can negotiate salary increases or benefits with confidence, ensuring you're fairly compensated for your time and expertise.

4. Side Hustles and Freelancing

Understanding your hourly wage can help you determine fair rates for side hustles or freelancing work, ensuring you're earning a decent income for your time and skills.

In conclusion, calculating your hourly wage can provide valuable insights into the value of your time and help you make more informed financial decisions. By considering factors like overtime, bonuses, and taxes, you can gain a more accurate understanding of your net hourly wage and use this information to improve your financial situation.

We'd love to hear from you! Share your thoughts on how you use your hourly wage information to make financial decisions. Do you have any tips or tricks for managing your time and income effectively? Leave a comment below and let's start a conversation!

How do I calculate my hourly wage?

+To calculate your hourly wage, divide your annual salary by the total number of hours you work per year. For example, if you earn $65,000 per year and work 2,080 hours per year, your hourly wage would be approximately $31.25 per hour.

What factors can affect my hourly wage?

+Several factors can influence your hourly wage, including overtime, bonuses, taxes, deductions, and benefits. It's essential to consider these factors when calculating your hourly wage.

How do I calculate my net hourly wage?

+To calculate your net hourly wage, subtract your annual taxes, deductions, and withholdings from your gross annual income, and then divide the result by the total number of hours worked per year.