Intro

Discover how to convert a $65,000 salary to an hourly wage with our simple 5-step guide. Learn the importance of hourly pay calculations, annual salary conversions, and hourly wage equivalents. Understand the impact of taxes, benefits, and overtime on your take-home pay. Get accurate hourly rate calculations and make informed financial decisions.

Converting a salary to an hourly wage can be a bit tricky, but it's essential to understand your take-home pay. Whether you're negotiating a job offer, comparing salaries, or simply curious about your hourly earnings, this guide will walk you through the process.

A $65,000 annual salary is a decent income, but have you ever wondered how much you earn per hour? Breaking down your salary to an hourly wage can give you a better understanding of your compensation. Let's dive into the 5-step process to convert your $65,000 salary to an hourly wage.

Understanding the Importance of Hourly Wage

Knowing your hourly wage can help you make informed decisions about your career, finances, and work-life balance. It can also aid in comparing job offers, negotiating salary, or determining whether a side hustle is worth your time.

Step 1: Determine Your Annual Salary

In this case, your annual salary is $65,000. Make sure to use your gross income, which is your salary before taxes and deductions.

Why Use Gross Income?

Using your gross income provides a more accurate calculation of your hourly wage. Net income, or take-home pay, can vary significantly depending on factors like taxes, health insurance, and retirement contributions.

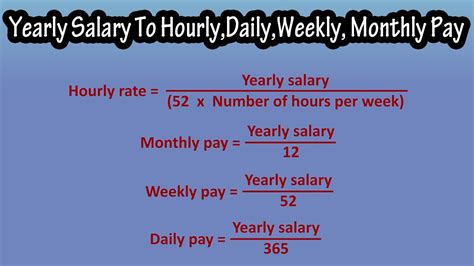

Step 2: Calculate Your Annual Work Hours

To calculate your annual work hours, you'll need to know the number of hours you work per week and the number of weeks you work per year. Assuming a standard full-time schedule:

- 40 hours/week × 52 weeks/year = 2,080 hours/year

Keep in mind that this is just an estimate, and your actual work hours may vary.

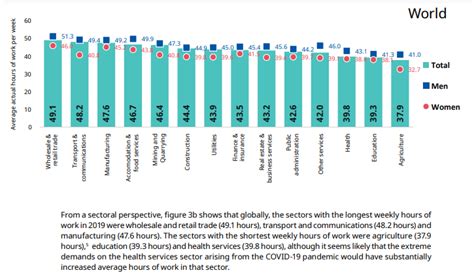

What About Overtime or Part-Time Schedules?

If you work overtime or have a part-time schedule, you'll need to adjust your annual work hours accordingly. For example, if you work 20 hours/week × 52 weeks/year, your annual work hours would be 1,040 hours/year.

Step 3: Calculate Your Hourly Wage

Now, let's calculate your hourly wage:

$65,000 (annual salary) ÷ 2,080 (annual work hours) = $31.25 (hourly wage)

What About Benefits and Bonuses?

Keep in mind that this calculation only accounts for your base salary. If you receive benefits, bonuses, or commissions, your total compensation package may be higher.

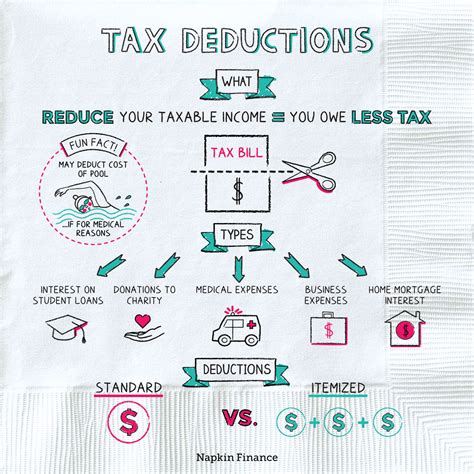

Step 4: Consider Taxes and Deductions

Taxes and deductions can significantly impact your take-home pay. To get a more accurate picture of your hourly wage, consider the following:

- Federal income taxes: 22% - 37% of your income

- State income taxes: 0% - 13.3% of your income

- Health insurance, retirement contributions, and other deductions

Using a tax calculator or consulting with a financial advisor can help you estimate your net hourly wage.

Step 5: Review and Adjust

Review your calculations and adjust as necessary. Consider factors like overtime, bonuses, or changes in your work schedule.

By following these 5 steps, you can accurately convert your $65,000 salary to an hourly wage. Remember to consider taxes, deductions, and benefits to get a comprehensive understanding of your compensation package.

What's Your Hourly Wage?

Use our simple calculator to determine your hourly wage:

Annual Salary: $___________ Annual Work Hours: ___________ Hourly Wage: $___________

Share your results in the comments below!

How do I calculate my hourly wage if I work part-time?

+To calculate your hourly wage as a part-time worker, follow the same steps as above, but use your part-time schedule to determine your annual work hours.

What's the difference between gross income and net income?

+Gross income is your salary before taxes and deductions, while net income is your take-home pay after taxes and deductions.

Can I use this calculation for freelancers or contractors?

+Yes, you can use this calculation as a rough estimate, but keep in mind that freelancers and contractors often have different tax implications and work schedules.