Intro

Unlock a rewarding career in cash management services, where financial expertise meets strategic planning. Discover lucrative job opportunities, growth prospects, and required skills in this field. Explore treasury management, cash forecasting, and liquidity optimization roles, and learn how to succeed in this in-demand profession with our comprehensive guide.

Effective cash management is crucial for the success of any business, and as a result, cash management services jobs are in high demand. These professionals play a vital role in managing an organization's financial resources, ensuring that they have sufficient liquidity to meet their financial obligations. In this article, we will explore the various career opportunities and growth prospects in cash management services jobs.

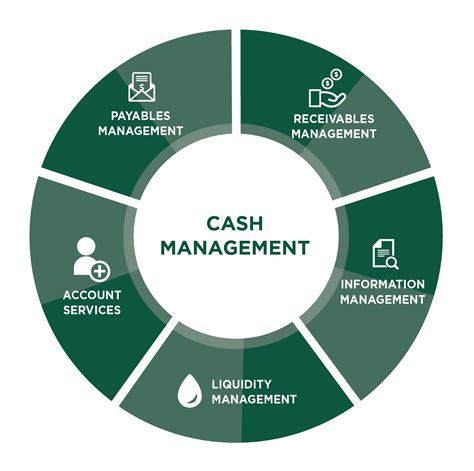

The Importance of Cash Management

Cash management is a critical function that involves managing an organization's cash flows, investments, and funding sources. It requires a deep understanding of financial markets, instruments, and regulations. Cash management professionals must be able to analyze financial data, identify trends, and make informed decisions to optimize cash flows. Their primary objective is to ensure that the organization has sufficient liquidity to meet its financial obligations, while also maximizing returns on investments.

Career Opportunities in Cash Management Services

Cash management services jobs offer a wide range of career opportunities for professionals with a background in finance, accounting, or economics. Some of the most common roles in cash management include:

- Cash Manager: Responsible for managing an organization's cash flows, investments, and funding sources.

- Treasury Manager: Oversees the management of an organization's treasury function, including cash management, investments, and funding.

- Financial Analyst: Analyzes financial data to identify trends and opportunities for cash flow optimization.

- Cash Flow Manager: Responsible for managing an organization's cash flows, including forecasting, budgeting, and reporting.

Growth Prospects in Cash Management Services

The demand for cash management services jobs is expected to grow significantly in the coming years, driven by the increasing complexity of financial markets and the need for organizations to optimize their cash flows. According to the Bureau of Labor Statistics, employment of financial managers, including cash management professionals, is projected to grow 16% from 2020 to 2030, much faster than the average for all occupations.

In addition, the increasing use of technology in cash management is expected to create new career opportunities for professionals with expertise in areas such as:

Key Skills Required for Cash Management Services Jobs

To be successful in cash management services jobs, professionals need to possess a range of skills, including:

- Financial analysis and planning

- Cash flow forecasting and budgeting

- Investment analysis and management

- Risk management and mitigation

- Communication and interpersonal skills

- Technical skills, including proficiency in financial software and systems

Cash Management Services Jobs: Industry Overview

Cash management services jobs are found in a wide range of industries, including:

- Banking and financial services

- Corporate treasury

- Investment management

- Asset management

- Insurance

Salary Range for Cash Management Services Jobs

The salary range for cash management services jobs varies widely depending on factors such as location, industry, experience, and qualifications. However, here are some approximate salary ranges for common cash management roles:

- Cash Manager: $80,000 - $150,000 per year

- Treasury Manager: $100,000 - $200,000 per year

- Financial Analyst: $60,000 - $120,000 per year

- Cash Flow Manager: $70,000 - $140,000 per year

Conclusion

Cash management services jobs offer a range of career opportunities and growth prospects for professionals with a background in finance, accounting, or economics. With the increasing complexity of financial markets and the need for organizations to optimize their cash flows, the demand for cash management professionals is expected to grow significantly in the coming years. By possessing the key skills required for cash management services jobs, professionals can take advantage of these opportunities and advance their careers in this exciting and rewarding field.

We invite you to share your thoughts and experiences in cash management services jobs. What are some of the most common challenges you face in your role, and how do you overcome them? Share your comments below!

What is cash management, and why is it important?

+Cash management is the process of managing an organization's cash flows, investments, and funding sources. It is critical for ensuring that an organization has sufficient liquidity to meet its financial obligations, while also maximizing returns on investments.

What are some common roles in cash management services?

+Some common roles in cash management services include Cash Manager, Treasury Manager, Financial Analyst, and Cash Flow Manager.

What skills are required for cash management services jobs?

+To be successful in cash management services jobs, professionals need to possess a range of skills, including financial analysis and planning, cash flow forecasting and budgeting, investment analysis and management, risk management and mitigation, communication and interpersonal skills, and technical skills.