Intro

Discover the benefits of banking with Community Wide Credit Union, your local financial partner. Learn how this member-owned cooperative provides personalized service, competitive rates, and a range of financial products, including loans, credit cards, and investment services, to support your financial well-being and goals in your community.

In today's fast-paced world, having a reliable financial partner is crucial for achieving stability and security. Community Wide Credit Union is one such partner that has been serving the local community with dedication and commitment. As a not-for-profit cooperative, Community Wide Credit Union is owned and controlled by its members, who share common goals and values. In this article, we will delve into the world of Community Wide Credit Union, exploring its benefits, services, and what makes it an ideal choice for your financial needs.

What is a Credit Union?

Before we dive into the specifics of Community Wide Credit Union, let's understand what a credit union is. A credit union is a type of financial cooperative that is owned and controlled by its members. Credit unions are not-for-profit organizations that aim to provide affordable financial services to their members. They are typically smaller than banks and offer more personalized services.

Benefits of Credit Unions

So, why should you choose a credit union over a traditional bank? Here are some benefits that credit unions offer:

- Better interest rates on loans and deposits

- Lower fees for services

- Personalized service and attention

- Community involvement and support

- Democratic ownership and control

Community Wide Credit Union Services

Community Wide Credit Union offers a wide range of financial services to its members, including:

- Checking and savings accounts

- Loans (personal, auto, mortgage, and more)

- Credit cards

- Investment services

- Insurance services

- Online banking and mobile banking

Checking and Savings Accounts

Community Wide Credit Union offers various types of checking and savings accounts to suit your needs. Their checking accounts come with features like:

- No monthly maintenance fees

- Free online banking and mobile banking

- Free bill pay

- Free debit card

Their savings accounts offer competitive interest rates and flexible terms.

Loans and Credit Cards

Community Wide Credit Union offers a range of loan options, including personal loans, auto loans, mortgage loans, and more. Their loans come with competitive interest rates and flexible repayment terms.

Their credit cards offer rewards programs, low interest rates, and no annual fees.

Investment and Insurance Services

Community Wide Credit Union also offers investment and insurance services to help you plan for the future. Their investment services include:

- Retirement accounts (IRAs, 401(k), etc.)

- Brokerage services

- Investment advice

Their insurance services include:

- Life insurance

- Health insurance

- Auto insurance

- Home insurance

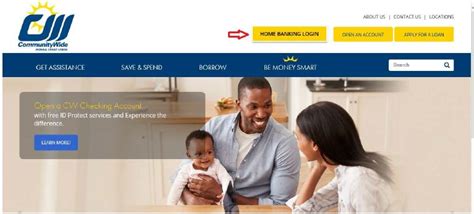

Online Banking and Mobile Banking

Community Wide Credit Union offers online banking and mobile banking services to make it easy for you to manage your accounts on the go.

Their online banking services allow you to:

- Check your account balances

- Transfer funds

- Pay bills

- View statements

Their mobile banking app allows you to do all of the above and more, right from your smartphone.

Community Involvement

Community Wide Credit Union is committed to giving back to the community. They participate in various community events and charity programs throughout the year.

Financial Education

Community Wide Credit Union also offers financial education programs to help you manage your finances effectively. Their programs cover topics such as:

- Budgeting

- Saving

- Investing

- Credit management

Conclusion

Community Wide Credit Union is a reliable financial partner that offers a wide range of services to its members. From checking and savings accounts to loans and investment services, they have everything you need to manage your finances effectively. Their commitment to community involvement and financial education makes them an ideal choice for those looking for a financial partner that truly cares.

So, why not join Community Wide Credit Union today and experience the benefits of a not-for-profit cooperative for yourself?

What is the difference between a credit union and a bank?

+A credit union is a not-for-profit cooperative owned and controlled by its members, while a bank is a for-profit institution owned by shareholders. Credit unions offer more personalized services and better interest rates, while banks offer a wider range of services and more branch locations.

How do I join Community Wide Credit Union?

+To join Community Wide Credit Union, you can visit their website or stop by one of their branch locations. You will need to provide identification and proof of residency, and you will need to deposit a minimum amount into your account.

What types of loans does Community Wide Credit Union offer?

+Community Wide Credit Union offers a range of loan options, including personal loans, auto loans, mortgage loans, and more. They also offer credit cards with competitive interest rates and rewards programs.