Intro

Discover the ins and outs of Denver, CO sales tax rates with our expert guide. Learn about the current sales tax rate, how its calculated, and whats exempt. Get the facts on special district taxes, combined rates, and more. Understand the impact on consumers and businesses in the Mile High City with our comprehensive breakdown.

As the capital city of Colorado, Denver is a hub for business, tourism, and commerce. With a thriving economy, it's essential to understand the Denver CO sales tax rate and how it affects consumers and businesses alike. In this article, we'll delve into the key facts about the Denver sales tax rate, its history, and what it means for you.

The sales tax rate in Denver, CO, is a crucial aspect of the city's economy, generating significant revenue for local governments and funding public services. With a complex tax system, it's easy to get lost in the numbers. However, by breaking down the key facts, you'll gain a better understanding of the Denver sales tax rate and its implications.

What is the Denver CO Sales Tax Rate?

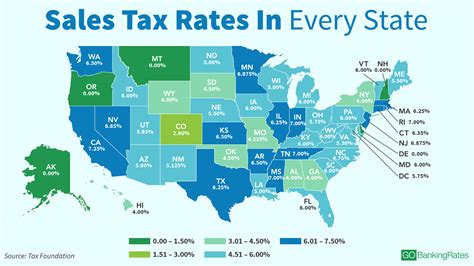

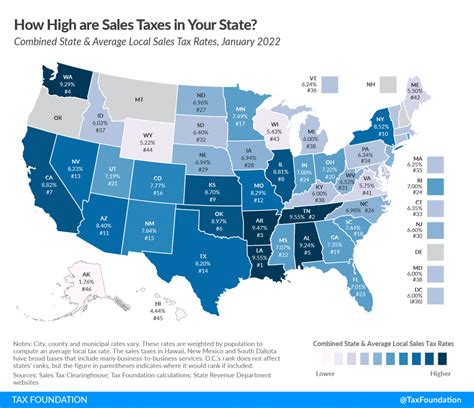

The Denver CO sales tax rate is currently 8.31%. This rate is a combination of the state sales tax rate (2.9%), the regional transportation district (RTD) tax rate (1.0%), and the city and county of Denver sales tax rate (4.31%). The total sales tax rate is applied to most purchases made within the city limits.

How is the Denver CO Sales Tax Rate Calculated?

The Denver CO sales tax rate is calculated based on the total purchase price of an item. The sales tax rate is applied to the purchase price, and the resulting amount is added to the total cost. For example, if you purchase an item for $100, the sales tax would be $8.31 (8.31% of $100), making the total cost $108.31.

History of the Denver CO Sales Tax Rate

The Denver CO sales tax rate has undergone several changes over the years. In 2019, the city and county of Denver sales tax rate increased from 3.65% to 4.31%. This increase was part of a broader effort to fund public services, including transportation and education.

What is the Impact of the Denver CO Sales Tax Rate on Businesses?

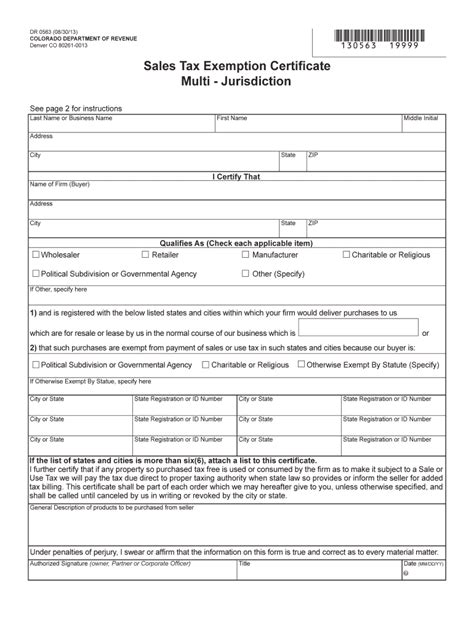

The Denver CO sales tax rate can have a significant impact on businesses operating within the city limits. Businesses are required to collect sales tax on most purchases and remit the funds to the city and state governments. This can be a complex process, especially for small businesses or those without experience with sales tax compliance.

Exemptions and Special Cases

While the Denver CO sales tax rate applies to most purchases, there are some exemptions and special cases to be aware of:

- Groceries: Food and groceries are exempt from sales tax in Denver, CO.

- Prescription medications: Prescription medications are also exempt from sales tax.

- Non-profit organizations: Non-profit organizations may be exempt from sales tax on certain purchases.

How to Calculate Denver CO Sales Tax

Calculating Denver CO sales tax can be a straightforward process. Here's a step-by-step guide:

- Determine the purchase price of the item.

- Multiply the purchase price by the sales tax rate (8.31%).

- Add the sales tax amount to the purchase price.

Denver CO Sales Tax Rate FAQs

What is the current Denver CO sales tax rate?

+The current Denver CO sales tax rate is 8.31%.

How is the Denver CO sales tax rate calculated?

+The Denver CO sales tax rate is calculated by multiplying the purchase price by the sales tax rate (8.31%).

Are there any exemptions from the Denver CO sales tax rate?

+Yes, there are exemptions from the Denver CO sales tax rate, including groceries, prescription medications, and non-profit organizations.

In conclusion, understanding the Denver CO sales tax rate is essential for both consumers and businesses. By knowing the current rate, how it's calculated, and any exemptions or special cases, you can navigate the complex world of sales tax with confidence. Whether you're a business owner or simply a resident of Denver, CO, being informed about the sales tax rate can help you make informed decisions and avoid any potential pitfalls.