Intro

As a resident, navigating the world of medical training can be overwhelming, especially when it comes to financial matters. While the primary focus is on gaining hands-on experience and developing medical skills, it's essential to understand how residents get paid during their training. In this article, we'll delve into the various ways residents receive financial compensation, helping you make informed decisions about your medical career.

Residency is a critical phase of medical training, providing hands-on experience and exposure to various medical specialties. During this period, residents work under the supervision of experienced physicians, honing their skills and developing their expertise. With the demands of residency come financial responsibilities, and understanding the payment structures is vital for managing your finances effectively.

Understanding Resident Compensation

Resident compensation varies depending on the institution, location, and specialty. However, most residents receive a stipend or salary, which is typically funded by the hospital or medical institution. In addition to their stipend, residents may also receive benefits such as health insurance, malpractice insurance, and paid time off.

1. Stipend or Salary

The most common form of resident compensation is a stipend or salary. This is usually paid biweekly or monthly and is based on the resident's level of training and the institution's pay scale. The stipend or salary is typically tax-free, and residents are not required to pay taxes on this income. However, it's essential to note that taxes may be withheld, and residents should consult with a tax professional to understand their tax obligations.

Additional Forms of Compensation

In addition to their stipend or salary, residents may receive other forms of compensation, including:

2. Moonlighting

Moonlighting is a common practice among residents, where they work extra shifts or take on additional responsibilities outside of their regular training program. This can include working in the emergency department, hospitalist shifts, or even private practice. Moonlighting can provide valuable experience and additional income, but it's essential to ensure that it does not interfere with regular training responsibilities.

3. Research Grants and Funding

Many residents participate in research projects during their training, which can provide additional funding and compensation. Research grants and funding can come from various sources, including government agencies, private foundations, and pharmaceutical companies. Residents can use this funding to support their research projects, travel to conferences, or attend workshops and training programs.

4. Teaching and Education

Residents may also receive compensation for teaching and education activities, such as leading workshops, presenting lectures, or mentoring medical students. This can be a valuable way to gain teaching experience and develop leadership skills, while also earning additional income.

5. Signing Bonuses and Relocation Assistance

Some residency programs offer signing bonuses or relocation assistance to attract top talent. These incentives can provide a lump sum payment or reimbursement for moving expenses, helping residents cover the costs of relocating to a new city or state.

Tips for Managing Resident Finances

Managing finances during residency can be challenging, but there are several tips to keep in mind:

- Create a budget and track expenses to ensure you're staying within your means.

- Take advantage of tax-advantaged savings options, such as 401(k) or Roth IRA accounts.

- Consider working with a financial advisor to develop a long-term financial plan.

- Prioritize needs over wants, and avoid overspending on non-essential items.

Conclusion

Residency is a critical phase of medical training, and understanding how residents get paid is essential for managing finances effectively. By exploring the various forms of compensation, including stipends, moonlighting, research grants, teaching, and signing bonuses, residents can make informed decisions about their financial future. Remember to prioritize needs over wants, take advantage of tax-advantaged savings options, and seek professional advice to ensure a secure financial foundation.

We hope this article has provided valuable insights into the world of resident compensation. Share your thoughts and experiences with us in the comments below, and don't forget to share this article with your colleagues and friends!

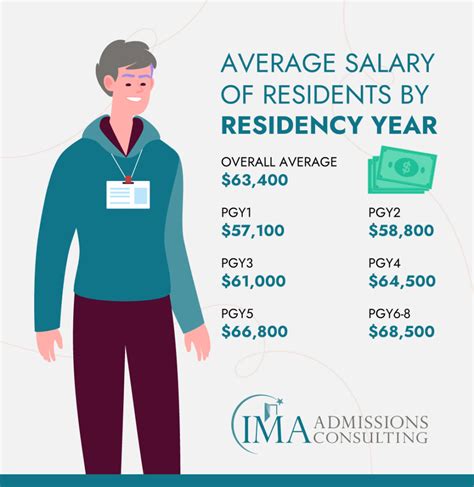

What is the average stipend for residents in the United States?

+The average stipend for residents in the United States varies depending on the institution, location, and specialty. However, according to the Association of American Medical Colleges (AAMC), the average annual stipend for residents in the 2022-2023 academic year is around $60,000.

Can residents negotiate their stipend or salary?

+While it's possible to negotiate, it's not common for residents to negotiate their stipend or salary. However, residents can discuss their financial situation and expenses with their program director or department chair to see if any adjustments can be made.

What are some common expenses for residents during training?

+Common expenses for residents during training include housing, food, transportation, and education expenses, such as textbooks and conference fees. Residents may also need to pay for malpractice insurance, licensing fees, and board exam fees.