Intro

Kickstart your financial services business with these 5 actionable strategies to boost early growth. Discover how to accelerate funding, leverage technology, build a strong team, and navigate regulatory hurdles. Learn the essential steps to drive revenue, enhance customer experience, and establish a competitive edge in the financial services industry.

As the financial services industry continues to evolve, it's becoming increasingly important for companies to find ways to boost early growth and stay ahead of the competition. Whether you're a startup or an established player, early growth can be a major challenge. However, with the right strategies in place, you can set yourself up for success and achieve rapid growth.

In this article, we'll explore five ways to boost early growth in financial services, from leveraging digital marketing to investing in data analytics.

1. Leverage Digital Marketing to Reach New Customers

In today's digital age, having a strong online presence is crucial for financial services companies. Digital marketing can help you reach new customers, increase brand awareness, and drive website traffic. Some effective digital marketing strategies for financial services include:

- Search engine optimization (SEO) to improve your website's visibility in search results

- Pay-per-click (PPC) advertising to target specific keywords and demographics

- Social media marketing to engage with customers and build brand awareness

- Content marketing to educate customers and establish thought leadership

By leveraging these digital marketing strategies, you can reach new customers and drive growth for your financial services company.

Benefits of Digital Marketing for Financial Services

- Increased brand awareness and reach

- Improved website traffic and engagement

- Targeted advertising to specific demographics and interests

- Cost-effective compared to traditional marketing methods

2. Invest in Data Analytics to Inform Business Decisions

Data analytics is a powerful tool for financial services companies, providing insights into customer behavior, market trends, and business performance. By investing in data analytics, you can make informed business decisions, identify areas for improvement, and drive growth.

Some key benefits of data analytics for financial services include:

- Improved risk management and compliance

- Enhanced customer experience and personalization

- Increased efficiency and productivity

- Better decision-making and strategic planning

By leveraging data analytics, you can gain a competitive edge and drive growth for your financial services company.

Benefits of Data Analytics for Financial Services

- Improved risk management and compliance

- Enhanced customer experience and personalization

- Increased efficiency and productivity

- Better decision-making and strategic planning

3. Develop Strategic Partnerships to Expand Reach

Strategic partnerships can be a powerful way to expand your reach and drive growth for your financial services company. By partnering with other businesses or organizations, you can:

- Increase brand awareness and credibility

- Access new markets and customer segments

- Improve product or service offerings

- Enhance customer experience and satisfaction

Some key benefits of strategic partnerships for financial services include:

- Increased brand awareness and credibility

- Access to new markets and customer segments

- Improved product or service offerings

- Enhanced customer experience and satisfaction

By developing strategic partnerships, you can drive growth and expansion for your financial services company.

Benefits of Strategic Partnerships for Financial Services

- Increased brand awareness and credibility

- Access to new markets and customer segments

- Improved product or service offerings

- Enhanced customer experience and satisfaction

4. Focus on Customer Experience to Drive Loyalty and Retention

Customer experience is a critical factor in driving growth and loyalty for financial services companies. By focusing on customer experience, you can:

- Improve customer satisfaction and loyalty

- Increase customer retention and reduce churn

- Enhance brand reputation and credibility

- Drive positive word-of-mouth and referrals

Some key strategies for improving customer experience in financial services include:

- Personalization and tailored solutions

- Omnichannel engagement and support

- Simplified and streamlined processes

- Proactive communication and education

By focusing on customer experience, you can drive growth and loyalty for your financial services company.

Benefits of Customer Experience for Financial Services

- Improved customer satisfaction and loyalty

- Increased customer retention and reduced churn

- Enhanced brand reputation and credibility

- Drive positive word-of-mouth and referrals

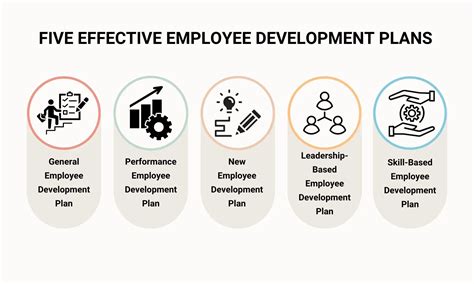

5. Invest in Employee Development and Training

Employee development and training are critical for driving growth and success in financial services. By investing in your employees, you can:

- Improve job satisfaction and engagement

- Increase productivity and efficiency

- Enhance customer experience and satisfaction

- Drive innovation and creativity

Some key strategies for employee development and training in financial services include:

- Ongoing training and education programs

- Mentorship and coaching initiatives

- Performance feedback and evaluation

- Opportunities for career advancement and growth

By investing in employee development and training, you can drive growth and success for your financial services company.

Benefits of Employee Development for Financial Services

- Improved job satisfaction and engagement

- Increased productivity and efficiency

- Enhanced customer experience and satisfaction

- Drive innovation and creativity

What are some common challenges faced by financial services companies in early growth?

+Common challenges faced by financial services companies in early growth include finding new customers, managing risk and compliance, and competing with established players in the market.

How can digital marketing help financial services companies drive growth?

+Digital marketing can help financial services companies drive growth by increasing brand awareness, improving website traffic, and targeting specific demographics and interests.

What are some key benefits of data analytics for financial services companies?

+Key benefits of data analytics for financial services companies include improved risk management and compliance, enhanced customer experience and personalization, and better decision-making and strategic planning.

By implementing these five strategies, financial services companies can drive early growth and set themselves up for long-term success. Whether you're a startup or an established player, these strategies can help you stay ahead of the competition and achieve your business goals.