Intro

The beautiful state of Hawaii, known for its stunning beaches, lush greenery, and active volcanoes. But, when it comes to planning for retirement, the Aloha State's Employee Retirement System (ERS) can be a complex and daunting task, especially for new employees or those nearing retirement age. In this article, we will delve into the world of Hawaii's ERS, exploring its intricacies and providing valuable insights to help you navigate the system with ease.

Hawaii's ERS is a defined benefit plan, which means that the benefit amount is calculated based on a formula, taking into account the employee's salary and years of service. The system is designed to provide a predictable income stream in retirement, helping employees achieve financial security and peace of mind. However, with so many options and rules to consider, it's essential to understand how the system works and how to make the most of it.

Understanding the Types of Membership

Before we dive into the nitty-gritty of Hawaii's ERS, it's crucial to understand the different types of membership. The system has two primary categories: contributory and non-contributory.

- Contributory members are those who contribute a portion of their salary to the ERS, while non-contributory members do not make contributions. The contributory membership is further divided into two sub-categories: Tier 1 and Tier 2.

- Tier 1 members are those who joined the ERS before July 1, 2012, and Tier 2 members are those who joined on or after July 1, 2012.

Key Differences Between Tier 1 and Tier 2

While both Tier 1 and Tier 2 members are part of the contributory membership category, there are significant differences between the two. Tier 1 members are eligible for a higher benefit multiplier, which can result in a larger retirement benefit. Additionally, Tier 1 members are not subject to the same vesting requirements as Tier 2 members.

Navigating the Retirement Process

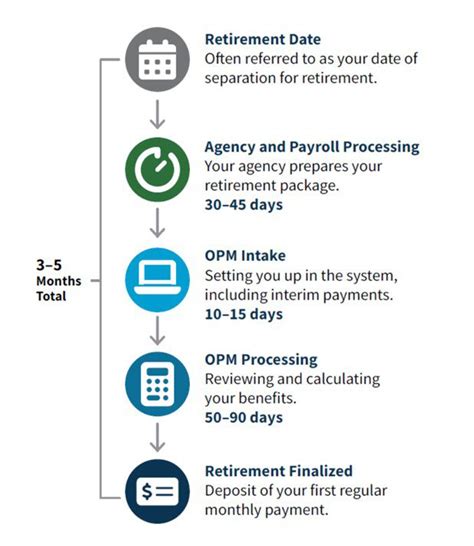

Now that we've covered the basics of Hawaii's ERS, let's move on to the retirement process. When an employee is ready to retire, they must submit an application to the ERS. The application process typically takes several months, so it's essential to plan ahead.

Here are the general steps to follow:

- Determine Eligibility: The employee must meet the eligibility requirements, which include age and years of service.

- Submit Application: The employee must submit a completed application to the ERS, along with required documentation.

- Review and Approval: The ERS will review the application and verify the employee's eligibility.

- Benefit Calculation: The ERS will calculate the employee's retirement benefit based on their salary and years of service.

Understanding the Benefit Options

Once the employee's retirement benefit is calculated, they will have several options to choose from. The most common options include:

- Lifetime Annuity: A guaranteed income stream for life.

- Joint and Survivor Annuity: A guaranteed income stream for the employee and their spouse.

- Lump Sum Payment: A one-time payment of the employee's accumulated contributions.

Choosing the Right Option

Choosing the right benefit option can be a daunting task, as it depends on individual circumstances and financial goals. It's essential to consider factors such as life expectancy, income needs, and tax implications.

Maximizing Your Retirement Benefit

To maximize your retirement benefit, it's essential to understand the system and plan ahead. Here are some tips to consider:

- Contribute to the ERS: Contributing to the ERS can increase your retirement benefit.

- Take Advantage of Catch-Up Contributions: If you're 50 or older, you may be eligible to make catch-up contributions to the ERS.

- Consider a Deferred Retirement Option Plan (DROP): A DROP allows you to continue working while accumulating a lump sum payment.

Conclusion

Navigating Hawaii's Employee Retirement System can be complex, but with the right knowledge and planning, you can make the most of your retirement benefits. By understanding the types of membership, navigating the retirement process, and choosing the right benefit option, you can ensure a secure financial future.

If you have any questions or concerns about Hawaii's ERS, we encourage you to comment below or share this article with your colleagues. Together, we can help each other achieve a happy and fulfilling retirement.

What is the difference between contributory and non-contributory membership?

+Contributory members contribute a portion of their salary to the ERS, while non-contributory members do not make contributions.

What is the benefit multiplier for Tier 1 members?

+The benefit multiplier for Tier 1 members is 2% per year of service, up to a maximum of 80% of their final average salary.

Can I contribute to the ERS if I'm a non-contributory member?

+No, non-contributory members are not eligible to contribute to the ERS.