Intro

Discover the intricacies of group life insurance policies, typically written as annual contracts. Learn how employers use these policies to provide employee benefits, covering aspects of term life insurance, group term life insurance, and supplemental life insurance. Understand policy renewal, premium payments, and conversion options for a comprehensive grasp of group life insurance.

Group life insurance policies are generally written as annual contracts, renewable at the option of the insurer. This means that the policy is in effect for a one-year period, after which the insurer has the option to renew the policy or cancel it. The terms of the policy, including the premium rate, may change at the time of renewal.

The annual contract feature of group life insurance policies provides flexibility for both the insurer and the policyholder. It allows the insurer to adjust the premium rate or policy terms as needed, based on factors such as changes in the group's demographics or claims experience. For the policyholder, it provides the opportunity to review and adjust the policy's coverage and terms on an annual basis.

Types of Group Life Insurance Policies

There are several types of group life insurance policies, each with its own unique features and benefits. Some of the most common types include:

Basic Life Insurance

Basic life insurance is the most common type of group life insurance policy. It provides a basic level of coverage, usually equal to one or two times the employee's annual salary. This type of policy is often provided by the employer as a benefit to employees.

Supplemental Life Insurance

Supplemental life insurance is an optional type of coverage that allows employees to purchase additional coverage beyond the basic level provided by the employer. This type of policy is usually paid for by the employee through payroll deductions.

Dependent Life Insurance

Dependent life insurance provides coverage for an employee's spouse and/or children. This type of policy is usually optional and may be paid for by the employee through payroll deductions.

Voluntary Life Insurance

Voluntary life insurance is a type of policy that allows employees to purchase coverage on a voluntary basis. This type of policy is usually paid for by the employee through payroll deductions.

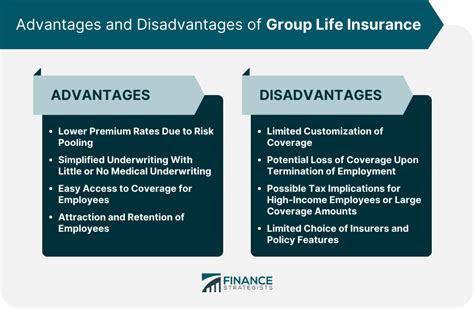

Benefits of Group Life Insurance Policies

Group life insurance policies offer several benefits to both employers and employees. Some of the most significant benefits include:

Tax Benefits

The premiums paid for group life insurance policies are generally tax-deductible for the employer. In addition, the death benefit paid to the beneficiary is usually tax-free.

Cost Savings

Group life insurance policies are often less expensive than individual life insurance policies. This is because the risk is spread across a larger group of people, reducing the cost of coverage.

Convenience

Group life insurance policies are often easier to administer than individual life insurance policies. The employer typically handles the paperwork and premium payments, making it a convenient option for employees.

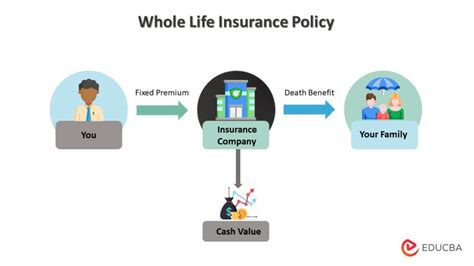

How Group Life Insurance Policies Work

Group life insurance policies work by pooling the risk of a group of people together. The insurer calculates the premium rate based on the overall risk of the group, rather than individual risk factors.

Here's an example of how group life insurance policies work:

- An employer purchases a group life insurance policy to cover its employees.

- The insurer calculates the premium rate based on the overall risk of the group.

- The employer pays the premiums for the policy.

- If an employee dies, the insurer pays a death benefit to the beneficiary.

Common Riders and Add-ons

Group life insurance policies often offer riders and add-ons that can enhance the coverage and benefits. Some common riders and add-ons include:

Waiver of Premium Rider

This rider waives the premium payments if the employee becomes disabled or critically ill.

Accidental Death and Dismemberment (AD&D) Rider

This rider provides additional coverage in the event of accidental death or dismemberment.

Long-Term Care Rider

This rider provides coverage for long-term care expenses, such as nursing home care or home health care.

FAQs

What is group life insurance?

+Group life insurance is a type of life insurance policy that covers a group of people, usually employees of a company or members of an organization.

How does group life insurance work?

+Group life insurance works by pooling the risk of a group of people together. The insurer calculates the premium rate based on the overall risk of the group, rather than individual risk factors.

What are the benefits of group life insurance?

+The benefits of group life insurance include tax benefits, cost savings, and convenience. The premiums paid for group life insurance policies are generally tax-deductible for the employer, and the death benefit paid to the beneficiary is usually tax-free.

We hope this article has provided you with a comprehensive understanding of group life insurance policies. If you have any further questions or would like to learn more about group life insurance, please don't hesitate to ask.