Intro

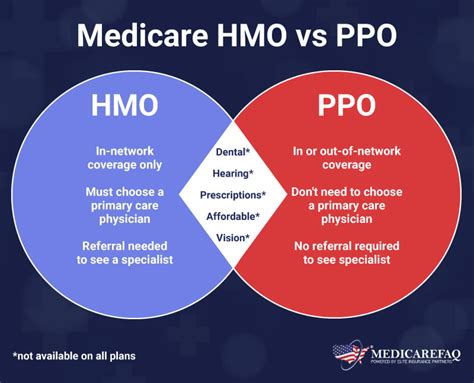

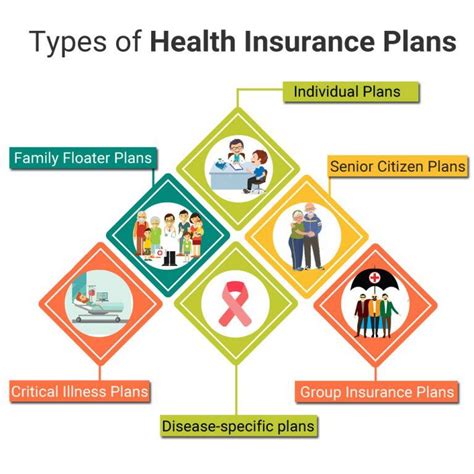

Choosing the right health plan can be a daunting task, especially with the numerous options available in the market. Two of the most popular types of health plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). While both plans have their advantages and disadvantages, they cater to different needs and preferences. In this article, we will delve into the details of HMO and PPO plans, their differences, and help you decide which one is best for you.

What is an HMO Plan?

A Health Maintenance Organization (HMO) plan is a type of health insurance that provides coverage for a specific network of healthcare providers. HMO plans are designed to offer comprehensive and coordinated care, with an emphasis on preventive care. When you enroll in an HMO plan, you typically choose a primary care physician (PCP) who coordinates your care and refers you to specialists within the network.

Pros of HMO Plans

- Lower premiums compared to PPO plans

- Emphasis on preventive care, which can lead to better health outcomes

- Coordinated care through a primary care physician

- Often includes additional benefits, such as wellness programs and health education

Cons of HMO Plans

- Limited network of healthcare providers

- Referrals required to see specialists

- Out-of-network care is often not covered or covered at a higher cost

- Less flexibility in choosing healthcare providers

What is a PPO Plan?

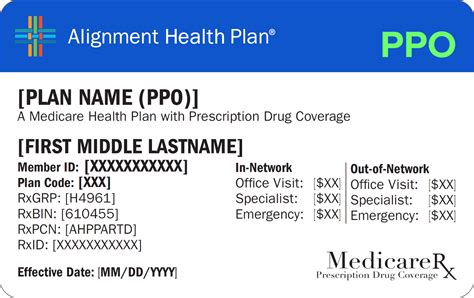

A Preferred Provider Organization (PPO) plan is a type of health insurance that offers a network of healthcare providers who have agreed to provide care at a negotiated rate. PPO plans offer more flexibility than HMO plans, allowing you to see any healthcare provider, both in-network and out-of-network.

Pros of PPO Plans

- More flexibility in choosing healthcare providers

- No referrals required to see specialists

- Out-of-network care is covered, although at a higher cost

- Often includes a wider network of healthcare providers

Cons of PPO Plans

- Higher premiums compared to HMO plans

- Out-of-network care can be expensive

- No emphasis on preventive care

- May not include additional benefits, such as wellness programs

Key Differences Between HMO and PPO Plans

- Network: HMO plans have a limited network of healthcare providers, while PPO plans offer a wider network and the option to see out-of-network providers.

- Referrals: HMO plans require referrals to see specialists, while PPO plans do not.

- Cost: HMO plans are generally less expensive than PPO plans.

- Flexibility: PPO plans offer more flexibility in choosing healthcare providers.

Which Plan is Best for You?

The choice between an HMO and PPO plan depends on your individual needs and preferences. If you value coordinated care, preventive care, and lower premiums, an HMO plan may be the best option for you. However, if you prefer more flexibility in choosing healthcare providers and are willing to pay higher premiums, a PPO plan may be the better choice.

Consider the following questions to help you make a decision:

- Do you have a primary care physician or prefer to choose one?

- Are you willing to pay higher premiums for more flexibility in choosing healthcare providers?

- Do you prioritize preventive care and coordinated care?

- Do you have ongoing medical needs that require frequent specialist visits?

Additional Tips for Choosing a Health Plan

- Research the network of healthcare providers for both HMO and PPO plans

- Compare the costs of both plans, including premiums, deductibles, and copays

- Consider any additional benefits, such as wellness programs and health education

- Read reviews and ask for referrals from friends and family members

In conclusion, both HMO and PPO plans have their advantages and disadvantages. By understanding the key differences between the two plans and considering your individual needs and preferences, you can make an informed decision about which plan is best for you.

We invite you to share your thoughts and experiences with HMO and PPO plans in the comments below. Have you had a positive or negative experience with one of these plans? Share your story and help others make informed decisions about their health insurance.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the network of healthcare providers. HMO plans have a limited network, while PPO plans offer a wider network and the option to see out-of-network providers.

Do HMO plans cover out-of-network care?

+HMO plans typically do not cover out-of-network care or cover it at a higher cost.

Which plan is more expensive, HMO or PPO?

+PPO plans are generally more expensive than HMO plans.