Intro

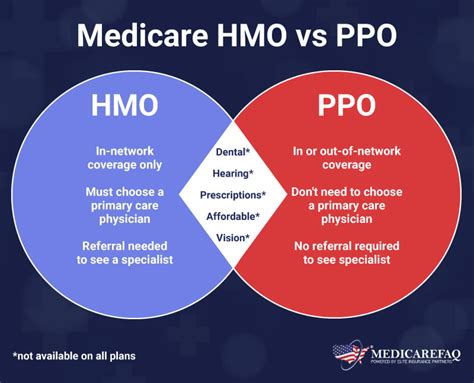

Discover the essential differences between HMO and PPO health insurance plans. Learn about network restrictions, out-of-pocket costs, provider choice, and more. Understand the pros and cons of each plan to make an informed decision. Compare HMO vs PPO plans and find the best fit for your healthcare needs and budget.

When it comes to choosing a health insurance plan, there are numerous options available, each with its unique set of benefits and drawbacks. Two of the most popular types of health insurance plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). While both plans provide essential health coverage, there are significant differences between them. In this article, we will delve into the 5 key differences between HMO and PPO plans, helping you make an informed decision when selecting a health insurance plan.

What is an HMO Plan?

An HMO plan is a type of health insurance plan that provides coverage for medical services within a specific network of healthcare providers. HMO plans typically require policyholders to select a primary care physician (PCP) who coordinates their care and refers them to specialists within the network. HMO plans often have lower premiums compared to PPO plans but may have more restrictions on care.

Key Characteristics of HMO Plans

- Lower premiums

- Narrow network of healthcare providers

- Requires selection of a primary care physician (PCP)

- PCP coordinates care and refers to specialists within the network

- Typically, no coverage for out-of-network care

What is a PPO Plan?

A PPO plan is a type of health insurance plan that provides coverage for medical services both within and outside of a specific network of healthcare providers. PPO plans do not require policyholders to select a primary care physician, and referrals to specialists are not necessary. PPO plans often have higher premiums compared to HMO plans but offer more flexibility in care.

Key Characteristics of PPO Plans

- Higher premiums

- Larger network of healthcare providers

- No requirement to select a primary care physician

- No referrals needed to see specialists

- Coverage for out-of-network care, although at a higher cost

Difference 1: Network Size and Flexibility

One of the most significant differences between HMO and PPO plans is the size and flexibility of their networks. HMO plans have a narrower network of healthcare providers, which means policyholders have fewer options when choosing a doctor or hospital. In contrast, PPO plans have a larger network of providers, offering more flexibility and choices for policyholders.

Difference 2: Primary Care Physician (PCP) Requirement

HMO plans require policyholders to select a primary care physician (PCP) who coordinates their care and refers them to specialists within the network. In contrast, PPO plans do not require policyholders to select a PCP, and referrals to specialists are not necessary.

Pros and Cons of PCP Requirement

- Pros:

- Encourages preventive care and coordinated care

- Helps manage chronic conditions

- Cons:

- Limits flexibility in care

- May lead to delays in specialist care

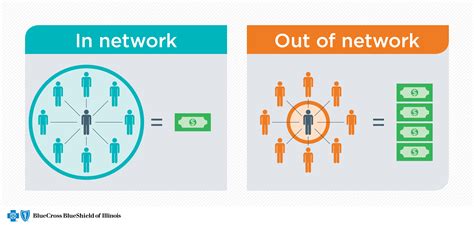

Difference 3: Out-of-Network Coverage

HMO plans typically do not cover out-of-network care, while PPO plans do, although at a higher cost. This means that policyholders with HMO plans may face significant out-of-pocket expenses if they receive care from a provider outside of their network.

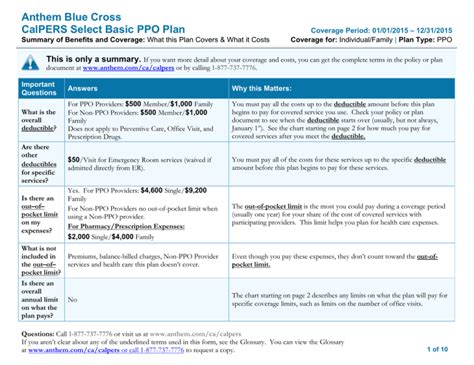

Difference 4: Premium Costs

HMO plans typically have lower premiums compared to PPO plans. However, policyholders with HMO plans may face higher out-of-pocket costs if they receive care from a provider outside of their network.

Comparing Premium Costs

- HMO plans: Lower premiums, but higher out-of-pocket costs for out-of-network care

- PPO plans: Higher premiums, but lower out-of-pocket costs for out-of-network care

Difference 5: Administrative Tasks

HMO plans often require more administrative tasks, such as obtaining referrals from a PCP and coordinating care within the network. In contrast, PPO plans typically require fewer administrative tasks, as policyholders can see specialists without referrals.

Comparing Administrative Tasks

- HMO plans: More administrative tasks, such as obtaining referrals and coordinating care

- PPO plans: Fewer administrative tasks, as policyholders can see specialists without referrals

In conclusion, while both HMO and PPO plans provide essential health coverage, there are significant differences between them. HMO plans offer lower premiums but have narrower networks and more restrictions on care. PPO plans offer more flexibility in care but have higher premiums and may require more out-of-pocket costs for out-of-network care. Ultimately, the choice between an HMO and PPO plan depends on your individual needs and preferences.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the size and flexibility of their networks. HMO plans have a narrower network of healthcare providers, while PPO plans have a larger network and more flexibility in care.

Do HMO plans cover out-of-network care?

+No, HMO plans typically do not cover out-of-network care. Policyholders may face significant out-of-pocket expenses if they receive care from a provider outside of their network.

Which plan has higher premiums?

+PPO plans typically have higher premiums compared to HMO plans. However, policyholders with PPO plans may have lower out-of-pocket costs for out-of-network care.

We hope this article has provided you with a comprehensive understanding of the differences between HMO and PPO plans. If you have any further questions or concerns, please feel free to comment below or share this article with your friends and family.