Intro

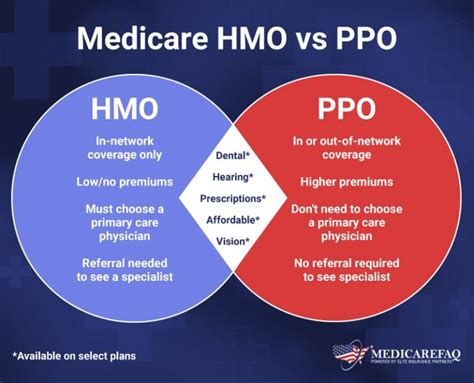

Discover the essential differences between HMO and PPO health insurance plans. Learn about network restrictions, out-of-pocket costs, provider choice, and more. Understand the pros and cons of each plan to make an informed decision. Compare HMO vs PPO plans and find the best fit for your healthcare needs and budget.

In the complex world of health insurance, understanding the differences between various plan types is crucial for making informed decisions about your healthcare coverage. Two of the most popular types of health insurance plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). While both offer comprehensive coverage, there are significant differences between them that can impact your healthcare experience and expenses. Here, we'll delve into the key differences between HMO and PPO plans, helping you make a more informed choice for your health insurance needs.

Network and Providers

One of the most significant differences between HMO and PPO plans lies in their network and provider structure. An HMO plan requires you to choose a primary care physician (PCP) from its network. This PCP acts as your first point of contact for medical care and referrals to specialists within the network. HMO plans typically have narrower networks, meaning fewer providers participate. However, this narrower network allows HMOs to negotiate lower rates with providers, which can result in lower premiums for you.

On the other hand, PPO plans offer a broader network of providers, including both in-network and out-of-network options. Unlike HMOs, PPOs do not require you to choose a PCP, and you can see any specialist without a referral. However, seeing an out-of-network provider will typically result in higher out-of-pocket costs compared to in-network care.

Key Benefits of Broader Networks in PPO Plans

- Flexibility in choosing providers, both in-network and out-of-network.

- No requirement for a primary care physician or referrals to specialists.

- Greater access to specialists and hospitals, potentially leading to faster diagnosis and treatment.

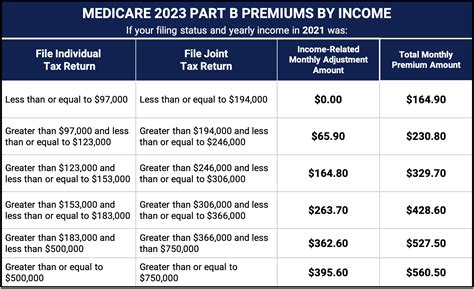

Costs and Premiums

The cost structure of HMO and PPO plans differs significantly, affecting your overall healthcare expenses. HMO plans generally offer lower premiums compared to PPO plans. This is because HMOs operate on a narrower network and have more control over the costs of care. However, HMO plans often come with higher copays and deductibles for out-of-network care, which can be a significant drawback if you need to see a specialist outside your network.

PPO plans, while often more expensive in terms of premiums, offer more flexibility with lower out-of-pocket costs for out-of-network care. This makes PPOs a better option if you prefer the freedom to see any doctor or specialist without worrying about higher costs.

Understanding Premiums and Out-of-Pocket Costs

- Premiums: Regular payments made to maintain health insurance coverage.

- Deductibles: Amounts you pay out-of-pocket before your insurance plan starts to pay.

- Copays and Coinsurance: Payments made at the time of service or after receiving a bill.

Preventive Care and Services

Both HMO and PPO plans cover preventive care services, such as routine check-ups, vaccinations, and screenings. However, the extent of coverage and the associated costs can vary. HMO plans often have more stringent requirements for preventive care, such as needing a referral from your primary care physician for certain services.

PPO plans, on the other hand, offer more flexibility in accessing preventive services. You can typically see any provider for these services without a referral, and the costs are usually lower if you stay within the network.

Benefits of Preventive Care

- Early detection and treatment of health issues.

- Reduction in healthcare costs over time.

- Improved overall health and well-being.

Emergency and Urgent Care

In cases of emergency or urgent care, both HMO and PPO plans cover services regardless of the provider's network status. However, PPO plans may offer more comprehensive coverage for urgent care services, such as lower copays or coinsurance rates.

Understanding Emergency and Urgent Care Coverage

- Emergency Care: Services needed immediately due to a severe injury or illness.

- Urgent Care: Non-emergency services that require prompt attention.

Making Your Decision

Choosing between an HMO and a PPO plan depends on your individual healthcare needs, preferences, and budget. If you prioritize lower premiums and are comfortable with a narrower network of providers, an HMO plan might be the best choice. However, if you prefer the flexibility to see any doctor or specialist without higher costs, a PPO plan might be more suitable.

Ultimately, it's essential to weigh the pros and cons of each plan type, considering factors such as network size, costs, preventive care, and emergency services, to make an informed decision that aligns with your healthcare goals and financial situation.

Don't hesitate to reach out to a healthcare professional or insurance expert to discuss your options in more detail. Share your experiences or questions about HMO and PPO plans in the comments below. Your insights can help others make more informed decisions about their health insurance.

What is the main difference between HMO and PPO plans?

+The main difference lies in their network and provider structure. HMO plans have narrower networks and require a primary care physician, while PPO plans offer broader networks and do not require a PCP or referrals.

Which plan type is more expensive?

+PPO plans are generally more expensive in terms of premiums but offer more flexibility and lower out-of-pocket costs for out-of-network care.

Do both plans cover preventive care services?

+Yes, both HMO and PPO plans cover preventive care services, but the extent of coverage and associated costs can vary.