Intro

Discover the average Kaiser insurance cost per month and explore factors affecting premiums. Get insights into Kaiser Permanentes health insurance plans, deductibles, and out-of-pocket costs. Compare rates and find affordable coverage options. Learn how age, location, and plan type impact Kaiser insurance costs and make informed decisions about your healthcare coverage.

Kaiser Permanente, a well-known health maintenance organization (HMO), offers a range of health insurance plans to individuals, families, and employers. With a strong presence in eight states and the District of Columbia, Kaiser Permanente has become a popular choice for those seeking comprehensive and affordable healthcare coverage. However, the cost of Kaiser insurance can vary significantly depending on several factors, including age, location, plan type, and metal tier. In this article, we will delve into the average Kaiser insurance cost per month, exploring the factors that influence premiums and providing insights into the different plan options available.

Factors Affecting Kaiser Insurance Cost

Before we dive into the average premiums, it's essential to understand the factors that influence Kaiser insurance costs. These factors include:

- Age: Premiums tend to increase with age, with older individuals typically paying more than younger ones.

- Location: Kaiser Permanente operates in eight states (California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, and Washington) and the District of Columbia. Premiums can vary significantly depending on the location.

- Plan type: Kaiser Permanente offers various plan types, including HMO, PPO, and EPO. Each plan type has its own premium structure.

- Metal tier: Kaiser Permanente offers plans in four metal tiers: Bronze, Silver, Gold, and Platinum. Each tier has a different premium level, with Bronze being the most affordable and Platinum being the most expensive.

- Subsidies: Eligible individuals may receive subsidies to help lower their premiums.

Age-Based Premiums

As mentioned earlier, age plays a significant role in determining Kaiser insurance costs. Here's a breakdown of the average monthly premiums for a Kaiser Permanente plan based on age:

- 20-29 years: $320-$450 per month

- 30-39 years: $380-$550 per month

- 40-49 years: $450-$650 per month

- 50-59 years: $550-$800 per month

- 60-64 years: $700-$1,000 per month

Keep in mind that these are general estimates and actual premiums may vary depending on your location, plan type, and other factors.

Average Kaiser Insurance Cost per Month

Based on data from Kaiser Permanente's website, here are the average monthly premiums for a Kaiser Permanente plan in each of the eight states and the District of Columbia:

- California: $430-$630 per month

- Colorado: $380-$560 per month

- Georgia: $410-$620 per month

- Hawaii: $450-$670 per month

- Maryland: $420-$640 per month

- Oregon: $390-$590 per month

- Virginia: $400-$610 per month

- Washington: $410-$630 per month

- District of Columbia: $450-$680 per month

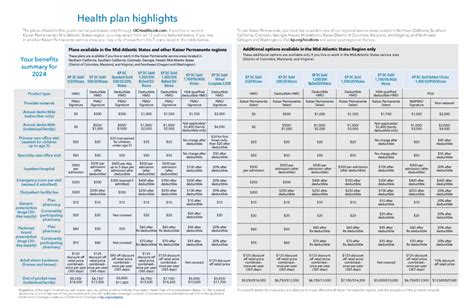

Kaiser Permanente Plan Options

Kaiser Permanente offers a range of plan options to suit different needs and budgets. Here are some of the most popular plans:

-

Kaiser Permanente Bronze Plan

+ Premium: $320-$450 per month + Deductible: $4,500-$6,000 + Coinsurance: 50% -

Kaiser Permanente Silver Plan

+ Premium: $450-$650 per month + Deductible: $2,500-$3,500 + Coinsurance: 30% -

Kaiser Permanente Gold Plan

+ Premium: $600-$900 per month + Deductible: $1,500-$2,500 + Coinsurance: 20% -

Kaiser Permanente Platinum Plan

+ Premium: $900-$1,400 per month + Deductible: $0-$1,000 + Coinsurance: 10%

Conclusion

In conclusion, the cost of Kaiser insurance can vary significantly depending on several factors, including age, location, plan type, and metal tier. While the average monthly premiums can range from $320 to $1,400, it's essential to consider your individual circumstances and choose a plan that meets your needs and budget. By understanding the factors that influence Kaiser insurance costs and exploring the different plan options available, you can make an informed decision about your healthcare coverage.

What's Next?

Now that you have a better understanding of Kaiser insurance costs, it's time to take the next step. If you're interested in learning more about Kaiser Permanente plans or would like to get a quote, visit their website or contact a licensed insurance agent. Remember to carefully review the plan details, including premiums, deductibles, and coinsurance, to ensure you're making an informed decision about your healthcare coverage.

What is the average cost of Kaiser insurance per month?

+The average cost of Kaiser insurance per month varies depending on age, location, plan type, and metal tier. However, based on data from Kaiser Permanente's website, the average monthly premiums range from $320 to $1,400.

What factors affect Kaiser insurance costs?

+Kaiser insurance costs are influenced by several factors, including age, location, plan type, and metal tier. Additionally, eligible individuals may receive subsidies to help lower their premiums.

What is the difference between Kaiser Permanente's Bronze, Silver, Gold, and Platinum plans?

+Kaiser Permanente's Bronze, Silver, Gold, and Platinum plans differ in terms of premium, deductible, and coinsurance. The Bronze plan has the lowest premium but highest deductible, while the Platinum plan has the highest premium but lowest deductible.