Intro

Discover how to maximize your savings with Kaiser Permanente insurance. Learn 5 effective ways to reduce your healthcare costs, from taking advantage of preventive care services to utilizing Kaisers affordable health plans and wellness programs. Optimize your coverage and minimize your expenses with these expert tips on Kaiser Permanente insurance savings.

As healthcare costs continue to rise, it's essential to find ways to save on medical expenses without compromising on quality care. Kaiser Permanente, a leading healthcare provider, offers various insurance plans that cater to diverse needs and budgets. In this article, we'll explore five ways to save with Kaiser Permanente insurance, helping you make the most of your healthcare dollars.

Kaiser Permanente is renowned for its integrated care model, which combines high-quality medical services with affordable insurance options. By choosing Kaiser Permanente, you can enjoy comprehensive coverage, convenient access to care, and numerous cost-saving opportunities. Whether you're an individual, family, or business owner, there are ways to reduce your healthcare expenses with Kaiser Permanente insurance.

1. Choose the Right Plan

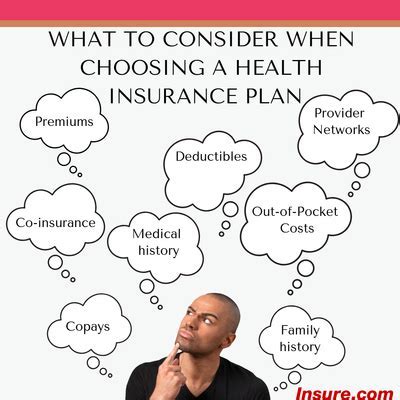

With Kaiser Permanente, you can select from a range of insurance plans that suit your needs and budget. From catastrophic coverage to comprehensive plans, there's an option for everyone. When choosing a plan, consider your healthcare requirements, financial situation, and lifestyle. For instance, if you're relatively healthy and don't require frequent medical visits, a lower-cost plan with a higher deductible might be the way to go.

Some popular Kaiser Permanente plans include:

- Bronze plans: Lower premiums, higher deductibles, and higher out-of-pocket costs

- Silver plans: Moderate premiums, moderate deductibles, and moderate out-of-pocket costs

- Gold plans: Higher premiums, lower deductibles, and lower out-of-pocket costs

Plan Selection Tips

- Assess your healthcare needs: Consider your medical history, current health, and potential future needs.

- Evaluate your budget: Balance your premium costs with potential out-of-pocket expenses.

- Compare plan features: Look at copays, coinsurance, and deductibles to ensure you're getting the best value.

2. Take Advantage of Preventive Care

Preventive care is essential for maintaining good health and reducing medical costs in the long run. Kaiser Permanente encourages preventive care by covering many services without copays or coinsurance. These services include:

- Annual physical exams

- Vaccinations (e.g., flu, HPV, and pneumonia)

- Cancer screenings (e.g., mammograms, colonoscopies)

- Health education and wellness programs

By taking advantage of these services, you can:

- Identify health issues early, reducing treatment costs

- Prevent illnesses and complications

- Improve your overall health and well-being

Preventive Care Tips

- Schedule regular check-ups and screenings

- Stay up-to-date on recommended vaccinations

- Participate in health education and wellness programs

3. Use Kaiser Permanente's Online Tools and Resources

Kaiser Permanente offers various online tools and resources to help you manage your healthcare and reduce costs. These include:

- My Health Manager: A secure online portal for accessing medical records, test results, and billing information

- Kaiser Permanente app: A mobile app for scheduling appointments, refilling prescriptions, and tracking health data

- Health and wellness resources: Online content and tools for managing chronic conditions, improving nutrition, and increasing physical activity

By utilizing these resources, you can:

- Streamline your healthcare management

- Stay informed and engaged in your care

- Make data-driven decisions about your health

Online Tool Tips

- Register for My Health Manager and explore its features

- Download the Kaiser Permanente app for easy access to your health information

- Utilize online resources for health education and wellness support

4. Leverage Kaiser Permanente's Network and Partnerships

Kaiser Permanente has an extensive network of healthcare providers, partnerships, and affiliations. By leveraging these relationships, you can:

- Access high-quality care from a wide range of specialists and primary care physicians

- Benefit from partnerships with top-ranked hospitals and medical centers

- Enjoy discounts and promotions from affiliated health and wellness businesses

Some notable Kaiser Permanente partnerships include:

- hospitals and medical centers

- specialty care providers

- health and wellness businesses

Network and Partnership Tips

- Research Kaiser Permanente's network and partnerships

- Take advantage of discounts and promotions from affiliated businesses

- Seek care from in-network providers to minimize out-of-pocket costs

5. Explore Cost-Saving Programs and Discounts

Kaiser Permanente offers various cost-saving programs and discounts to help you reduce your healthcare expenses. These include:

- Cost-sharing reductions: Discounts on premiums and out-of-pocket costs for eligible individuals and families

- Wellness programs: Discounts on gym memberships, fitness classes, and wellness services

- Employee discounts: Exclusive discounts for Kaiser Permanente employees and their families

By exploring these programs and discounts, you can:

- Reduce your healthcare costs

- Improve your overall health and well-being

- Enhance your quality of life

Cost-Saving Program Tips

- Research cost-sharing reductions and wellness programs

- Take advantage of employee discounts (if applicable)

- Stay informed about new programs and discounts

By implementing these five strategies, you can save money on your Kaiser Permanente insurance while still receiving high-quality care. Remember to choose the right plan, take advantage of preventive care, utilize online tools and resources, leverage Kaiser Permanente's network and partnerships, and explore cost-saving programs and discounts.

We hope this article has provided you with valuable insights and practical tips for saving with Kaiser Permanente insurance. Share your thoughts and experiences in the comments below, and don't hesitate to reach out to Kaiser Permanente for more information on their insurance plans and cost-saving opportunities.

What is the difference between a Bronze and Gold plan?

+A Bronze plan typically has lower premiums, higher deductibles, and higher out-of-pocket costs, while a Gold plan has higher premiums, lower deductibles, and lower out-of-pocket costs.

How do I access Kaiser Permanente's online tools and resources?

+You can access Kaiser Permanente's online tools and resources by registering for My Health Manager and downloading the Kaiser Permanente app.

Can I get a discount on gym memberships with Kaiser Permanente?

+Yes, Kaiser Permanente offers discounts on gym memberships and fitness classes through its wellness programs.