Intro

Discover if Kaiser Permanente is the right insurance fit for you. Learn about its pros and cons, coverage options, and network of healthcare providers. Get insights into its affordability, customer satisfaction, and claims process. Make an informed decision with our comprehensive review of Kaiser Permanentes insurance plans and benefits.

As the healthcare landscape continues to evolve, individuals and families are faced with a multitude of options when it comes to choosing the right health insurance. One of the most well-established and respected names in the industry is Kaiser Permanente. But is Kaiser Permanente good insurance for your needs? In this article, we'll delve into the details of Kaiser Permanente's coverage, benefits, and drawbacks to help you make an informed decision.

Kaiser Permanente is a not-for-profit health plan that has been serving the community for over 75 years. With a strong presence in eight states and the District of Columbia, Kaiser Permanente is one of the largest health plans in the country. Its commitment to providing high-quality, affordable care has earned it a reputation as a leader in the healthcare industry.

Benefits of Kaiser Permanente Insurance

Kaiser Permanente offers a range of benefits that make it an attractive option for individuals and families. Some of the key advantages include:

- Comprehensive coverage: Kaiser Permanente's plans cover a wide range of services, including doctor visits, hospital stays, prescriptions, and wellness programs.

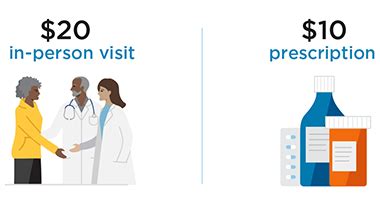

- Low out-of-pocket costs: Kaiser Permanente's plans often have lower deductibles and copays compared to other health plans.

- Access to a network of providers: Kaiser Permanente has a large network of doctors, hospitals, and medical facilities, ensuring that you have access to quality care when you need it.

- Preventive care: Kaiser Permanente places a strong emphasis on preventive care, offering a range of services and programs to help you stay healthy.

- Online resources: Kaiser Permanente's website and mobile app provide easy access to your medical records, test results, and appointment scheduling.

Types of Plans Offered

Kaiser Permanente offers a range of plans to suit different needs and budgets. Some of the most popular plans include:

- Individual and family plans: Kaiser Permanente offers a range of plans for individuals and families, including catastrophic plans and bronze, silver, and gold plans.

- Group plans: Kaiser Permanente offers group plans for businesses and organizations, providing comprehensive coverage for employees and their families.

- Medicare plans: Kaiser Permanente offers a range of Medicare plans, including Medicare Advantage plans and Medicare Supplement plans.

- Dental and vision plans: Kaiser Permanente also offers dental and vision plans, providing comprehensive coverage for these essential services.

How Kaiser Permanente Works

Kaiser Permanente's integrated healthcare model is designed to provide seamless, coordinated care. Here's how it works:

- Primary care physicians: Kaiser Permanente's primary care physicians serve as the central point of contact for your care, coordinating with specialists and other healthcare professionals as needed.

- Specialist care: Kaiser Permanente's network of specialists provides expert care for a range of conditions, from cardiology to oncology.

- Hospital care: Kaiser Permanente's hospitals provide 24/7 emergency care, as well as inpatient and outpatient services.

- Pharmacy services: Kaiser Permanente's pharmacies offer convenient access to prescription medications and expert advice from pharmacists.

Pros and Cons of Kaiser Permanente Insurance

Like any health insurance plan, Kaiser Permanente has its pros and cons. Here are some of the key advantages and disadvantages to consider:

Pros:

- Comprehensive coverage: Kaiser Permanente's plans cover a wide range of services, including doctor visits, hospital stays, and prescriptions.

- Low out-of-pocket costs: Kaiser Permanente's plans often have lower deductibles and copays compared to other health plans.

- Access to a network of providers: Kaiser Permanente has a large network of doctors, hospitals, and medical facilities.

Cons:

- Limited provider network: While Kaiser Permanente's network is large, it may not include all providers in your area.

- Restrictive referrals: Kaiser Permanente's primary care physicians may need to refer you to specialists within the network, which may limit your options.

- Higher premiums: Kaiser Permanente's plans may be more expensive than other health plans, especially for individuals and families with lower incomes.

Kaiser Permanente Insurance Cost

The cost of Kaiser Permanente insurance varies depending on the plan you choose, your age, and your location. Here are some general estimates of what you might expect to pay:

- Individual plans: Kaiser Permanente's individual plans can range from $300 to $600 per month, depending on the plan and your age.

- Family plans: Kaiser Permanente's family plans can range from $800 to $1,500 per month, depending on the plan and your age.

- Group plans: Kaiser Permanente's group plans can range from $200 to $500 per month, depending on the plan and your age.

How to Choose the Right Kaiser Permanente Plan

Choosing the right Kaiser Permanente plan depends on your individual needs and budget. Here are some tips to consider:

- Assess your needs: Consider your healthcare needs, including any chronic conditions or medications you take.

- Compare plans: Compare Kaiser Permanente's plans, including the benefits, deductibles, and copays.

- Check the network: Make sure Kaiser Permanente's network includes your primary care physician and any specialists you see.

- Evaluate the cost: Consider the premium cost, as well as any out-of-pocket costs, such as deductibles and copays.

Kaiser Permanente Insurance Reviews

Kaiser Permanente has a strong reputation for providing high-quality care and excellent customer service. Here are some reviews from satisfied customers:

- "I've been with Kaiser Permanente for over 10 years and have always been impressed with the care I receive. The doctors are knowledgeable and caring, and the staff is always friendly and helpful." - Rachel, age 35

- "I was skeptical about switching to Kaiser Permanente, but I've been pleasantly surprised by the quality of care and the convenience of the online portal." - John, age 42

- "Kaiser Permanente has been a lifesaver for my family. The coverage is comprehensive, and the customer service is top-notch." - Maria, age 50

Common Complaints about Kaiser Permanente Insurance

While Kaiser Permanente has a strong reputation, there are some common complaints about the insurance plan. Here are some of the most common issues:

- Limited provider network: Some customers have complained about the limited provider network, which may not include all providers in their area.

- Restrictive referrals: Some customers have complained about the restrictive referrals, which may limit their options for specialist care.

- Higher premiums: Some customers have complained about the higher premiums, which may be out of reach for individuals and families with lower incomes.

Kaiser Permanente Insurance FAQs

Is Kaiser Permanente a good insurance plan?

+Kaiser Permanente is a highly rated insurance plan that offers comprehensive coverage, low out-of-pocket costs, and access to a network of providers. However, it may not be the best option for everyone, especially those with limited budgets or those who prefer a wider range of provider options.

How much does Kaiser Permanente insurance cost?

+The cost of Kaiser Permanente insurance varies depending on the plan, your age, and your location. Individual plans can range from $300 to $600 per month, while family plans can range from $800 to $1,500 per month.

Is Kaiser Permanente a non-profit organization?

+Yes, Kaiser Permanente is a not-for-profit organization that is committed to providing high-quality, affordable care to its members.

Final Thoughts

Kaiser Permanente is a highly rated insurance plan that offers comprehensive coverage, low out-of-pocket costs, and access to a network of providers. While it may not be the best option for everyone, especially those with limited budgets or those who prefer a wider range of provider options, it is a solid choice for individuals and families who value high-quality care and convenience. By understanding the benefits and drawbacks of Kaiser Permanente insurance, you can make an informed decision about whether it is the right choice for your needs.

We hope this article has provided you with a comprehensive overview of Kaiser Permanente insurance. If you have any further questions or would like to share your own experiences with Kaiser Permanente, please leave a comment below.