Intro

Discover the ins and outs of Kaiser Permanente health insurance plans, including coverage options, pricing, and benefits. Learn how Kaisers integrated care model and wide network of providers can meet your healthcare needs, and explore the pros and cons of choosing a Kaiser plan for you and your family.

Kaiser Permanente is one of the largest and most reputable health insurance providers in the United States, serving millions of members across eight states and the District of Columbia. With a wide range of health insurance plans to choose from, Kaiser Permanente offers individuals, families, and businesses a comprehensive and affordable way to manage their healthcare needs. In this article, we will delve into the details of Kaiser Permanente health insurance plans, including their benefits, working mechanisms, and key information that can help you make an informed decision.

Types of Kaiser Permanente Health Insurance Plans

Kaiser Permanente offers a variety of health insurance plans that cater to different needs and budgets. Some of the most popular plans include:

- HMO (Health Maintenance Organization) Plans: These plans provide comprehensive coverage for medical services, including doctor visits, hospital stays, and prescription medications. HMO plans are generally more affordable than other types of plans but require members to receive care from Kaiser Permanente's network of physicians and hospitals.

- PPO (Preferred Provider Organization) Plans: These plans offer more flexibility than HMO plans, allowing members to receive care from both in-network and out-of-network providers. PPO plans typically have higher premiums than HMO plans but provide more comprehensive coverage.

- EPO (Exclusive Provider Organization) Plans: These plans are similar to HMO plans but do not require a primary care physician referral to see a specialist. EPO plans are a good option for those who want more flexibility in their care but still want to save on premiums.

- Catastrophic Plans: These plans are designed for individuals under the age of 30 or those who qualify for a hardship exemption. Catastrophic plans have lower premiums but higher deductibles and limited coverage.

Benefits of Kaiser Permanente Health Insurance Plans

Kaiser Permanente health insurance plans offer a range of benefits that make them an attractive option for individuals and families. Some of the key benefits include:

- Comprehensive coverage: Kaiser Permanente plans cover a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care.

- Low out-of-pocket costs: Kaiser Permanente plans have low deductibles and copays, making it easier for members to access the care they need without breaking the bank.

- Large network of providers: Kaiser Permanente has a vast network of physicians, hospitals, and medical facilities, ensuring that members have access to quality care wherever they are.

- Preventive care: Kaiser Permanente plans cover a range of preventive services, including vaccinations, screenings, and health education programs.

How Kaiser Permanente Health Insurance Plans Work

Kaiser Permanente health insurance plans work by providing members with access to a network of physicians, hospitals, and medical facilities. Members pay a monthly premium, which varies depending on the plan they choose, and receive comprehensive coverage for medical services.

Here's a step-by-step guide to how Kaiser Permanente health insurance plans work:

- Choose a plan: Select a Kaiser Permanente health insurance plan that meets your needs and budget.

- Pay your premium: Pay your monthly premium to maintain coverage.

- Receive care: Visit a Kaiser Permanente physician or hospital for medical care.

- Pay copays and deductibles: Pay copays and deductibles for medical services, which vary depending on the plan.

- Get reimbursed: Kaiser Permanente reimburses you for medical expenses, depending on the plan and coverage.

Key Information to Consider

When choosing a Kaiser Permanente health insurance plan, there are several key factors to consider:

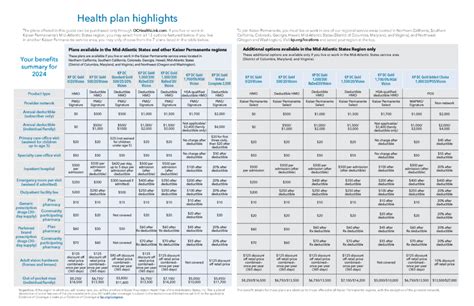

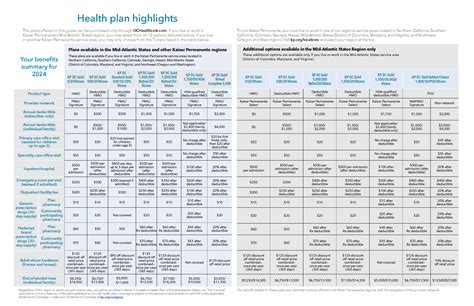

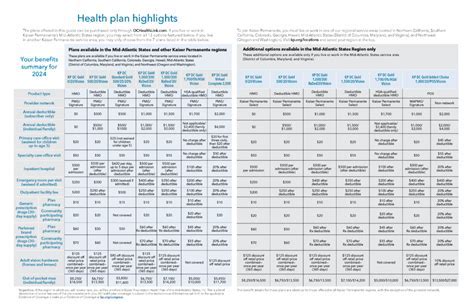

- Premium costs: Compare the premium costs of different plans to ensure you're getting the best value for your money.

- Network of providers: Check if your primary care physician and specialists are part of Kaiser Permanente's network.

- Coverage and benefits: Review the coverage and benefits of each plan to ensure they meet your needs.

- Deductibles and copays: Consider the deductibles and copays associated with each plan and how they will impact your out-of-pocket costs.

Conclusion

Kaiser Permanente health insurance plans offer a comprehensive and affordable way to manage your healthcare needs. With a range of plans to choose from, including HMO, PPO, EPO, and catastrophic plans, you're sure to find a plan that meets your needs and budget. By understanding the benefits, working mechanisms, and key information related to Kaiser Permanente health insurance plans, you can make an informed decision and take the first step towards protecting your health and well-being.

We hope this article has provided you with a comprehensive understanding of Kaiser Permanente health insurance plans. If you have any further questions or would like to share your experiences with Kaiser Permanente, please leave a comment below.

What is the difference between an HMO and PPO plan?

+An HMO plan requires members to receive care from a network of physicians and hospitals, while a PPO plan allows members to receive care from both in-network and out-of-network providers.

Do Kaiser Permanente plans cover preventive care?

+Yes, Kaiser Permanente plans cover a range of preventive services, including vaccinations, screenings, and health education programs.

How do I choose the right Kaiser Permanente plan for me?

+Consider your budget, coverage needs, and network of providers when choosing a Kaiser Permanente plan. You can also speak with a licensed agent for personalized guidance.