Intro

Discover the comprehensive range of Kaiser Permanente health insurance plans and benefits. Learn about their network, coverage options, and exclusive perks. From individual and family plans to Medicare and employer-sponsored coverage, understand how Kaiser Permanentes integrated care model can meet your unique healthcare needs and budget.

As one of the largest and most well-established health insurance providers in the United States, Kaiser Permanente offers a wide range of plans and benefits to its members. With a commitment to providing high-quality, affordable healthcare, Kaiser Permanente has become a trusted name in the industry. In this article, we will delve into the details of Kaiser Permanente health insurance plans and benefits, helping you make an informed decision about your healthcare needs.

Kaiser Permanente's history dates back to 1945, when industrialist Henry J. Kaiser and physician Sidney Garfield formed a partnership to provide healthcare to Kaiser's shipyard workers. Today, the organization serves over 12 million members across eight states and the District of Columbia. Kaiser Permanente's integrated care model, which combines healthcare delivery and insurance under one umbrella, sets it apart from other health insurance providers.

Kaiser Permanente Health Insurance Plans

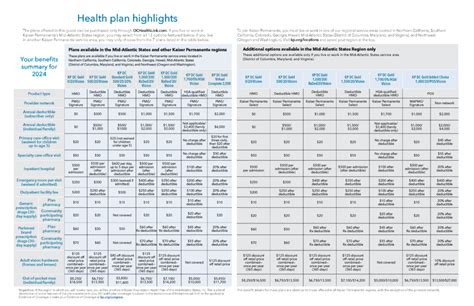

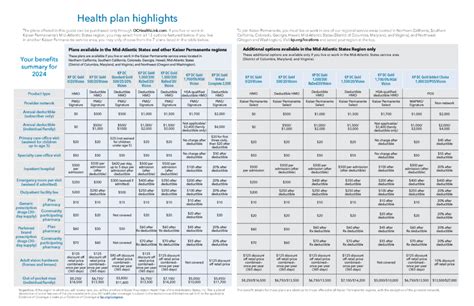

Kaiser Permanente offers a variety of health insurance plans to suit different needs and budgets. These plans are designed to provide comprehensive coverage, including preventive care, hospital stays, and prescription medications. Some of the most popular plans include:

- Kaiser Permanente HMO (Health Maintenance Organization) Plan: This plan provides comprehensive coverage, including preventive care, hospital stays, and prescription medications, with a focus on preventive care and early intervention.

- Kaiser Permanente PPO (Preferred Provider Organization) Plan: This plan offers more flexibility than the HMO plan, allowing members to see out-of-network providers for a higher copayment.

- Kaiser Permanente Medicare Advantage Plan: This plan is designed for seniors and individuals with disabilities, offering comprehensive coverage, including prescription medications and preventive care.

Benefits of Kaiser Permanente Health Insurance Plans

Kaiser Permanente health insurance plans offer numerous benefits, including:

- Comprehensive Coverage: Kaiser Permanente plans cover a wide range of services, including preventive care, hospital stays, and prescription medications.

- Affordable Premiums: Kaiser Permanente plans are often more affordable than other health insurance options, making them an attractive choice for individuals and families.

- Integrated Care: Kaiser Permanente's integrated care model allows for seamless coordination between healthcare providers, ensuring that members receive high-quality, comprehensive care.

- Preventive Care: Kaiser Permanente places a strong emphasis on preventive care, offering a range of services, including routine check-ups, screenings, and vaccinations.

- Pharmacy Services: Kaiser Permanente offers convenient pharmacy services, including mail-order prescriptions and online refill options.

How Kaiser Permanente Health Insurance Plans Work

Kaiser Permanente health insurance plans work similarly to other health insurance plans. Members pay a monthly premium, which varies depending on the plan and individual circumstances. In exchange, members receive comprehensive coverage, including preventive care, hospital stays, and prescription medications.

To access care, members can visit a Kaiser Permanente medical facility or see a Kaiser Permanente physician. Members can also use the Kaiser Permanente website or mobile app to manage their care, including scheduling appointments, refilling prescriptions, and accessing medical records.

Kaiser Permanente Health Insurance Costs

The cost of Kaiser Permanente health insurance plans varies depending on the plan, individual circumstances, and location. On average, Kaiser Permanente plans tend to be more affordable than other health insurance options.

To give you a better idea of the costs involved, here are some estimated premium rates for a 40-year-old individual living in California:

- Kaiser Permanente HMO Plan: $350-$450 per month

- Kaiser Permanente PPO Plan: $450-$550 per month

- Kaiser Permanente Medicare Advantage Plan: $200-$300 per month

Keep in mind that these are estimated premium rates and may vary depending on your individual circumstances and location.

Kaiser Permanente Health Insurance Reviews

Kaiser Permanente has a reputation for providing high-quality, comprehensive care to its members. Here are some reviews from satisfied members:

- "I've been a Kaiser Permanente member for over 10 years and have always received excellent care. The staff is friendly and knowledgeable, and the facilities are clean and modern." - Rachel, California

- "I was skeptical about switching to Kaiser Permanente, but I'm so glad I did. The care is top-notch, and the prices are affordable." - John, Oregon

Of course, as with any health insurance provider, there may be some drawbacks to Kaiser Permanente plans. Some members have reported difficulty accessing care outside of Kaiser Permanente facilities, while others have experienced long wait times for appointments.

Kaiser Permanente Health Insurance FAQs

What is Kaiser Permanente?

+Kaiser Permanente is a health insurance provider that offers comprehensive coverage, including preventive care, hospital stays, and prescription medications.

How do Kaiser Permanente health insurance plans work?

+Kaiser Permanente health insurance plans work similarly to other health insurance plans. Members pay a monthly premium, which varies depending on the plan and individual circumstances. In exchange, members receive comprehensive coverage, including preventive care, hospital stays, and prescription medications.

What are the benefits of Kaiser Permanente health insurance plans?

+Kaiser Permanente health insurance plans offer numerous benefits, including comprehensive coverage, affordable premiums, integrated care, preventive care, and pharmacy services.

In conclusion, Kaiser Permanente health insurance plans offer comprehensive coverage, affordable premiums, and integrated care, making them an attractive choice for individuals and families. While there may be some drawbacks to Kaiser Permanente plans, the benefits far outweigh the drawbacks. If you're considering Kaiser Permanente health insurance, we encourage you to explore their plans and benefits in more detail.

We hope this article has provided you with a comprehensive understanding of Kaiser Permanente health insurance plans and benefits. If you have any questions or comments, please feel free to share them below.