Intro

Discover the ultimate guide to selecting the best Kaiser medical insurance. Learn the top 5 ways to choose the perfect plan, including evaluating network providers, comparing coverage options, and assessing out-of-pocket costs. Get expert tips on navigating Kaisers health insurance plans and make an informed decision for your healthcare needs.

Choosing the right medical insurance can be a daunting task, especially with the numerous options available in the market. Kaiser Permanente, a well-established health care organization, offers a range of medical insurance plans that cater to different needs and budgets. However, selecting the best Kaiser medical insurance plan can be overwhelming, especially for those who are new to the world of health insurance. In this article, we will explore five ways to choose the best Kaiser medical insurance plan that suits your needs.

1. Assess Your Health Care Needs

Before selecting a Kaiser medical insurance plan, it's essential to assess your health care needs. Consider your age, health status, and medical requirements. If you have ongoing medical conditions or require regular doctor visits, you may need a plan that offers more comprehensive coverage. On the other hand, if you're relatively healthy and don't require frequent medical visits, a basic plan may suffice.

Think about the following factors when assessing your health care needs:

- Do you have any pre-existing medical conditions?

- Do you require regular doctor visits or medical treatments?

- Are you planning to start a family or have young children?

- Do you have any ongoing prescriptions or medical expenses?

By understanding your health care needs, you can choose a Kaiser medical insurance plan that provides the right level of coverage and benefits.

Types of Kaiser Medical Insurance Plans

Kaiser Permanente offers a range of medical insurance plans, including:

- HMO (Health Maintenance Organization) plans

- PPO (Preferred Provider Organization) plans

- POS (Point of Service) plans

- Medicare Advantage plans

- Medicaid plans

Each plan type has its unique features, benefits, and limitations. For example, HMO plans require you to choose a primary care physician and receive referrals for specialist care, while PPO plans offer more flexibility in choosing your health care providers.

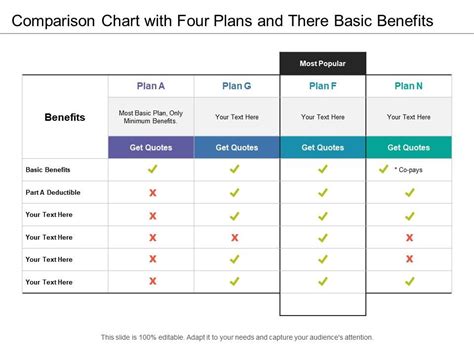

2. Compare Plan Benefits and Coverage

Once you've assessed your health care needs and chosen a plan type, it's essential to compare the benefits and coverage offered by different Kaiser medical insurance plans. Consider the following factors:

- Doctor and hospital network: Does the plan offer a wide network of doctors and hospitals?

- Prescription coverage: Does the plan cover your prescription medications?

- Preventive care: Does the plan cover routine check-ups, vaccinations, and screenings?

- Out-of-pocket costs: What are the copays, deductibles, and coinsurance costs?

- Maximum out-of-pocket costs: What is the maximum amount you'll pay for medical expenses in a year?

By comparing plan benefits and coverage, you can choose a Kaiser medical insurance plan that meets your needs and budget.

3. Check the Plan's Network and Providers

Kaiser Permanente has a large network of doctors, hospitals, and medical facilities. However, it's essential to check the plan's network and providers to ensure they meet your needs. Consider the following factors:

- Are your current doctors and hospitals part of the plan's network?

- Are there any specialist providers or hospitals in the network that you may need?

- Are there any limitations or restrictions on accessing care from out-of-network providers?

By checking the plan's network and providers, you can ensure that you have access to quality care and minimize out-of-pocket costs.

How to Check the Plan's Network and Providers

You can check the plan's network and providers by:

- Visiting Kaiser Permanente's website and using their provider directory tool

- Contacting Kaiser Permanente's customer service department

- Reviewing the plan's documentation and materials

4. Evaluate the Plan's Cost and Affordability

Kaiser medical insurance plans vary in cost, depending on factors such as age, location, and plan type. It's essential to evaluate the plan's cost and affordability to ensure it fits your budget. Consider the following factors:

- Premium costs: What is the monthly premium cost?

- Out-of-pocket costs: What are the copays, deductibles, and coinsurance costs?

- Maximum out-of-pocket costs: What is the maximum amount you'll pay for medical expenses in a year?

- Subsidies and discounts: Are there any subsidies or discounts available?

By evaluating the plan's cost and affordability, you can choose a Kaiser medical insurance plan that meets your needs and budget.

5. Read Reviews and Ask for Recommendations

Finally, it's essential to read reviews and ask for recommendations from friends, family, or coworkers who have experience with Kaiser medical insurance plans. Consider the following factors:

- Satisfaction with plan benefits and coverage

- Quality of care and provider network

- Customer service and support

- Claims processing and billing

By reading reviews and asking for recommendations, you can gain valuable insights and make an informed decision when choosing a Kaiser medical insurance plan.

By following these five steps, you can choose the best Kaiser medical insurance plan that meets your needs and budget. Remember to assess your health care needs, compare plan benefits and coverage, check the plan's network and providers, evaluate the plan's cost and affordability, and read reviews and ask for recommendations.

What is Kaiser Permanente?

+Kaiser Permanente is a health care organization that provides medical care and health insurance to its members.

What types of Kaiser medical insurance plans are available?

+Kaiser Permanente offers a range of medical insurance plans, including HMO, PPO, POS, Medicare Advantage, and Medicaid plans.

How do I choose the best Kaiser medical insurance plan?

+You can choose the best Kaiser medical insurance plan by assessing your health care needs, comparing plan benefits and coverage, checking the plan's network and providers, evaluating the plan's cost and affordability, and reading reviews and asking for recommendations.

We hope this article has provided you with valuable insights and information to help you choose the best Kaiser medical insurance plan that meets your needs and budget. If you have any further questions or concerns, please don't hesitate to contact us.