Intro

Discover affordable health insurance options with Kaiser Permanente. Explore their range of plans, coverage, and benefits. Learn how Kaiser Permanentes integrated care model provides high-quality, cost-effective healthcare. Compare rates and find the best fit for your needs. Get expert insights on navigating the healthcare system and maximizing your benefits.

Kaiser Permanente is a well-established health insurance provider that has been serving millions of members across the United States for over 75 years. With a strong commitment to providing high-quality, affordable healthcare, Kaiser Permanente has become a trusted name in the health insurance industry. In this article, we will delve into the various affordable care options offered by Kaiser Permanente, highlighting their benefits, working mechanisms, and key features.

Understanding Kaiser Permanente's Health Insurance Model

Kaiser Permanente's health insurance model is built around a unique approach that integrates healthcare delivery and financing. This model, known as the "prepaid group practice," allows Kaiser Permanente to provide comprehensive care to its members while controlling costs. By owning and operating its own hospitals, medical offices, and pharmacies, Kaiser Permanente is able to streamline care delivery, reduce administrative costs, and invest in preventive care.

Key Features of Kaiser Permanente's Health Insurance Plans

Kaiser Permanente's health insurance plans are designed to provide affordable, comprehensive care to individuals, families, and businesses. Some key features of their plans include:

- Comprehensive coverage: Kaiser Permanente's plans cover a wide range of medical services, including doctor visits, hospital stays, surgeries, and prescription medications.

- Preventive care: Kaiser Permanente places a strong emphasis on preventive care, offering free or low-cost screenings, vaccinations, and health education programs.

- Network of providers: Kaiser Permanente has a large network of primary care physicians, specialists, and hospitals, making it easy for members to access care.

- Pharmacy services: Kaiser Permanente operates its own pharmacies, offering convenient access to prescription medications and competitive pricing.

Affordable Care Options for Individuals and Families

Kaiser Permanente offers a range of affordable care options for individuals and families, including:

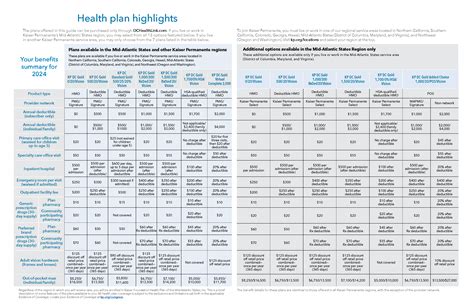

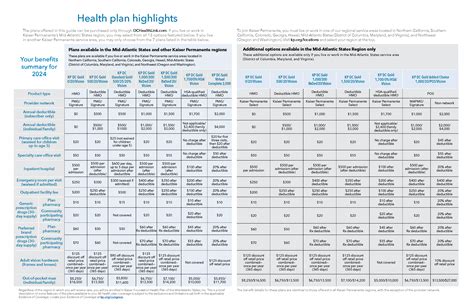

- Bronze, Silver, Gold, and Platinum plans: These metal-tiered plans offer varying levels of coverage and cost-sharing, allowing members to choose the plan that best fits their needs and budget.

- Catastrophic plans: These plans are designed for young adults and individuals who are exempt from the Affordable Care Act's (ACA) individual mandate, offering lower premiums in exchange for higher deductibles and limited coverage.

- Medicaid and Medicare plans: Kaiser Permanente offers Medicaid and Medicare plans in select regions, providing affordable coverage to low-income individuals and seniors.

Group Health Insurance Options for Businesses

Kaiser Permanente also offers a range of group health insurance options for businesses, including:

- HMO and PPO plans: These plans offer employers a choice between a more traditional HMO model and a PPO model, which provides more flexibility in provider choice.

- Tiered plans: Kaiser Permanente's tiered plans allow employers to choose from different levels of coverage and cost-sharing, making it easier to manage healthcare costs.

- Wellness programs: Kaiser Permanente offers a range of wellness programs and services, helping employers promote employee health and productivity.

How to Choose the Right Kaiser Permanente Plan

With so many plan options available, choosing the right Kaiser Permanente plan can be overwhelming. Here are some tips to help you make an informed decision:

- Assess your healthcare needs: Consider your medical needs and those of your family members, including any chronic conditions or ongoing treatments.

- Evaluate plan costs: Compare the premiums, deductibles, and out-of-pocket costs of different plans to determine which one best fits your budget.

- Check provider networks: Make sure your primary care physician and any specialists you see are part of Kaiser Permanente's network.

- Consider additional benefits: Some Kaiser Permanente plans offer additional benefits, such as dental and vision coverage or wellness programs.

Frequently Asked Questions

What is the difference between Kaiser Permanente's HMO and PPO plans?

+Kaiser Permanente's HMO plans require members to receive care from in-network providers, while PPO plans offer more flexibility in provider choice and allow members to see out-of-network providers for a higher copayment.

Can I see any doctor I want with Kaiser Permanente's insurance?

+No, Kaiser Permanente's insurance plans require members to receive care from in-network providers, except in emergency situations. However, some plans may offer out-of-network benefits for a higher copayment.

How do I enroll in a Kaiser Permanente plan?

+You can enroll in a Kaiser Permanente plan through their website, by phone, or in person at a Kaiser Permanente office. You can also work with a licensed insurance agent or broker to help you choose and enroll in a plan.

In conclusion, Kaiser Permanente offers a range of affordable care options for individuals, families, and businesses. By understanding the benefits and features of their plans, you can make an informed decision and choose the right plan for your healthcare needs. Don't hesitate to reach out to Kaiser Permanente or a licensed insurance agent to learn more about their plans and enrollment process. Share your thoughts and experiences with Kaiser Permanente's health insurance plans in the comments below!