Intro

Kaiser Permanente is a well-established health care organization that offers a wide range of insurance plans to individuals, families, and businesses. With a strong focus on preventive care, Kaiser Permanente aims to provide high-quality, affordable health care to its members. In this article, we will delve into the various insurance plans offered by Kaiser Permanente, their benefits, and what sets them apart from other health insurance providers.

One of the key advantages of Kaiser Permanente insurance plans is their emphasis on preventive care. By focusing on early detection and treatment, Kaiser Permanente aims to reduce the risk of chronic diseases and improve overall health outcomes. This approach not only benefits the individual but also helps to control healthcare costs in the long run.

Individual and Family Plans

Kaiser Permanente offers a range of individual and family plans that cater to different needs and budgets. These plans are designed to provide comprehensive coverage for essential health benefits, including doctor visits, hospital stays, and prescription medications.

Some of the key features of Kaiser Permanente's individual and family plans include:

- Low out-of-pocket costs for preventive care services

- Access to a network of experienced physicians and hospitals

- Comprehensive coverage for essential health benefits

- Flexible premium payment options

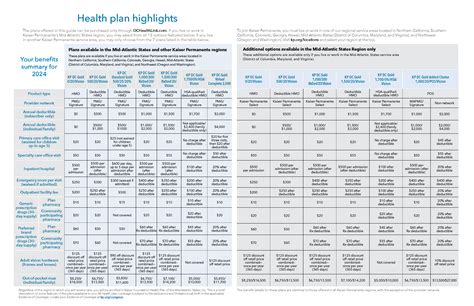

Plan Options

Kaiser Permanente offers several plan options for individuals and families, including:

- Bronze Plan: This plan offers lower premiums but higher out-of-pocket costs.

- Silver Plan: This plan provides a balance between premiums and out-of-pocket costs.

- Gold Plan: This plan offers higher premiums but lower out-of-pocket costs.

- Platinum Plan: This plan provides the highest level of coverage but also comes with higher premiums.

Group Plans for Businesses

Kaiser Permanente also offers group plans for businesses, which can help employers provide high-quality health care to their employees. These plans are designed to be flexible and customizable, allowing businesses to choose the level of coverage that best suits their needs.

Some of the key features of Kaiser Permanente's group plans include:

- Comprehensive coverage for essential health benefits

- Access to a network of experienced physicians and hospitals

- Flexible premium payment options

- Customizable plan options to suit business needs

Benefits for Employers

Kaiser Permanente's group plans offer several benefits for employers, including:

- Improved employee health and productivity

- Reduced absenteeism and presenteeism

- Enhanced employee recruitment and retention

- Customizable plan options to suit business needs

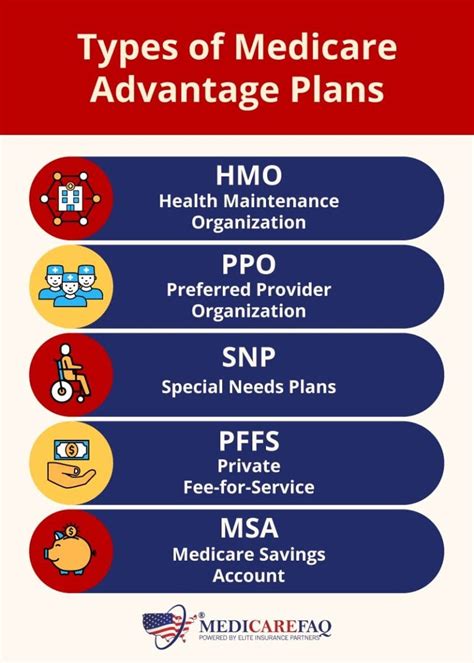

Medicare Advantage Plans

Kaiser Permanente also offers Medicare Advantage plans for individuals who are eligible for Medicare. These plans provide comprehensive coverage for Medicare-eligible individuals and offer additional benefits not covered by traditional Medicare.

Some of the key features of Kaiser Permanente's Medicare Advantage plans include:

- Comprehensive coverage for Medicare-eligible individuals

- Additional benefits not covered by traditional Medicare

- Access to a network of experienced physicians and hospitals

- Flexible premium payment options

Benefits for Medicare-Eligible Individuals

Kaiser Permanente's Medicare Advantage plans offer several benefits for Medicare-eligible individuals, including:

- Comprehensive coverage for essential health benefits

- Additional benefits not covered by traditional Medicare

- Access to a network of experienced physicians and hospitals

- Flexible premium payment options

Dental and Vision Plans

Kaiser Permanente also offers dental and vision plans that can be purchased separately or in conjunction with their medical plans. These plans provide comprehensive coverage for dental and vision care services.

Some of the key features of Kaiser Permanente's dental and vision plans include:

- Comprehensive coverage for dental and vision care services

- Access to a network of experienced dentists and optometrists

- Flexible premium payment options

Benefits of Dental and Vision Plans

Kaiser Permanente's dental and vision plans offer several benefits, including:

- Comprehensive coverage for dental and vision care services

- Early detection and treatment of dental and vision problems

- Improved overall health and well-being

What is the difference between Kaiser Permanente's individual and family plans?

+Kaiser Permanente's individual plans are designed for individuals who do not have access to group coverage through their employer. Family plans, on the other hand, are designed for families who need coverage for multiple individuals.

Can I customize my Kaiser Permanente plan to suit my needs?

+Yes, Kaiser Permanente offers flexible plan options that can be customized to suit your needs. You can choose from a range of plans with different levels of coverage and premium payments.

Do Kaiser Permanente plans cover preventive care services?

+Yes, Kaiser Permanente plans cover preventive care services, including doctor visits, screenings, and vaccinations. Preventive care services are designed to help prevent illness and detect health problems early.

In conclusion, Kaiser Permanente insurance plans offer a range of benefits and options for individuals, families, and businesses. With a focus on preventive care and comprehensive coverage, Kaiser Permanente aims to provide high-quality, affordable health care to its members. By understanding the different plan options and benefits, you can make an informed decision about your health care coverage.