Intro

Unlock the benefits of Kaiser Permanentes pension plan. Discover how this comprehensive retirement plan provides financial security, health benefits, and peace of mind for eligible employees. Learn about plan details, investment options, and retirement income streams in this detailed overview, highlighting Kaiser Permanentes commitment to employee well-being.

Kaiser Permanente is a well-established healthcare organization that provides comprehensive medical services to its members. In addition to its healthcare services, Kaiser Permanente also offers a pension plan to its employees, providing them with a secure financial future. In this article, we will delve into the details of the Kaiser Permanente pension plan, its benefits, and how it works.

The importance of a pension plan cannot be overstated. With the rising cost of living and the uncertainty of social security, having a reliable pension plan is crucial for a secure retirement. Kaiser Permanente's pension plan is designed to provide its employees with a predictable income stream in their golden years, allowing them to enjoy their retirement without financial stress.

How the Kaiser Permanente Pension Plan Works

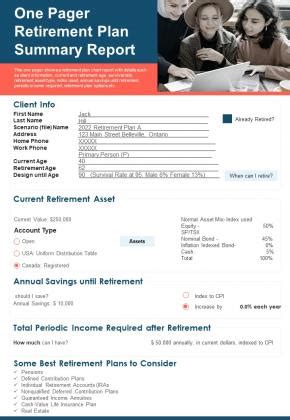

The Kaiser Permanente pension plan is a defined benefit plan, which means that the employer contributes a fixed amount to the employee's pension fund based on their salary and years of service. The plan is designed to provide a predictable income stream to employees in retirement, based on their final average pay and years of service.

The pension plan is funded by Kaiser Permanente, and the company is responsible for managing the investments and ensuring that the plan is fully funded. Employees are not required to contribute to the plan, and they do not have the option to opt out.

Key Features of the Kaiser Permanente Pension Plan

Here are some key features of the Kaiser Permanente pension plan:

- Predictable income stream: The pension plan provides a predictable income stream to employees in retirement, based on their final average pay and years of service.

- Fully funded by Kaiser Permanente: The plan is fully funded by Kaiser Permanente, which means that employees do not have to contribute to the plan.

- No opt-out option: Employees are automatically enrolled in the plan and do not have the option to opt out.

- Vesting period: Employees are fully vested in the plan after five years of service.

Benefits of the Kaiser Permanente Pension Plan

The Kaiser Permanente pension plan offers several benefits to employees, including:

- Secure financial future: The pension plan provides a predictable income stream to employees in retirement, ensuring a secure financial future.

- No investment risk: The plan is fully funded by Kaiser Permanente, which means that employees do not have to worry about investment risk.

- Guaranteed income: The plan provides a guaranteed income stream to employees in retirement, based on their final average pay and years of service.

- Tax benefits: The plan offers tax benefits to employees, as contributions are made before taxes.

Eligibility and Enrollment

To be eligible for the Kaiser Permanente pension plan, employees must meet certain requirements, including:

- Age: Employees must be at least 21 years old to be eligible for the plan.

- Service: Employees must have completed one year of service to be eligible for the plan.

- Job classification: Employees must be in a job classification that is eligible for the plan.

Once an employee is eligible, they are automatically enrolled in the plan. Employees do not have the option to opt out of the plan.

Retirement Options and Benefits

The Kaiser Permanente pension plan offers several retirement options and benefits to employees, including:

- Normal retirement age: The normal retirement age for the plan is 65.

- Early retirement: Employees can retire early, but their benefits will be reduced.

- Delayed retirement: Employees can delay retirement and receive increased benefits.

- Lump sum payment: Employees can receive a lump sum payment instead of a monthly annuity.

- Survivor benefits: The plan offers survivor benefits to employees' spouses and dependents.

Plan Administration and Management

The Kaiser Permanente pension plan is administered and managed by Kaiser Permanente's benefits department. The department is responsible for:

- Plan design: The department designs the plan and makes changes as necessary.

- Investment management: The department manages the plan's investments and ensures that the plan is fully funded.

- Employee communication: The department communicates with employees about the plan and provides educational resources.

Conclusion

The Kaiser Permanente pension plan is a valuable benefit that provides employees with a secure financial future. The plan offers a predictable income stream, no investment risk, and guaranteed income, making it an attractive option for employees who want to plan for their retirement. With its comprehensive benefits and features, the Kaiser Permanente pension plan is an excellent choice for employees who want to ensure a secure financial future.

We hope this article has provided you with a comprehensive overview of the Kaiser Permanente pension plan and its benefits. If you have any questions or comments, please feel free to share them below.

What is the Kaiser Permanente pension plan?

+The Kaiser Permanente pension plan is a defined benefit plan that provides a predictable income stream to employees in retirement, based on their final average pay and years of service.

How is the plan funded?

+The plan is fully funded by Kaiser Permanente, which means that employees do not have to contribute to the plan.

What are the benefits of the plan?

+The plan offers several benefits, including a predictable income stream, no investment risk, and guaranteed income, making it an attractive option for employees who want to plan for their retirement.