Intro

Discover the comprehensive range of Kaiser Permanente health insurance plans and options, designed to cater to diverse needs and budgets. Explore their network, coverage, and benefits, including medical, dental, and vision care. Learn about their Medicare and Medicaid plans, and find the perfect fit for you and your familys healthcare requirements.

As one of the largest and most reputable health insurance providers in the United States, Kaiser Permanente offers a wide range of health insurance plans and options to cater to diverse needs and budgets. With a strong focus on preventive care, innovative medical technologies, and a comprehensive network of healthcare professionals, Kaiser Permanente has become a trusted name in the healthcare industry. In this article, we will delve into the various health insurance plans and options offered by Kaiser Permanente, highlighting their benefits, features, and eligibility criteria.

Individual and Family Health Insurance Plans

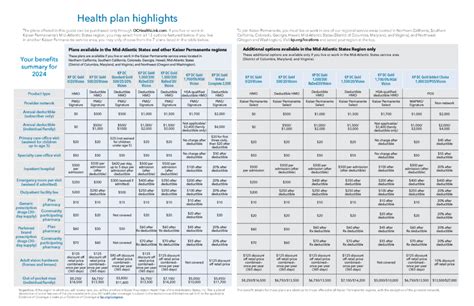

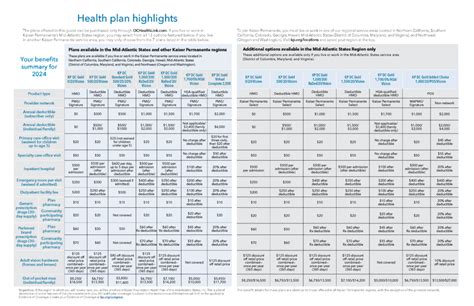

Kaiser Permanente offers a variety of individual and family health insurance plans that cater to different needs and budgets. These plans are designed to provide comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. Some of the key features of Kaiser Permanente's individual and family health insurance plans include:

- Comprehensive coverage: Kaiser Permanente's individual and family health insurance plans offer comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

- Preventive care: Kaiser Permanente emphasizes preventive care, with many plans offering free or low-cost preventive services, such as annual physicals, vaccinations, and cancer screenings.

- Network of healthcare professionals: Kaiser Permanente has a large network of healthcare professionals, including doctors, nurses, and specialists, who are dedicated to providing high-quality care.

Some of the most popular individual and family health insurance plans offered by Kaiser Permanente include:

- Kaiser Permanente Bronze Plan: This plan offers lower premiums but higher out-of-pocket costs. It is ideal for individuals and families who do not require frequent medical care.

- Kaiser Permanente Silver Plan: This plan offers moderate premiums and out-of-pocket costs. It is ideal for individuals and families who require occasional medical care.

- Kaiser Permanente Gold Plan: This plan offers higher premiums but lower out-of-pocket costs. It is ideal for individuals and families who require frequent medical care.

Group Health Insurance Plans

Kaiser Permanente also offers group health insurance plans for businesses and organizations. These plans are designed to provide comprehensive coverage for employees and their families, while also helping employers control healthcare costs. Some of the key features of Kaiser Permanente's group health insurance plans include:

- Comprehensive coverage: Kaiser Permanente's group health insurance plans offer comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

- Customizable plans: Kaiser Permanente offers customizable plans that can be tailored to meet the specific needs and budgets of businesses and organizations.

- Administrative support: Kaiser Permanente provides administrative support to help employers manage their group health insurance plans.

Some of the most popular group health insurance plans offered by Kaiser Permanente include:

- Kaiser Permanente HMO Plan: This plan offers comprehensive coverage for medical expenses, with a focus on preventive care and coordinated care.

- Kaiser Permanente PPO Plan: This plan offers comprehensive coverage for medical expenses, with the flexibility to see out-of-network providers.

- Kaiser Permanente EPO Plan: This plan offers comprehensive coverage for medical expenses, with a focus on preventive care and coordinated care, and the flexibility to see out-of-network providers.

Medicare and Medicaid Plans

Kaiser Permanente also offers Medicare and Medicaid plans for individuals who are eligible for these programs. These plans are designed to provide comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. Some of the key features of Kaiser Permanente's Medicare and Medicaid plans include:

- Comprehensive coverage: Kaiser Permanente's Medicare and Medicaid plans offer comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

- Affordable premiums: Kaiser Permanente's Medicare and Medicaid plans offer affordable premiums, with many plans available at no cost or low cost.

- Network of healthcare professionals: Kaiser Permanente has a large network of healthcare professionals, including doctors, nurses, and specialists, who are dedicated to providing high-quality care.

Some of the most popular Medicare and Medicaid plans offered by Kaiser Permanente include:

- Kaiser Permanente Medicare Advantage Plan: This plan offers comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications.

- Kaiser Permanente Medicaid Plan: This plan offers comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications, for individuals who are eligible for Medicaid.

Dental and Vision Insurance Plans

Kaiser Permanente also offers dental and vision insurance plans that can be added to individual and family health insurance plans or group health insurance plans. These plans are designed to provide comprehensive coverage for dental and vision care, including routine cleanings, fillings, and eye exams. Some of the key features of Kaiser Permanente's dental and vision insurance plans include:

- Comprehensive coverage: Kaiser Permanente's dental and vision insurance plans offer comprehensive coverage for dental and vision care, including routine cleanings, fillings, and eye exams.

- Affordable premiums: Kaiser Permanente's dental and vision insurance plans offer affordable premiums, with many plans available at no cost or low cost.

- Network of dental and vision care professionals: Kaiser Permanente has a large network of dental and vision care professionals, including dentists, optometrists, and ophthalmologists, who are dedicated to providing high-quality care.

How to Choose the Right Kaiser Permanente Health Insurance Plan

With so many health insurance plans and options available from Kaiser Permanente, it can be overwhelming to choose the right plan. Here are some tips to help you choose the right Kaiser Permanente health insurance plan:

- Assess your healthcare needs: Consider your healthcare needs and the needs of your family. Do you require frequent medical care? Do you have a chronic condition?

- Compare plans: Compare the different health insurance plans offered by Kaiser Permanente, including individual and family plans, group plans, Medicare and Medicaid plans, and dental and vision plans.

- Consider your budget: Consider your budget and the premiums, deductibles, and out-of-pocket costs associated with each plan.

- Check the network: Check the network of healthcare professionals, including doctors, nurses, and specialists, who are part of the plan.

By following these tips, you can choose the right Kaiser Permanente health insurance plan that meets your needs and budget.

What is Kaiser Permanente?

+Kaiser Permanente is a health insurance provider that offers a wide range of health insurance plans and options to individuals, families, and businesses.

What types of health insurance plans does Kaiser Permanente offer?

+Kaiser Permanente offers individual and family health insurance plans, group health insurance plans, Medicare and Medicaid plans, and dental and vision insurance plans.

How do I choose the right Kaiser Permanente health insurance plan?

+To choose the right Kaiser Permanente health insurance plan, assess your healthcare needs, compare plans, consider your budget, and check the network of healthcare professionals.

We hope this article has provided you with a comprehensive overview of Kaiser Permanente's health insurance plans and options. Whether you're an individual, family, or business, Kaiser Permanente has a plan that can meet your needs and budget. By choosing a Kaiser Permanente health insurance plan, you can enjoy comprehensive coverage, affordable premiums, and access to a large network of healthcare professionals.