Intro

Discover the ins and outs of per diem rates in Washington D.C. with our comprehensive guide. Learn how to calculate daily allowances, understand GSA per diem rates, and navigate lodging and meal expenses. Get expert insights on D.C.s unique per diem rules and regulations to ensure compliance and maximize reimbursements.

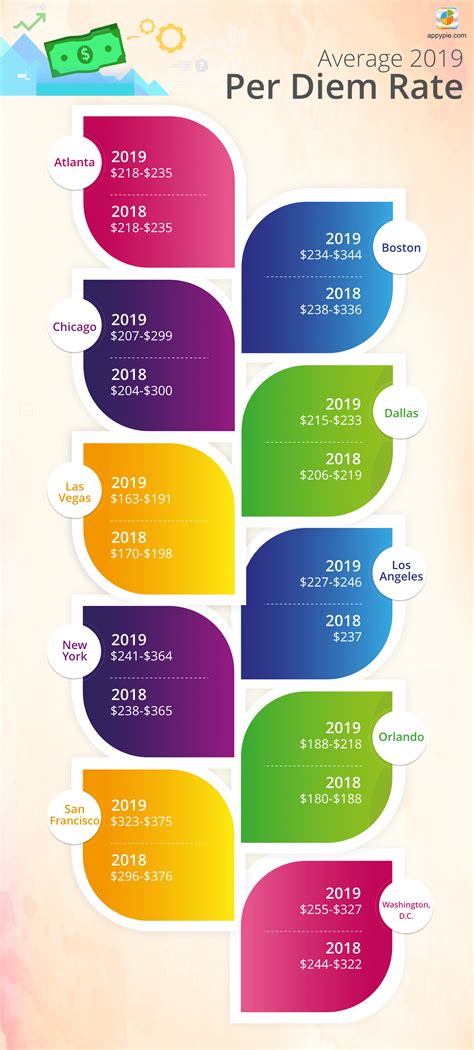

The per diem rate in Washington D.C. is a crucial piece of information for business travelers, government employees, and contractors who frequently visit the nation's capital. Understanding the per diem rate can help individuals and organizations budget and plan for trips to D.C. more effectively. In this article, we will delve into the world of per diem rates in D.C., exploring what they are, how they are set, and what they cover.

What is a Per Diem Rate?

A per diem rate is a daily allowance provided to employees or contractors to cover expenses incurred while traveling for business. The per diem rate is designed to reimburse individuals for meals, lodging, and other expenses related to their trip. In the context of Washington D.C., the per diem rate is set by the General Services Administration (GSA) and is used by federal agencies, contractors, and other organizations to reimburse employees for expenses incurred while traveling to the nation's capital.

How is the Per Diem Rate in D.C. Set?

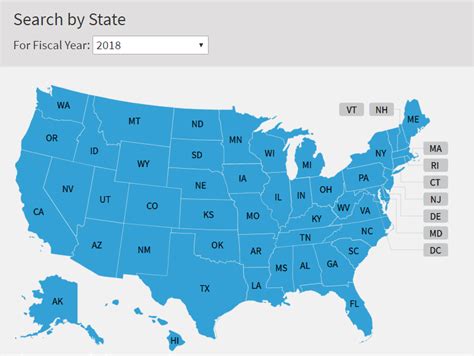

The per diem rate in D.C. is set by the GSA, which conducts a thorough analysis of the cost of living in the area. The GSA considers factors such as the cost of meals, lodging, and other expenses to determine the per diem rate. The rate is typically adjusted annually to reflect changes in the cost of living in D.C.

What Does the Per Diem Rate in D.C. Cover?

The per diem rate in D.C. covers a range of expenses, including:

- Meals: The per diem rate includes a daily allowance for meals, which can be used to reimburse employees for breakfast, lunch, and dinner.

- Lodging: The per diem rate also includes a daily allowance for lodging, which can be used to reimburse employees for hotel stays or other accommodations.

- Incidental expenses: The per diem rate may also cover incidental expenses, such as tips, taxis, and other miscellaneous costs.

Per Diem Rate in D.C. for Fiscal Year 2023

The per diem rate in D.C. for fiscal year 2023 is as follows:

- Meals: $74 per day

- Lodging: $255 per day

- Incidental expenses: $10 per day

Total per diem rate: $339 per day

How to Calculate Per Diem Rate in D.C.

Calculating the per diem rate in D.C. is relatively straightforward. To calculate the per diem rate, you can use the following formula:

Per diem rate = (Meals + Lodging + Incidental expenses) x Number of days

For example, if you are traveling to D.C. for 3 days, your per diem rate would be:

Per diem rate = ($74 + $255 + $10) x 3 Per diem rate = $339 x 3 Per diem rate = $1,017

Per Diem Rate in D.C. for Special Cases

There are some special cases where the per diem rate in D.C. may be adjusted. For example:

- If you are traveling to D.C. during peak season (June to August), the per diem rate may be higher.

- If you are traveling to D.C. for an extended period (more than 30 days), the per diem rate may be lower.

Per Diem Rate in D.C. vs. Actual Expenses

It's worth noting that the per diem rate in D.C. is not always the same as actual expenses. In some cases, actual expenses may be higher or lower than the per diem rate. If actual expenses are higher, you may need to provide receipts or other documentation to support your expenses.

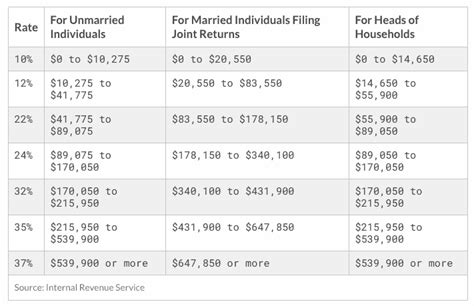

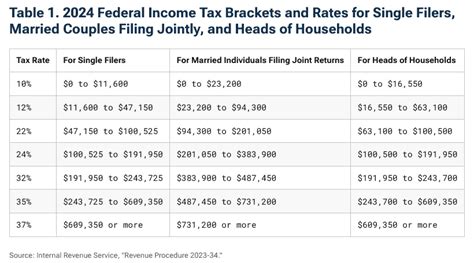

Per Diem Rate in D.C. and Taxes

The per diem rate in D.C. is considered taxable income. However, if you are reimbursed for expenses using the per diem rate, you may not need to report the reimbursement as income.

Per Diem Rate in D.C. for Contractors

Contractors working in D.C. may be eligible for the per diem rate. However, contractors may need to provide documentation to support their expenses.

Per Diem Rate in D.C. for Government Employees

Government employees traveling to D.C. may be eligible for the per diem rate. However, government employees may need to follow specific guidelines and procedures to claim reimbursement.

Conclusion

In conclusion, the per diem rate in D.C. is an important consideration for business travelers, government employees, and contractors. Understanding the per diem rate can help individuals and organizations budget and plan for trips to D.C. more effectively. By following the guidelines and procedures outlined in this article, you can ensure that you are reimbursed for your expenses and stay within your budget.

We encourage you to share your thoughts and experiences with the per diem rate in D.C. in the comments below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the per diem rate in D.C. for fiscal year 2023?

+The per diem rate in D.C. for fiscal year 2023 is $339 per day, which includes $74 for meals, $255 for lodging, and $10 for incidental expenses.

How is the per diem rate in D.C. set?

+The per diem rate in D.C. is set by the General Services Administration (GSA), which conducts a thorough analysis of the cost of living in the area.

What expenses are covered by the per diem rate in D.C.?

+The per diem rate in D.C. covers meals, lodging, and incidental expenses.