Intro

Unlock the latest Per Diem Rates 2024 and maximize your travel allowance. Get expert insights on daily allowances, meal rates, and lodging expenses. Stay ahead of the game with our comprehensive guide, covering IRS regulations, reimbursement rates, and tax implications. Plan your business trips with confidence and optimize your expense reports.

As a business traveler, understanding per diem rates is crucial to ensure you're reimbursed fairly for your expenses on the road. Per diem rates are standardized amounts that employers use to reimburse employees for daily expenses incurred while traveling on business. In this comprehensive guide, we'll break down the per diem rates for 2024, explain how they work, and provide you with the information you need to navigate the complex world of travel allowances.

Per diem rates are essential for businesses and employees alike, as they help to simplify the reimbursement process and reduce administrative burdens. By understanding the per diem rates for 2024, you'll be able to plan your business trips with confidence, knowing exactly how much you'll be reimbursed for your daily expenses.

What are Per Diem Rates?

Per diem rates are daily allowances that employers use to reimburse employees for expenses incurred while traveling on business. These rates are usually based on the location of the trip and the type of expenses incurred. Per diem rates can vary significantly depending on the location, with major cities like New York and San Francisco tend to have higher rates than smaller towns and rural areas.

How are Per Diem Rates Calculated?

Per diem rates are typically calculated based on the following factors:

- Location: Per diem rates vary depending on the location of the trip. Major cities tend to have higher rates than smaller towns and rural areas.

- Type of expenses: Per diem rates can vary depending on the type of expenses incurred, such as meals, lodging, and transportation.

- Time of year: Per diem rates can vary depending on the time of year, with higher rates during peak travel seasons.

2024 Per Diem Rates

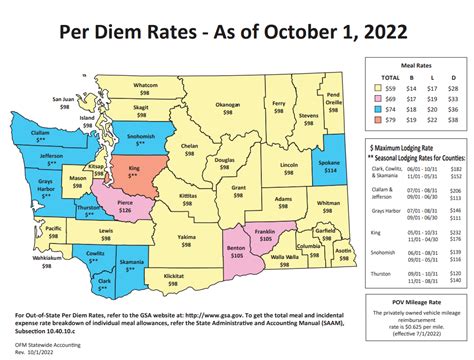

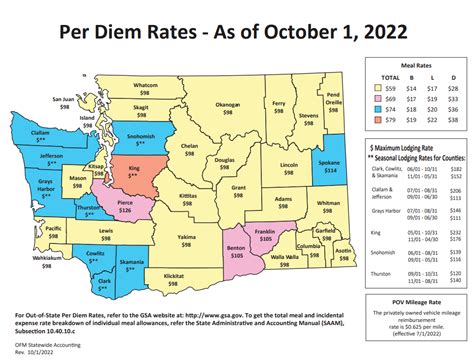

The 2024 per diem rates have been released by the General Services Administration (GSA), which sets the standard rates for federal employees. These rates are widely adopted by private sector employers as well. Here are the 2024 per diem rates for the continental United States:

- Lodging: $98 per night (average rate for the continental United States)

- Meals: $55 per day (average rate for the continental United States)

- Incidental expenses: $5 per day (average rate for the continental United States)

Per Diem Rates for International Travel

Per diem rates for international travel vary significantly depending on the location. Here are some examples of 2024 per diem rates for popular international destinations:

- London, UK: Lodging: $220 per night, Meals: $80 per day, Incidental expenses: $10 per day

- Tokyo, Japan: Lodging: $250 per night, Meals: $90 per day, Incidental expenses: $15 per day

- Paris, France: Lodging: $200 per night, Meals: $70 per day, Incidental expenses: $12 per day

How to Calculate Per Diem Rates for International Travel

Calculating per diem rates for international travel can be complex, as rates vary depending on the location and type of expenses incurred. Here are some steps to follow:

- Determine the location of the trip: Research the per diem rates for the specific location of the trip.

- Determine the type of expenses: Determine the type of expenses incurred, such as meals, lodging, and transportation.

- Use a per diem rate calculator: Use a per diem rate calculator to determine the total daily allowance.

Benefits of Using Per Diem Rates

Using per diem rates can provide several benefits for both employers and employees. Here are some of the advantages:

- Simplifies reimbursement process: Per diem rates simplify the reimbursement process, as employees don't need to keep track of individual expenses.

- Reduces administrative burdens: Per diem rates reduce administrative burdens, as employers don't need to process individual expense reports.

- Provides predictability: Per diem rates provide predictability, as employees know exactly how much they'll be reimbursed for their daily expenses.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using per diem rates:

- Not understanding the per diem rate: Make sure to understand the per diem rate and how it applies to your specific situation.

- Not keeping records: Keep records of your expenses, even if you're using per diem rates.

- Not reporting expenses accurately: Report expenses accurately, as per diem rates can vary depending on the location and type of expenses incurred.

Conclusion

Per diem rates are an essential tool for business travelers, providing a standardized way to reimburse employees for daily expenses incurred on the road. By understanding the per diem rates for 2024, you'll be able to plan your business trips with confidence, knowing exactly how much you'll be reimbursed for your daily expenses. Remember to avoid common mistakes, such as not understanding the per diem rate or not keeping records of your expenses.

What's Next?

Now that you've read this comprehensive guide to per diem rates for 2024, it's time to take action. Here are some next steps:

- Review your company's per diem rate policy: Make sure to review your company's per diem rate policy to understand how it applies to your specific situation.

- Plan your business trips: Plan your business trips with confidence, knowing exactly how much you'll be reimbursed for your daily expenses.

- Keep records: Keep records of your expenses, even if you're using per diem rates.

Share Your Thoughts

We hope you found this guide to per diem rates for 2024 helpful. Share your thoughts and experiences with per diem rates in the comments below. Do you have any questions or concerns about per diem rates? Let us know and we'll do our best to help.

What are per diem rates?

+Per diem rates are daily allowances that employers use to reimburse employees for expenses incurred while traveling on business.

How are per diem rates calculated?

+Per diem rates are calculated based on the location of the trip, type of expenses incurred, and time of year.

What are the 2024 per diem rates for the continental United States?

+The 2024 per diem rates for the continental United States are: Lodging: $98 per night, Meals: $55 per day, Incidental expenses: $5 per day.