Intro

Unlock the secrets of State Department per diem rates with our expert guide. Learn how to navigate the complex world of travel reimbursement, including lodging, meal, and incidental expenses. Discover 5 essential ways to understand per diem rates, ensuring compliance and maximizing your business travel budget.

Understanding State Department per diem rates is crucial for individuals and organizations dealing with international travel, particularly those related to government contracts, business, or diplomacy. The United States Department of State establishes these rates to provide a standardized reimbursement system for travelers on official business. Here's a comprehensive guide to help you grasp the concept of State Department per diem rates and how they work.

What are State Department Per Diem Rates?

State Department per diem rates are the maximum amounts that can be reimbursed to travelers for expenses incurred while on official business in foreign countries. These rates cover various expenses, including lodging, meals, and incidental expenses. The rates are determined by the Department of State and are updated periodically to reflect changes in local costs.

How are State Department Per Diem Rates Calculated?

The calculation of State Department per diem rates involves a thorough analysis of local costs, including:

- Lodging: The cost of a single room in a moderate-priced hotel.

- Meals: The cost of three meals per day, including breakfast, lunch, and dinner.

- Incidental expenses: Miscellaneous expenses, such as laundry, tips, and transportation.

The rates are calculated based on data collected from various sources, including:

- Hotel surveys

- Restaurant surveys

- Local transportation costs

- Other miscellaneous expenses

Types of State Department Per Diem Rates

There are two main types of State Department per diem rates:

1. Lodging Per Diem Rate

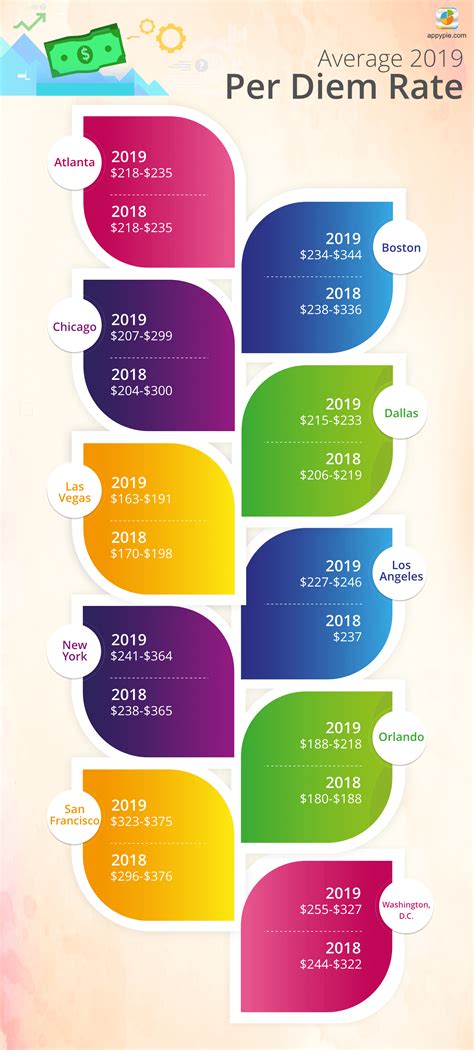

The lodging per diem rate is the maximum amount that can be reimbursed for lodging expenses. This rate varies depending on the location and is usually higher in major cities.

2. Meals and Incidental Expenses (M&IE) Per Diem Rate

The M&IE per diem rate is the maximum amount that can be reimbursed for meals and incidental expenses. This rate also varies depending on the location and is usually higher in areas with a high cost of living.

How to Use State Department Per Diem Rates

Using State Department per diem rates is relatively straightforward. Here's a step-by-step guide:

1. Determine the Location

Identify the location where the traveler will be visiting. This will help you determine the applicable per diem rate.

2. Choose the Correct Rate

Select the correct per diem rate based on the location and the type of expense (lodging or M&IE).

3. Calculate the Reimbursement Amount

Calculate the reimbursement amount by multiplying the per diem rate by the number of days the traveler will be in the location.

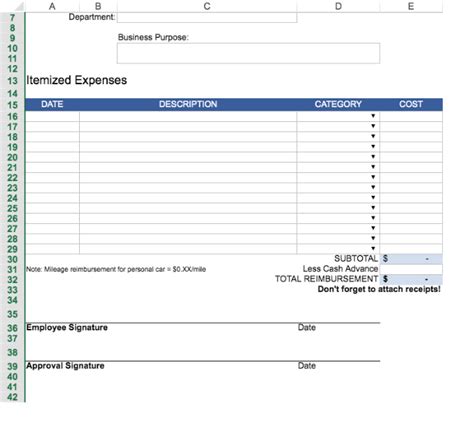

4. Submit the Reimbursement Request

Submit the reimbursement request, including the calculated amount and supporting documentation, such as receipts and invoices.

Benefits of Using State Department Per Diem Rates

Using State Department per diem rates offers several benefits, including:

- Simplified reimbursement process

- Reduced administrative burden

- Increased transparency and consistency

- Compliance with government regulations

Challenges and Limitations

While State Department per diem rates provide a standardized reimbursement system, there are some challenges and limitations to consider:

- Rates may not reflect actual costs

- Rates may not be updated frequently enough to reflect changes in local costs

- Rates may not account for exceptional circumstances, such as natural disasters or economic instability

Best Practices for Implementing State Department Per Diem Rates

To ensure a smooth implementation of State Department per diem rates, follow these best practices:

- Regularly review and update rates to reflect changes in local costs

- Communicate clearly with travelers and stakeholders about the reimbursement process

- Provide supporting documentation and receipts to facilitate reimbursement

- Consider using automated reimbursement systems to streamline the process

Conclusion

Understanding State Department per diem rates is crucial for individuals and organizations dealing with international travel. By following the guidelines outlined in this article, you can ensure a smooth reimbursement process and compliance with government regulations. Remember to regularly review and update rates, communicate clearly with travelers and stakeholders, and consider using automated reimbursement systems to streamline the process.

What are State Department per diem rates?

+State Department per diem rates are the maximum amounts that can be reimbursed to travelers for expenses incurred while on official business in foreign countries.

How are State Department per diem rates calculated?

+The rates are calculated based on data collected from various sources, including hotel surveys, restaurant surveys, local transportation costs, and other miscellaneous expenses.

What are the benefits of using State Department per diem rates?

+The benefits include a simplified reimbursement process, reduced administrative burden, increased transparency and consistency, and compliance with government regulations.