Intro

Mastering per diem rates in Washington D.C. just got easier. Discover the top 5 ways to navigate the complex world of per diem rates, including understanding GSA rates, calculating reimbursable expenses, and leveraging per diem calculators. Stay compliant and maximize your reimbursements with our expert guide to per diem in Washington D.C.

As the capital of the United States, Washington D.C. is a hub for business travelers, government contractors, and consultants. With its high cost of living, navigating per diem rates in Washington D.C. can be a daunting task. Per diem rates are the maximum amounts that employers can reimburse employees for expenses incurred while traveling on business. In this article, we will explore the five ways to navigate per diem rates in Washington D.C.

Understanding Per Diem Rates in Washington D.C.

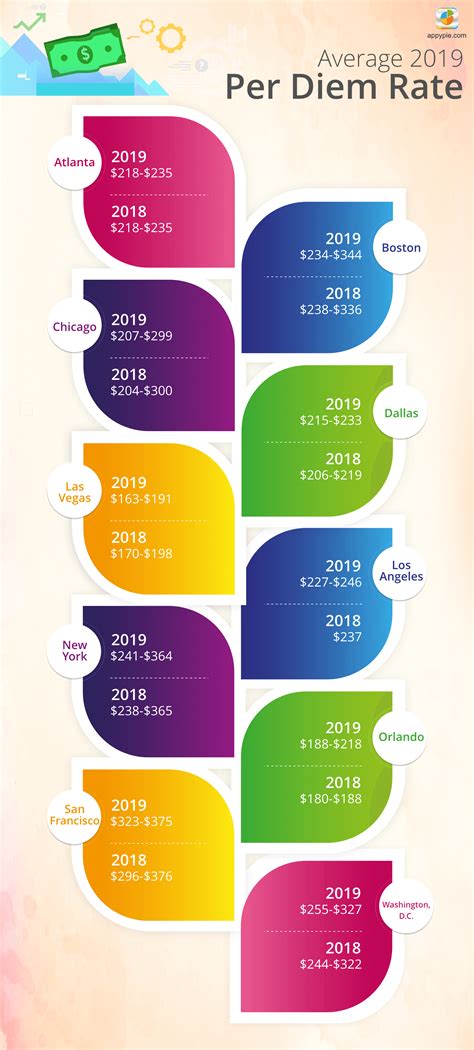

Before we dive into the five ways to navigate per diem rates, it's essential to understand what per diem rates are and how they are calculated. Per diem rates are set by the General Services Administration (GSA) and vary by location. In Washington D.C., the per diem rate is $69 for lodging and $59 for meals and incidentals.

Why Understanding Per Diem Rates Matters

Understanding per diem rates is crucial for businesses and employees alike. For employers, per diem rates can help control travel expenses and ensure compliance with tax regulations. For employees, per diem rates can impact their take-home pay and benefits. Inaccurate or outdated per diem rates can lead to over- or under-reimbursement, resulting in financial losses or tax liabilities.

1. Use the GSA Per Diem Rate Calculator

The GSA provides a per diem rate calculator that allows users to look up per diem rates by location. The calculator is available on the GSA website and can be accessed by anyone. Simply enter the location and dates of travel, and the calculator will provide the per diem rate.

Benefits of Using the GSA Per Diem Rate Calculator

Using the GSA per diem rate calculator offers several benefits, including:

- Accuracy: The calculator provides the most up-to-date per diem rates, ensuring accuracy and compliance.

- Convenience: The calculator is easy to use and accessible online.

- Time-saving: The calculator saves time and effort in researching per diem rates.

2. Consult with a Travel Manager or Accountant

For businesses or individuals who frequently travel to Washington D.C., consulting with a travel manager or accountant can be beneficial. They can provide expert advice on per diem rates, travel expenses, and tax regulations.

Benefits of Consulting with a Travel Manager or Accountant

Consulting with a travel manager or accountant offers several benefits, including:

- Expertise: They have in-depth knowledge of per diem rates, travel expenses, and tax regulations.

- Customized advice: They can provide tailored advice based on individual or business needs.

- Compliance: They can ensure compliance with tax regulations and company policies.

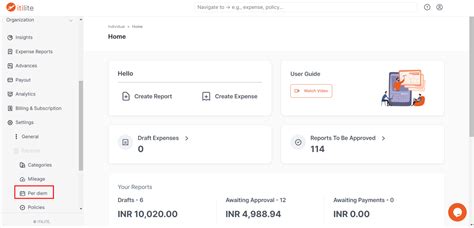

3. Use Per Diem Rate Software

Per diem rate software can help streamline the process of calculating per diem rates. These software solutions can be integrated with accounting systems and provide real-time updates on per diem rates.

Benefits of Using Per Diem Rate Software

Using per diem rate software offers several benefits, including:

- Automation: The software automates the process of calculating per diem rates, reducing errors and saving time.

- Integration: The software can be integrated with accounting systems, providing a seamless experience.

- Real-time updates: The software provides real-time updates on per diem rates, ensuring accuracy and compliance.

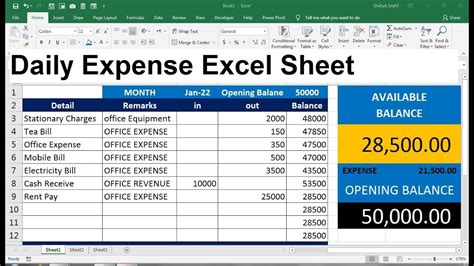

4. Keep Records of Expenses

Keeping accurate records of expenses is essential for businesses and employees. This includes receipts, invoices, and bank statements.

Benefits of Keeping Records of Expenses

Keeping records of expenses offers several benefits, including:

- Accuracy: Accurate records ensure accurate reimbursement and compliance with tax regulations.

- Convenience: Records can be easily accessed and referenced, saving time and effort.

- Compliance: Records can be used to demonstrate compliance with company policies and tax regulations.

5. Review and Update Per Diem Rates Regularly

Per diem rates can change frequently, so it's essential to review and update rates regularly. This ensures accuracy and compliance with tax regulations.

Benefits of Reviewing and Updating Per Diem Rates Regularly

Reviewing and updating per diem rates regularly offers several benefits, including:

- Accuracy: Regular updates ensure accuracy and compliance with tax regulations.

- Convenience: Regular updates save time and effort in researching per diem rates.

- Compliance: Regular updates demonstrate compliance with company policies and tax regulations.

What are per diem rates?

+Per diem rates are the maximum amounts that employers can reimburse employees for expenses incurred while traveling on business.

How are per diem rates calculated?

+Per diem rates are set by the General Services Administration (GSA) and vary by location.

Why is it important to understand per diem rates?

+Understanding per diem rates is crucial for businesses and employees to ensure compliance with tax regulations and control travel expenses.

We hope this article has provided valuable insights into navigating per diem rates in Washington D.C. By following these five ways, businesses and employees can ensure accuracy, compliance, and convenience when it comes to per diem rates. If you have any questions or comments, please feel free to share them below.