Intro

Discover the 7 ways to calculate per diem in San Francisco, including the General Services Administration (GSA) rate, IRS mileage rate, and more. Learn how to navigate San Franciscos per diem rates for meals, lodging, and incidentals, ensuring accurate expense tracking and reimbursement for business travelers and employees.

San Francisco, one of the most vibrant and diverse cities in the United States, is a hub for business travelers, tourists, and entrepreneurs alike. With its iconic Golden Gate Bridge, steep hills, and colorful Victorian homes, the City by the Bay is a popular destination for both work and play. However, navigating the city's expenses, especially for business travelers, can be daunting. One crucial aspect to consider is the per diem rate, which is the daily allowance for expenses incurred while on business. In this article, we will delve into the world of per diem rates in San Francisco, exploring seven ways to calculate them and providing insights into the city's unique expenses.

Understanding Per Diem Rates in San Francisco

Per diem rates are essential for businesses to reimburse employees for expenses incurred during business trips. These rates vary by location and are influenced by factors such as food, lodging, and transportation costs. In San Francisco, the per diem rate is crucial due to the city's high cost of living. The General Services Administration (GSA) sets the per diem rates for federal employees, which serves as a benchmark for private companies. However, businesses can choose to use different methods to calculate per diem rates, taking into account their specific needs and expenses.

Method 1: GSA Per Diem Rates

The GSA sets per diem rates for federal employees, which includes a lodging rate and a meal and incidental expense (M&IE) rate. For San Francisco, the GSA per diem rates are as follows:

- Lodging rate: $172 per night

- M&IE rate: $74 per day

These rates serve as a benchmark for private companies, but businesses can adjust them according to their specific needs.

Method 2: Flat Rate Per Diem

A flat rate per diem is a fixed daily amount that covers all expenses, including food, lodging, and transportation. This method is simple to administer, but it may not accurately reflect the actual expenses incurred by employees. A common flat rate per diem for San Francisco is $200-$250 per day.

Method 3: Tiered Per Diem Rates

Tiered per diem rates involve setting different rates based on the time of year, day of the week, or location within San Francisco. For example, a company might set a higher per diem rate for employees staying in the city center during peak travel seasons. This method allows for more flexibility and accuracy in reimbursing employees.

Method 4: Actual Expense Method

The actual expense method involves reimbursing employees for their actual expenses, rather than using a per diem rate. This method requires employees to keep detailed records of their expenses, which can be time-consuming and administrative-intensive.

Method 5: Per Diem Plus Actual Expenses

This method combines the per diem rate with actual expenses for certain items, such as transportation or laundry. For example, a company might set a per diem rate for food and lodging, but reimburse employees for actual transportation expenses.

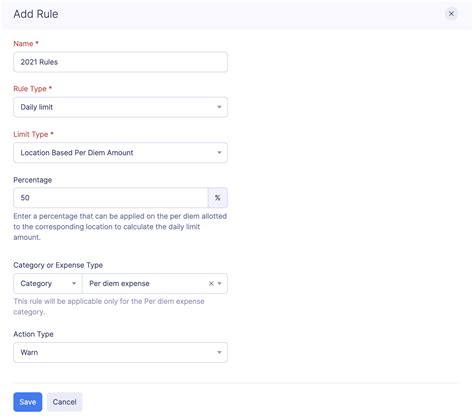

Method 6: Location-Based Per Diem Rates

Location-based per diem rates take into account the specific location within San Francisco, such as the city center or outer neighborhoods. This method allows for more accurate reimbursement, as expenses can vary significantly depending on the location.

Method 7: Custom Per Diem Rates

Custom per diem rates involve setting rates based on a company's specific needs and expenses. This method requires analyzing the company's expense data and setting rates that reflect the actual costs incurred by employees.

Conclusion

Calculating per diem rates in San Francisco requires consideration of various factors, including food, lodging, and transportation costs. By understanding the different methods for calculating per diem rates, businesses can ensure that their employees are accurately reimbursed for expenses incurred during business trips. Whether using the GSA per diem rates, flat rate per diem, or custom per diem rates, it's essential to choose a method that reflects the company's specific needs and expenses.

We invite you to share your thoughts on calculating per diem rates in San Francisco. How do you calculate per diem rates for your business? Share your experiences and insights in the comments below.

What is the GSA per diem rate for San Francisco?

+The GSA per diem rate for San Francisco is $172 per night for lodging and $74 per day for meal and incidental expenses (M&IE).

What is a flat rate per diem?

+A flat rate per diem is a fixed daily amount that covers all expenses, including food, lodging, and transportation.

What is the actual expense method?

+The actual expense method involves reimbursing employees for their actual expenses, rather than using a per diem rate.