Intro

Maximize your Social Security benefits in Mission Viejo with expert strategies. Learn how to optimize your retirement income, avoid costly mistakes, and make informed decisions about claiming benefits, spousal benefits, and delayed retirement credits. Get the most out of your Social Security with these 5 proven ways to boost your benefits and secure your financial future.

As a resident of Mission Viejo, you're likely no stranger to the importance of planning for a secure financial future. One crucial aspect of this planning is maximizing your Social Security benefits. With the right strategies, you can increase your monthly payments and enjoy a more comfortable retirement. In this article, we'll explore five ways to maximize your Social Security benefits, helping you make the most of this vital resource.

Understanding Social Security Benefits

Before we dive into the strategies for maximizing your Social Security benefits, it's essential to understand how these benefits work. Social Security is a government-funded program designed to provide financial assistance to eligible recipients, including retirees, disabled individuals, and the survivors of deceased workers. The amount of your Social Security benefits depends on your earnings history, with higher earners receiving larger benefits.

How Social Security Benefits Are Calculated

Your Social Security benefits are calculated based on your 35 highest-earning years, with the Social Security Administration (SSA) using a formula to determine your Primary Insurance Amount (PIA). This amount serves as the foundation for your monthly benefits. To maximize your benefits, it's crucial to understand how the SSA calculates your PIA and how you can influence this calculation.

Strategy 1: Delay Claiming Benefits

One of the most effective ways to maximize your Social Security benefits is to delay claiming them. While you can start receiving benefits as early as age 62, doing so will result in reduced payments. By waiting until your full retirement age (FRA), you'll receive your full PIA. Additionally, delaying benefits beyond your FRA can lead to increased payments, with an 8% annual increase until age 70.

The Benefits of Delaying Benefits

Delaying benefits can have a significant impact on your monthly payments. For example, if your PIA is $2,000 per month, claiming benefits at age 62 would result in a reduced payment of $1,500 per month. However, waiting until age 70 would increase your payment to $2,480 per month. By delaying benefits, you can enjoy a more comfortable retirement and increase your financial security.

Strategy 2: Maximize Your Earnings History

Your earnings history plays a significant role in determining your Social Security benefits. To maximize your benefits, focus on increasing your earnings, especially during your 35 highest-earning years. This can involve pursuing higher-paying job opportunities, taking on side hustles, or investing in education and training to boost your earning potential.

The Impact of Earnings History on Benefits

Your earnings history has a direct impact on your Social Security benefits. By increasing your earnings, you can higher your PIA and ultimately receive larger benefits. For example, if you increase your earnings by $10,000 per year, you could see an increase of $200-$300 per month in your Social Security benefits.

Strategy 3: Claim Spousal Benefits

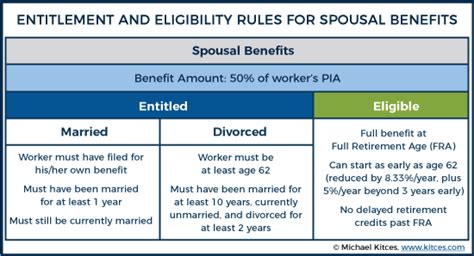

If you're married, you may be eligible for spousal benefits, which can provide an additional source of income in retirement. Spousal benefits allow you to claim benefits based on your spouse's earnings history, potentially increasing your overall benefits.

How Spousal Benefits Work

Spousal benefits allow you to claim up to 50% of your spouse's PIA. To be eligible, you must be at least 62 years old and your spouse must have already claimed their benefits. By claiming spousal benefits, you can increase your overall benefits and enjoy a more comfortable retirement.

Strategy 4: Consider a Claiming Strategy

If you're married, you may want to consider a claiming strategy to maximize your benefits. One popular strategy is the "claim and switch" approach, where one spouse claims benefits early and the other spouse delays benefits until age 70. This strategy can provide an additional source of income in retirement while also increasing your overall benefits.

The Benefits of a Claiming Strategy

A claiming strategy can help you maximize your benefits and increase your financial security in retirement. By coordinating your claiming strategy with your spouse, you can enjoy a more comfortable retirement and make the most of your Social Security benefits.

Strategy 5: Review and Adjust Your Strategy

Finally, it's essential to review and adjust your Social Security strategy regularly. Your circumstances may change over time, and your strategy should adapt to these changes. By regularly reviewing your strategy, you can ensure you're making the most of your benefits and enjoying a comfortable retirement.

The Importance of Reviewing Your Strategy

Reviewing and adjusting your Social Security strategy is crucial to ensuring you're making the most of your benefits. By regularly reviewing your strategy, you can identify areas for improvement and make changes to optimize your benefits.

As a resident of Mission Viejo, maximizing your Social Security benefits is crucial to enjoying a comfortable retirement. By implementing these five strategies, you can increase your monthly payments and make the most of this vital resource. Remember to review and adjust your strategy regularly to ensure you're making the most of your benefits.

What is the full retirement age for Social Security benefits?

+The full retirement age for Social Security benefits varies depending on your birth year. For those born in 1960 or later, the full retirement age is 67.

How do I apply for Social Security benefits?

+You can apply for Social Security benefits online, by phone, or in person at your local Social Security office.

Can I claim Social Security benefits if I'm still working?

+Yes, you can claim Social Security benefits while still working. However, your benefits may be reduced if you earn above a certain threshold.