Intro

Boost your travel reimbursement with our expert guide on 5 ways to maximize State Dept per diem. Learn how to optimize your daily allowances, navigate complex regulations, and master the art of expense reporting. Discover the secrets to maximizing your per diem, from understanding reimbursement rates to leveraging travel management tools.

As a government employee, contractor, or military personnel, you're likely familiar with the per diem rates set by the State Department for travel expenses. These rates are designed to cover the costs of meals, lodging, and other expenses while on official business. However, maximizing your per diem can be a challenge, especially when navigating unfamiliar destinations. In this article, we'll explore five ways to make the most of your State Department per diem.

Understanding State Department Per Diem Rates

Before we dive into the tips, it's essential to understand how State Department per diem rates work. The rates are set by the Department of State and are based on the location, time of year, and other factors. The rates are divided into three categories: lodging, meals, and incidental expenses.

- Lodging: This rate covers the cost of a hotel room or other accommodation.

- Meals: This rate covers the cost of breakfast, lunch, and dinner.

- Incidental expenses: This rate covers other expenses such as tips, laundry, and transportation.

How to Maximize Your Per Diem

Now that we've covered the basics, let's explore five ways to maximize your State Department per diem.

1. Choose Your Accommodations Wisely

When it comes to lodging, the key is to find a hotel or accommodation that meets your needs while staying within the per diem rate. Here are a few tips to help you maximize your lodging per diem:

- Research, research, research: Look for hotels or accommodations that offer the best value for your money.

- Consider alternative options: Instead of staying in a hotel, consider staying in a hostel, Airbnb, or vacation rental.

- Book in advance: Booking your accommodations well in advance can help you save money and ensure that you get the best rate.

2. Eat Smart

Eating out can be expensive, especially when traveling. Here are a few tips to help you maximize your meal per diem:

- Eat at local restaurants: Instead of eating at touristy restaurants, try eating at local restaurants or street food stalls.

- Avoid room service: Room service can be expensive, so try to avoid it if possible.

- Pack snacks: Packing snacks can help you save money and ensure that you have something to eat when you need it.

Meal Per Diem Tips

- Keep receipts: Make sure to keep receipts for all of your meals, as you'll need them to claim reimbursement.

- Use cash: Using cash instead of credit cards can help you stick to your budget and avoid overspending.

- Eat breakfast: Eating breakfast can help you save money and ensure that you have energy for the day ahead.

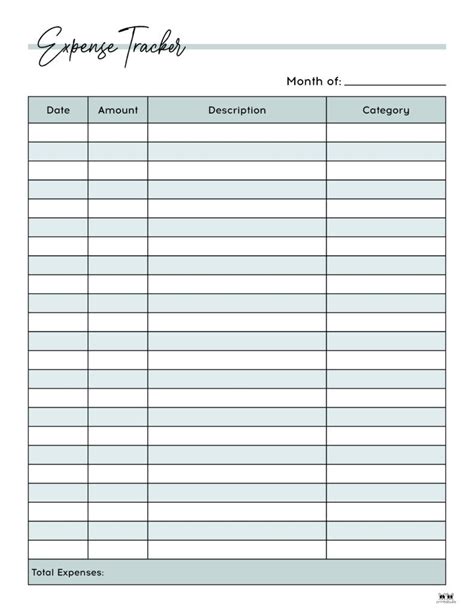

3. Track Your Expenses

Tracking your expenses is crucial to maximizing your per diem. Here are a few tips to help you stay on top of your expenses:

- Use a spreadsheet: Create a spreadsheet to track your expenses, including meals, lodging, and incidental expenses.

- Keep receipts: Make sure to keep receipts for all of your expenses, as you'll need them to claim reimbursement.

- Use a budgeting app: Consider using a budgeting app to help you track your expenses and stay within your budget.

Expense Tracking Tips

- Be detailed: Make sure to include detailed descriptions of each expense, including the date, time, and location.

- Categorize expenses: Categorize your expenses to make it easier to track and claim reimbursement.

- Review regularly: Review your expenses regularly to ensure that you're staying within your budget.

4. Take Advantage of Tax-Free Allowances

As a government employee, contractor, or military personnel, you may be eligible for tax-free allowances. Here are a few tips to help you take advantage of these allowances:

- Research tax-free allowances: Research tax-free allowances and ensure that you're taking advantage of them.

- Keep receipts: Keep receipts for all of your expenses, as you'll need them to claim reimbursement.

- Consult with a tax professional: Consult with a tax professional to ensure that you're taking advantage of all the tax-free allowances available to you.

Tax-Free Allowance Tips

- Understand the rules: Understand the rules and regulations surrounding tax-free allowances.

- Keep accurate records: Keep accurate records of your expenses, including receipts and invoices.

- Claim reimbursement: Claim reimbursement for all eligible expenses.

5. Plan Ahead

Finally, planning ahead is crucial to maximizing your per diem. Here are a few tips to help you plan ahead:

- Research your destination: Research your destination to understand the local culture, customs, and expenses.

- Create a budget: Create a budget to ensure that you're staying within your means.

- Book accommodations and flights in advance: Booking accommodations and flights in advance can help you save money and ensure that you get the best rate.

Planning Ahead Tips

- Be flexible: Be flexible with your travel plans and accommodation arrangements.

- Consider off-peak travel: Consider traveling during off-peak seasons to save money.

- Use travel rewards: Use travel rewards credit cards or loyalty programs to earn points and redeem rewards.

By following these five tips, you can maximize your State Department per diem and ensure that you're getting the most out of your travel expenses. Remember to research, plan ahead, and track your expenses to make the most of your per diem.

We hope you found this article helpful! If you have any questions or comments, please don't hesitate to reach out. Don't forget to share this article with your colleagues and friends who may be traveling on official business.

What is the State Department per diem rate?

+The State Department per diem rate is a daily allowance for meals, lodging, and incidental expenses while on official business.

How do I claim reimbursement for my expenses?

+To claim reimbursement for your expenses, you'll need to submit a travel voucher with receipts and documentation to your agency or organization.

Can I use my per diem for personal expenses?

+No, your per diem is only for official business expenses. Using your per diem for personal expenses is not allowed and may result in reimbursement being denied.