Intro

Term insurance is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. It is a popular choice among individuals who want to ensure financial security for their loved ones in the event of their untimely death. But is term insurance right for you? In this article, we will explore the benefits and features of term insurance to help you decide.

Term insurance is a cost-effective way to provide financial protection to your family. It is ideal for individuals who have dependents, such as children or a spouse, who rely on their income. The policy pays a death benefit to the nominee if the policyholder dies during the term of the policy. This ensures that the family's financial needs are met, even if the breadwinner is no longer around.

One of the primary benefits of term insurance is its affordability. The premiums are lower compared to other types of life insurance, making it an attractive option for individuals on a budget. Additionally, term insurance policies often come with flexible premium payment options, allowing policyholders to choose from various payment modes, such as monthly, quarterly, or annually.

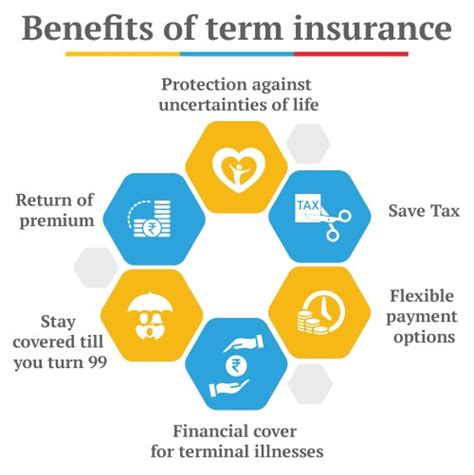

Benefits of Term Insurance

Term insurance offers several benefits that make it an attractive option for individuals seeking life insurance coverage. Some of the key benefits include:

- Financial Security: Term insurance provides financial security to the policyholder's family in the event of their untimely death.

- Affordability: Term insurance premiums are lower compared to other types of life insurance, making it an affordable option for individuals on a budget.

- Flexibility: Term insurance policies often come with flexible premium payment options, allowing policyholders to choose from various payment modes.

- Tax Benefits: Term insurance premiums are eligible for tax benefits under Section 80C of the Income Tax Act, 1961.

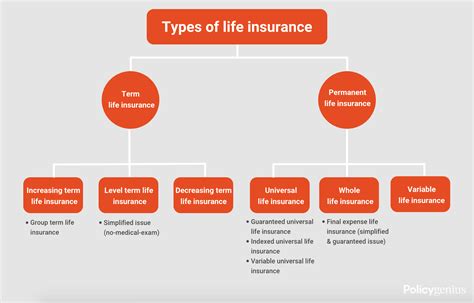

Types of Term Insurance Policies

There are several types of term insurance policies available in the market, each with its unique features and benefits. Some of the most common types of term insurance policies include:

- Level Term Insurance: This type of policy provides a fixed death benefit throughout the term of the policy.

- Increasing Term Insurance: This type of policy provides an increasing death benefit throughout the term of the policy.

- Decreasing Term Insurance: This type of policy provides a decreasing death benefit throughout the term of the policy.

- Convertible Term Insurance: This type of policy allows policyholders to convert their term insurance policy to a whole life insurance policy.

How to Choose the Right Term Insurance Policy

Choosing the right term insurance policy can be a daunting task, especially with the numerous options available in the market. Here are some tips to help you choose the right term insurance policy:

- Assess Your Needs: Assess your financial needs and determine how much coverage you require.

- Choose the Right Term: Choose a term that aligns with your financial goals and needs.

- Compare Policies: Compare policies from different insurers to find the best option.

- Check the Insurer's Reputation: Check the insurer's reputation and financial stability.

Common Mistakes to Avoid When Buying Term Insurance

When buying term insurance, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Not Assessing Your Needs: Not assessing your financial needs and buying a policy that does not provide adequate coverage.

- Not Choosing the Right Term: Not choosing a term that aligns with your financial goals and needs.

- Not Comparing Policies: Not comparing policies from different insurers to find the best option.

- Not Checking the Insurer's Reputation: Not checking the insurer's reputation and financial stability.

Conclusion

Term insurance is a cost-effective way to provide financial protection to your family. It is ideal for individuals who have dependents and want to ensure their financial security in the event of their untimely death. When buying term insurance, it is essential to assess your needs, choose the right term, compare policies, and check the insurer's reputation. By avoiding common mistakes and choosing the right policy, you can ensure that your family's financial needs are met, even if you are no longer around.

What is term insurance?

+Term insurance is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years.

What are the benefits of term insurance?

+Term insurance provides financial security to the policyholder's family, is affordable, and offers flexible premium payment options.

How to choose the right term insurance policy?

+Assess your needs, choose the right term, compare policies, and check the insurer's reputation to choose the right term insurance policy.

We hope this article has provided you with a comprehensive understanding of term insurance and its benefits. If you have any further questions or would like to share your experiences, please feel free to comment below.