Intro

Discover reliable coverage solutions with Tower Hill Insurance Florida. Get comprehensive protection for your home, auto, and business with tailored policies. Learn about their extensive coverage options, competitive rates, and exceptional customer service. Find the perfect insurance solution for your Florida lifestyle, from hurricane-prone areas to bustling cities.

As a homeowner in Florida, you understand the importance of having reliable insurance coverage to protect your property and loved ones from the state's unique risks, such as hurricanes, sinkholes, and flooding. With so many insurance providers in the market, it can be overwhelming to choose the right one. That's where Tower Hill Insurance comes in – a reputable and experienced insurance company that has been serving Floridians for over 40 years. In this article, we will delve into the world of Tower Hill Insurance Florida, exploring their coverage solutions, benefits, and what sets them apart from other insurance providers.

Who is Tower Hill Insurance?

Tower Hill Insurance is a Florida-based insurance company that specializes in providing personalized coverage solutions to homeowners, condominium owners, and renters across the state. With a strong commitment to customer service and a deep understanding of Florida's unique insurance needs, Tower Hill has established itself as a trusted and reliable insurance provider.

History of Tower Hill Insurance

Tower Hill Insurance was founded in 1972, with a mission to provide Floridians with comprehensive and affordable insurance coverage. Over the years, the company has grown and evolved to meet the changing needs of its customers, while remaining true to its core values of integrity, excellence, and customer satisfaction.

Insurance Coverage Solutions

Tower Hill Insurance offers a range of coverage solutions designed to protect your property and loved ones from various risks. Some of their key coverage options include:

- Homeowners Insurance: Tower Hill's homeowners insurance policy provides comprehensive coverage for your home, including the structure, personal belongings, and liability.

- Condominium Insurance: If you own a condominium, Tower Hill's condominium insurance policy can provide coverage for your unit, personal belongings, and liability.

- Renters Insurance: As a renter, you may not need to insure the building itself, but you still need to protect your personal belongings and liability. Tower Hill's renters insurance policy can provide the coverage you need.

- Flood Insurance: Florida is prone to flooding, and Tower Hill's flood insurance policy can provide coverage for your home and personal belongings in the event of a flood.

Benefits of Choosing Tower Hill Insurance

So, what sets Tower Hill Insurance apart from other insurance providers in Florida? Here are some benefits of choosing Tower Hill Insurance:

- Personalized Service: Tower Hill Insurance is committed to providing personalized service to its customers. Their experienced agents will work with you to understand your unique insurance needs and provide customized coverage solutions.

- Competitive Rates: Tower Hill Insurance offers competitive rates without compromising on coverage. They understand that insurance can be expensive, and they strive to provide affordable solutions that meet your budget.

- Financial Stability: Tower Hill Insurance is a financially stable company with a strong track record of paying claims. You can trust that they will be there to support you when you need it most.

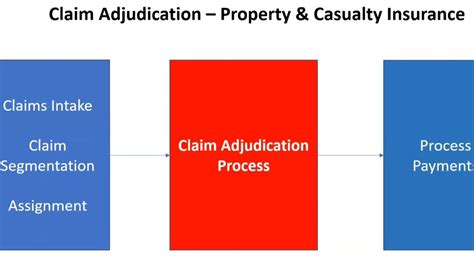

Claims Process

Filing a claim can be a stressful and overwhelming experience, but Tower Hill Insurance is committed to making the process as smooth and efficient as possible. Here's what you can expect:

- 24/7 Claims Service: Tower Hill Insurance offers 24/7 claims service, so you can file a claim at any time.

- Dedicated Claims Team: Their dedicated claims team will work with you to process your claim quickly and efficiently.

- Fair and Prompt Settlements: Tower Hill Insurance is committed to providing fair and prompt settlements, so you can get back to normal as soon as possible.

Customer Reviews

Don't just take our word for it – here's what some of Tower Hill Insurance's satisfied customers have to say:

- "I've been with Tower Hill Insurance for over 10 years, and I've always been impressed with their customer service and competitive rates." - John D.

- "I recently filed a claim with Tower Hill Insurance, and the process was smooth and efficient. I was impressed with their professionalism and courtesy." - Emily K.

Conclusion

Tower Hill Insurance is a reliable and trustworthy insurance provider that offers comprehensive coverage solutions to homeowners, condominium owners, and renters in Florida. With their personalized service, competitive rates, and financial stability, they are an excellent choice for anyone looking for insurance coverage in the Sunshine State. Whether you're looking for homeowners insurance, condominium insurance, renters insurance, or flood insurance, Tower Hill Insurance has got you covered.

Get a Quote Today!

If you're interested in learning more about Tower Hill Insurance and getting a quote, visit their website or contact one of their experienced agents today.

What types of insurance coverage does Tower Hill Insurance offer?

+Tower Hill Insurance offers a range of coverage solutions, including homeowners insurance, condominium insurance, renters insurance, and flood insurance.

How do I file a claim with Tower Hill Insurance?

+You can file a claim with Tower Hill Insurance by contacting their 24/7 claims service or by visiting their website.

Is Tower Hill Insurance financially stable?

+Yes, Tower Hill Insurance is a financially stable company with a strong track record of paying claims.

We hope this article has provided you with valuable information about Tower Hill Insurance and their coverage solutions. If you have any further questions or would like to share your experiences with Tower Hill Insurance, please leave a comment below!