Intro

Discover the comprehensive list of Kaiser accepted insurance plans, including Medicare, Medicaid, and individual plans. Learn about Kaisers network, coverage options, and benefits. Get insights into out-of-pocket costs, deductibles, and copays. Make informed decisions about your healthcare with our detailed guide to Kaisers insurance plans and network providers.

Kaiser Permanente is a well-established health care organization that has been providing top-notch medical services to its members for over 70 years. With its comprehensive network of hospitals, medical offices, and specialized care centers, Kaiser Permanente has become a trusted name in the healthcare industry. However, navigating the complex world of health insurance can be daunting, especially when it comes to understanding which insurance plans are accepted by Kaiser Permanente. In this article, we will delve into the world of Kaiser accepted insurance plans, exploring the different types of plans, their benefits, and what you need to know to make informed decisions about your healthcare.

Understanding Kaiser Permanente's Insurance Plans

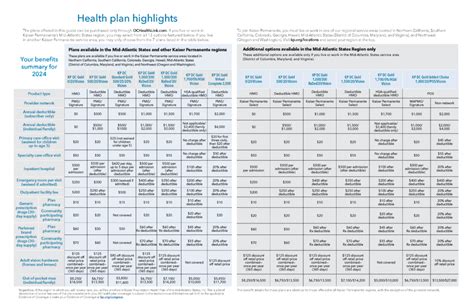

Kaiser Permanente offers a range of insurance plans designed to cater to different needs and budgets. These plans are divided into several categories, including individual and family plans, group plans, Medicare plans, and Medicaid plans. Each plan has its unique set of benefits, deductibles, and copays, making it essential to understand the specifics of each plan before making a decision.

Individual and Family Plans

Kaiser Permanente's individual and family plans are designed for those who do not have access to group coverage through their employer. These plans offer a range of benefits, including preventive care, doctor visits, hospital stays, and prescription medication. Some of the popular individual and family plans offered by Kaiser Permanente include:

- Bronze Plan: This plan offers basic coverage with lower premiums but higher deductibles and copays.

- Silver Plan: This plan provides moderate coverage with moderate premiums and deductibles.

- Gold Plan: This plan offers comprehensive coverage with higher premiums but lower deductibles and copays.

- Platinum Plan: This plan provides the highest level of coverage with the highest premiums but lowest deductibles and copays.

Group Plans

Kaiser Permanente's group plans are designed for businesses and organizations looking to provide health insurance coverage to their employees. These plans offer a range of benefits, including medical, dental, and vision coverage. Group plans can be customized to meet the specific needs of each organization, making them an attractive option for businesses of all sizes.

Medicare Plans

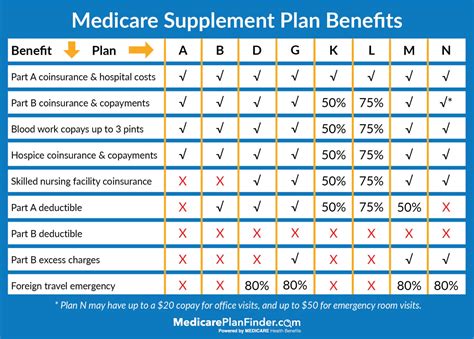

Kaiser Permanente's Medicare plans are designed for individuals 65 and older or those with certain disabilities. These plans offer a range of benefits, including medical, hospital, and prescription medication coverage. Some of the popular Medicare plans offered by Kaiser Permanente include:

- Medicare Advantage Plan: This plan provides comprehensive coverage with lower out-of-pocket costs.

- Medicare Supplement Plan: This plan offers additional coverage to supplement Medicare Parts A and B.

- Medicare Part D Plan: This plan provides prescription medication coverage.

Medicaid Plans

Kaiser Permanente's Medicaid plans are designed for low-income individuals and families who meet certain eligibility requirements. These plans offer a range of benefits, including medical, hospital, and prescription medication coverage. Medicaid plans can vary depending on the state and local regulations.

Additional Benefits

In addition to the standard benefits offered by Kaiser Permanente's insurance plans, some plans may offer additional benefits, including:

- Wellness programs: These programs offer discounts on fitness classes, gym memberships, and healthy lifestyle activities.

- Mental health services: These services provide access to mental health professionals and counseling services.

- Vision and dental coverage: These plans offer coverage for vision and dental care, including eye exams, glasses, and dental cleanings.

How to Choose the Right Kaiser Permanente Insurance Plan

Choosing the right Kaiser Permanente insurance plan can be overwhelming, especially with the numerous options available. Here are some tips to help you make an informed decision:

- Assess your health needs: Consider your medical history, current health status, and any ongoing health needs.

- Evaluate your budget: Determine how much you can afford to pay in premiums, deductibles, and copays.

- Research plan options: Compare the benefits, deductibles, and copays of different plans to find the best fit for your needs and budget.

- Consider additional benefits: Think about any additional benefits you may need, such as wellness programs or mental health services.

What to Expect from Kaiser Permanente

Kaiser Permanente is committed to providing high-quality healthcare services to its members. Here are some things you can expect from Kaiser Permanente:

- Comprehensive care: Kaiser Permanente offers a range of medical services, including primary care, specialty care, and hospital services.

- Convenient access: Kaiser Permanente has a large network of medical offices, hospitals, and specialized care centers, making it easy to access care when you need it.

- Personalized care: Kaiser Permanente's healthcare professionals are dedicated to providing personalized care that meets your unique needs and preferences.

Conclusion

Kaiser Permanente's insurance plans offer a range of benefits and options to meet different needs and budgets. By understanding the different types of plans, their benefits, and what to expect from Kaiser Permanente, you can make informed decisions about your healthcare. Remember to assess your health needs, evaluate your budget, research plan options, and consider additional benefits to find the best fit for your needs and budget.

Take Action

Now that you have a better understanding of Kaiser Permanente's insurance plans, it's time to take action. Here are some steps you can take:

- Visit Kaiser Permanente's website to learn more about their insurance plans and benefits.

- Contact a Kaiser Permanente representative to discuss your options and answer any questions you may have.

- Enroll in a Kaiser Permanente insurance plan that meets your needs and budget.

What is Kaiser Permanente?

+Kaiser Permanente is a health care organization that provides medical services to its members.

What types of insurance plans does Kaiser Permanente offer?

+Kaiser Permanente offers individual and family plans, group plans, Medicare plans, and Medicaid plans.

How do I choose the right Kaiser Permanente insurance plan?

+Assess your health needs, evaluate your budget, research plan options, and consider additional benefits to find the best fit for your needs and budget.