Intro

Kaiser Permanente is a well-established health care organization that provides a range of insurance plans to individuals, families, and groups. With a strong network of medical facilities, hospitals, and healthcare professionals, Kaiser Permanente is a popular choice for those seeking comprehensive and affordable health coverage. But what exactly is accepted under Kaiser Permanente insurance plans?

In this article, we will delve into the details of Kaiser Permanente insurance plans, including what is accepted, what is covered, and what to expect from their services.

Understanding Kaiser Permanente Insurance Plans

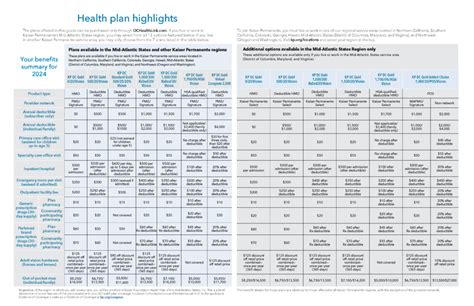

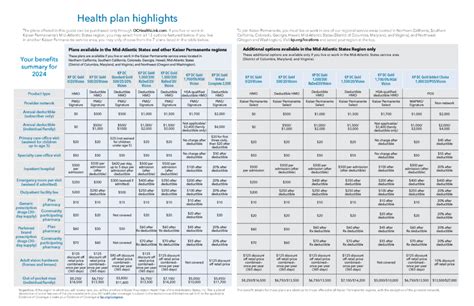

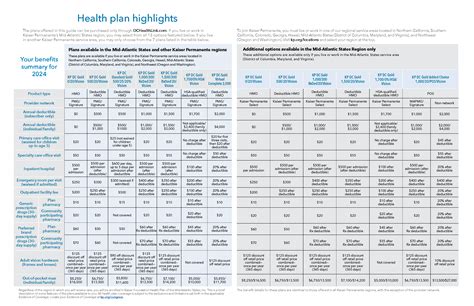

Kaiser Permanente offers a variety of insurance plans that cater to different needs and budgets. Their plans are designed to provide comprehensive coverage for medical, dental, and vision care. Here are some key aspects of Kaiser Permanente insurance plans:

- Network: Kaiser Permanente has an extensive network of healthcare providers, including primary care physicians, specialists, hospitals, and medical facilities.

- Coverage: Their plans cover a range of services, including preventive care, diagnostic tests, hospital stays, surgical procedures, and prescription medications.

- Cost-sharing: Kaiser Permanente plans often come with cost-sharing options, such as copays, deductibles, and coinsurance.

What is Accepted Under Kaiser Permanente Insurance Plans?

Kaiser Permanente insurance plans accept a wide range of medical services and treatments. Here are some examples:

- Preventive care: Routine check-ups, vaccinations, screenings, and health education.

- Primary care: Visits to primary care physicians, including family medicine, internal medicine, and pediatrics.

- Specialty care: Referrals to specialists, such as cardiologists, oncologists, and orthopedic surgeons.

- Hospital care: Inpatient and outpatient hospital services, including surgical procedures and emergency care.

- Mental health: Coverage for mental health services, including counseling, therapy, and psychiatric care.

- Rehabilitation: Physical, occupational, and speech therapy.

- Durable medical equipment: Coverage for medical equipment, such as wheelchairs, walkers, and oxygen tanks.

Benefits of Kaiser Permanente Insurance Plans

Kaiser Permanente insurance plans offer numerous benefits, including:

- Comprehensive coverage: Their plans provide comprehensive coverage for medical, dental, and vision care.

- Network: Kaiser Permanente has an extensive network of healthcare providers, making it easy to find a doctor or hospital.

- Cost-effective: Their plans often come with cost-sharing options, making healthcare more affordable.

- Convenience: Kaiser Permanente offers online services, including appointment scheduling, prescription refills, and bill payments.

How to Choose the Right Kaiser Permanente Insurance Plan

Choosing the right Kaiser Permanente insurance plan depends on several factors, including your budget, health needs, and preferences. Here are some tips to help you choose the right plan:

- Assess your health needs: Consider your medical history, health status, and any ongoing treatments.

- Compare plans: Research and compare different Kaiser Permanente plans, including their coverage, cost-sharing, and network.

- Check the network: Ensure that your primary care physician and any specialists you see are part of the Kaiser Permanente network.

- Evaluate the cost: Calculate the total cost of the plan, including premiums, deductibles, and copays.

Common Questions About Kaiser Permanente Insurance Plans

Here are some common questions about Kaiser Permanente insurance plans:

- What is the difference between Kaiser Permanente and other health insurance providers? Kaiser Permanente is a unique healthcare organization that provides comprehensive coverage and a wide range of services.

- Can I see any doctor I want with Kaiser Permanente insurance? Kaiser Permanente has a network of healthcare providers, but you can see any doctor you want, including out-of-network providers, although this may incur additional costs.

- How do I know if Kaiser Permanente insurance is right for me? Consider your health needs, budget, and preferences, and compare Kaiser Permanente plans with other health insurance providers.

What is the Kaiser Permanente insurance plan network?

+Kaiser Permanente has an extensive network of healthcare providers, including primary care physicians, specialists, hospitals, and medical facilities.

What is covered under Kaiser Permanente insurance plans?

+Kaiser Permanente insurance plans cover a range of services, including preventive care, diagnostic tests, hospital stays, surgical procedures, and prescription medications.

How do I choose the right Kaiser Permanente insurance plan?

+Assess your health needs, compare plans, check the network, and evaluate the cost to choose the right Kaiser Permanente insurance plan.

In conclusion, Kaiser Permanente insurance plans offer comprehensive coverage and a wide range of services. By understanding what is accepted under their plans, you can make informed decisions about your healthcare needs. Remember to assess your health needs, compare plans, and evaluate the cost to choose the right Kaiser Permanente insurance plan for you.

We hope this article has provided you with valuable insights into Kaiser Permanente insurance plans. If you have any questions or comments, please feel free to share them below.