Intro

Discover the yearly salary equivalent of $24 an hour. Learn how to calculate annual income from hourly wages and understand the impact on your lifestyle. Find out what $24 an hour annually translates to in terms of monthly, weekly, and daily earnings, and explore the benefits and drawbacks of this salary range.

If you earn $24 an hour, you might be wondering what that translates to in terms of annual salary. The answer depends on the number of hours you work per week and the number of weeks you work per year.

Assuming a standard full-time schedule of 40 hours per week and 52 weeks per year, let's do some math:

$24 per hour x 40 hours per week = $960 per week $960 per week x 52 weeks per year = $49,920 per year

So, if you earn $24 an hour and work 40 hours a week for 52 weeks a year, your annual salary would be approximately $49,920.

However, this calculation doesn't take into account factors like overtime, bonuses, or time off. Additionally, the number of hours worked per week and weeks worked per year can vary significantly depending on the industry, job type, and employer.

To give you a better idea, here are some annual salary estimates based on different hourly work schedules:

- 20 hours/week: $24,960 per year

- 30 hours/week: $37,440 per year

- 40 hours/week: $49,920 per year

- 50 hours/week: $62,400 per year

Keep in mind that these are rough estimates and don't account for variables like taxes, benefits, or overtime pay.

Now that we've explored the annual salary equivalent of $24 an hour, let's dive deeper into the world of hourly wages and explore some related topics.

How to Calculate Your Hourly Wage

Calculating your hourly wage is a straightforward process. Here's a step-by-step guide:

- Determine your annual salary or annual earnings.

- Divide your annual salary by the number of hours you work per year.

For example, if you earn $50,000 per year and work 2,080 hours per year (40 hours/week x 52 weeks/year), your hourly wage would be:

$50,000 ÷ 2,080 hours = $24.04 per hour

You can use this formula to calculate your hourly wage based on your individual circumstances.

Factors Affecting Hourly Wages

Several factors can influence your hourly wage, including:

- Industry: Different industries have varying pay scales. For instance, healthcare professionals tend to earn higher hourly wages than those in the retail sector.

- Location: The cost of living in your area can impact your hourly wage. Cities with a high cost of living often have higher hourly wages to compensate.

- Experience: More experienced workers tend to earn higher hourly wages than those just starting out.

- Education: Higher levels of education can lead to higher hourly wages.

- Job type: Certain jobs, such as those in the tech industry, may offer higher hourly wages due to the specialized skills required.

These factors can affect your hourly wage, so it's essential to consider them when evaluating your compensation package.

Benefits of Knowing Your Hourly Wage

Understanding your hourly wage can have several benefits:

- Better budgeting: Knowing your hourly wage can help you create a more accurate budget and make informed financial decisions.

- Salary negotiations: Being aware of your hourly wage can give you a solid foundation for salary negotiations with your employer.

- Career development: Understanding your hourly wage can help you identify areas for career growth and development.

- Financial planning: Knowing your hourly wage can aid in long-term financial planning, such as saving for retirement or a down payment on a house.

In conclusion, knowing your hourly wage can provide valuable insights into your compensation package and help you make informed financial decisions.

How to Increase Your Hourly Wage

If you're looking to boost your hourly wage, consider the following strategies:

- Develop new skills: Acquiring new skills or certifications can make you more valuable to your employer and increase your earning potential.

- Take on additional responsibilities: Volunteering for more responsibilities or taking on a leadership role can demonstrate your value to your employer and lead to higher pay.

- Negotiate with your employer: Prepare a solid case for a raise and negotiate with your employer to increase your hourly wage.

- Explore new job opportunities: If you're not satisfied with your current hourly wage, consider exploring new job opportunities that offer higher pay.

Remember, increasing your hourly wage takes time and effort, but it can have a significant impact on your overall compensation package.

In the next section, we'll delve into the world of hourly wage laws and regulations.

Hourly Wage Laws and Regulations

Hourly wage laws and regulations vary by country, state, or province. Here are some key aspects to consider:

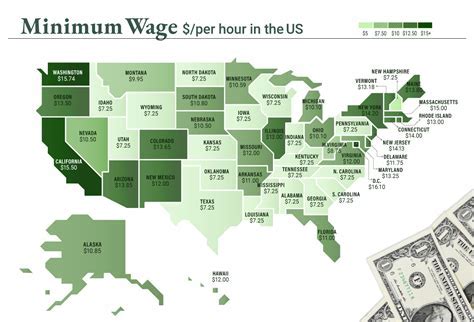

- Minimum wage laws: Many countries and states have minimum wage laws that dictate the lowest hourly wage employers can pay employees.

- Overtime pay: Laws regulating overtime pay vary, but most require employers to pay employees at least 1.5 times their regular hourly wage for work exceeding 40 hours per week.

- Equal pay laws: These laws aim to prevent pay discrimination based on factors like gender, age, or ethnicity.

It's essential to familiarize yourself with the hourly wage laws and regulations in your area to ensure you're receiving fair compensation.

In conclusion, understanding your hourly wage is crucial for making informed financial decisions and ensuring you're receiving fair compensation.

FAQs

What is the minimum hourly wage in the United States?

+The federal minimum wage in the United States is $7.25 per hour, although some states and cities have higher minimum wages.

How do I calculate my hourly wage?

+To calculate your hourly wage, divide your annual salary by the number of hours you work per year.

What factors affect my hourly wage?

+Factors affecting your hourly wage include industry, location, experience, education, and job type.

We hope this article has provided you with a comprehensive understanding of hourly wages and their importance in your financial well-being. If you have any further questions or topics you'd like to discuss, please feel free to comment below or share this article with others.

By understanding your hourly wage and its implications, you can make informed decisions about your career and finances. Remember to stay informed about hourly wage laws and regulations in your area to ensure you're receiving fair compensation.

Share your thoughts and experiences with hourly wages in the comments below.