Intro

Discover the ins and outs of High-Deductible Health Plans (HDHPs) and how they can impact your healthcare costs. Learn about HDHP benefits, deductibles, out-of-pocket maximums, and compatible Health Savings Accounts (HSAs). Understand the pros and cons of HDHPs and make informed decisions about your health insurance coverage.

In today's complex healthcare landscape, individuals and families are constantly seeking ways to manage their medical expenses. One popular option is the High-Deductible Health Plan (HDHP). But what exactly is an HDHP, and how does it work? In this article, we'll delve into the world of HDHPs, exploring their benefits, drawbacks, and everything in between.

High-Deductible Health Plans are a type of health insurance plan that requires policyholders to pay a higher deductible before their insurance coverage kicks in. In exchange for this higher deductible, HDHPs often come with lower premiums, making them an attractive option for those who want to save on their monthly health insurance costs.

How Do HDHPs Work?

To understand how HDHPs work, let's break down the key components:

- Deductible: The amount you must pay out-of-pocket before your insurance coverage begins. For HDHPs, this deductible is typically higher than that of traditional health plans.

- Premiums: The monthly or annual payment you make to maintain your health insurance coverage. HDHPs often have lower premiums compared to traditional plans.

- Out-of-Pocket Maximum: The maximum amount you'll pay for healthcare expenses within a calendar year. This includes deductibles, copays, and coinsurance.

- Coinsurance: The percentage of healthcare costs you'll pay after meeting your deductible.

Here's an example of how an HDHP might work:

- John has an HDHP with a $2,000 deductible, 20% coinsurance, and a $5,000 out-of-pocket maximum. He pays $200 per month in premiums.

- John visits the doctor and receives a bill for $1,000. Since he hasn't met his deductible, he pays the full $1,000.

- Later, John needs surgery, which costs $10,000. He's already paid $1,000 towards his deductible, so he still owes $1,000 to meet his deductible. After meeting his deductible, his insurance kicks in, and he pays 20% of the remaining $9,000 (=$1,800).

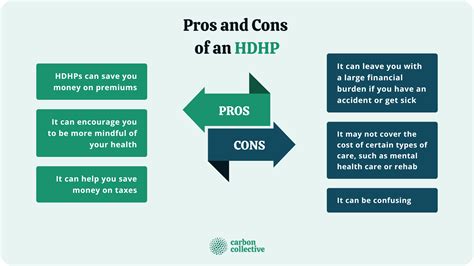

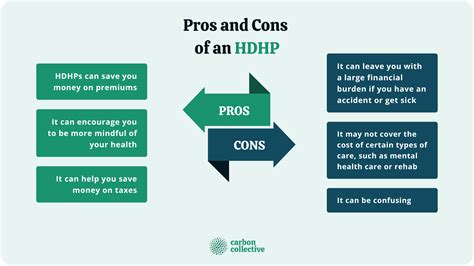

Benefits of HDHPs

So, why would anyone choose an HDHP? Here are some benefits:

- Lower Premiums: HDHPs often have lower premiums compared to traditional health plans, making them an attractive option for those on a budget.

- Health Savings Account (HSA) Eligibility: HDHPs are often paired with HSAs, which allow you to set aside pre-tax dollars for medical expenses.

- Increased Consumer Engagement: With HDHPs, policyholders are more likely to be engaged in their healthcare decisions, as they're paying more out-of-pocket.

Drawbacks of HDHPs

While HDHPs have their benefits, there are also some drawbacks to consider:

- Higher Out-of-Pocket Costs: HDHPs require policyholders to pay more out-of-pocket before their insurance coverage kicks in.

- Limited Provider Networks: Some HDHPs may have limited provider networks, which can restrict access to certain doctors or hospitals.

- Administrative Burden: HDHPs can be more complex to manage, as policyholders need to track their deductible and out-of-pocket expenses.

Who Are HDHPs Best For?

HDHPs are often a good fit for:

- Healthy Individuals: Those who don't require frequent medical care may find HDHPs to be a cost-effective option.

- Young Families: Families with young children may find HDHPs to be a more affordable option, especially if they're relatively healthy.

- Self-Employed Individuals: Self-employed individuals may appreciate the lower premiums and flexibility of HDHPs.

However, HDHPs may not be the best fit for:

- Those with Chronic Conditions: Individuals with ongoing medical needs may find HDHPs to be too costly, as they'll need to pay more out-of-pocket for their care.

- Older Adults: Older adults may find HDHPs to be too expensive, especially if they require frequent medical care.

How to Choose the Right HDHP

If you're considering an HDHP, here are some tips to keep in mind:

- Assess Your Healthcare Needs: Consider your medical history and any ongoing health needs.

- Compare Premiums and Deductibles: Weigh the pros and cons of different HDHPs, considering both premiums and deductibles.

- Check Provider Networks: Ensure that your HDHP has a robust provider network that includes your preferred doctors and hospitals.

Conclusion

In conclusion, HDHPs can be a valuable option for those seeking to manage their healthcare costs. By understanding the benefits and drawbacks of HDHPs, policyholders can make informed decisions about their health insurance coverage. Whether you're a healthy individual or a family with ongoing medical needs, there's an HDHP out there that can meet your unique needs.

What is a High-Deductible Health Plan (HDHP)?

+A High-Deductible Health Plan (HDHP) is a type of health insurance plan that requires policyholders to pay a higher deductible before their insurance coverage begins.

How do HDHPs work?

+HDHPs require policyholders to pay a higher deductible before their insurance coverage begins. After meeting the deductible, policyholders pay a percentage of healthcare costs (coinsurance) until they reach their out-of-pocket maximum.

Who are HDHPs best for?

+HDHPs are often a good fit for healthy individuals, young families, and self-employed individuals who want to save on their monthly health insurance costs.