Intro

When it comes to choosing a health insurance plan, the options can be overwhelming. Two popular types of health insurance plans are HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). While both plans have their benefits and drawbacks, there are significant differences between them.

Understanding the differences between HMO and PPO plans is crucial to make an informed decision about your health insurance coverage. In this article, we'll delve into the details of both plans, including their benefits, drawbacks, and how they work.

What is an HMO Plan?

An HMO plan is a type of health insurance plan that provides coverage for a network of healthcare providers who agree to provide care at a lower cost. HMO plans typically have a primary care physician (PCP) who coordinates your care and refers you to specialists within the network.

Here are some key characteristics of HMO plans:

- Network: HMO plans have a specific network of healthcare providers who participate in the plan.

- Primary Care Physician (PCP): You must choose a PCP from the network who will coordinate your care.

- Referrals: You need a referral from your PCP to see a specialist within the network.

- Out-of-network care: HMO plans usually do not cover out-of-network care, except in emergency situations.

- Cost: HMO plans tend to be more affordable than PPO plans.

What is a PPO Plan?

A PPO plan is a type of health insurance plan that offers more flexibility than an HMO plan. PPO plans have a network of healthcare providers, but you can also see out-of-network providers for a higher cost.

Here are some key characteristics of PPO plans:

- Network: PPO plans have a network of healthcare providers who participate in the plan.

- No PCP required: You do not need to choose a PCP or get referrals to see specialists.

- Out-of-network care: PPO plans cover out-of-network care, but at a higher cost.

- Flexibility: PPO plans offer more flexibility in terms of choosing healthcare providers.

- Cost: PPO plans tend to be more expensive than HMO plans.

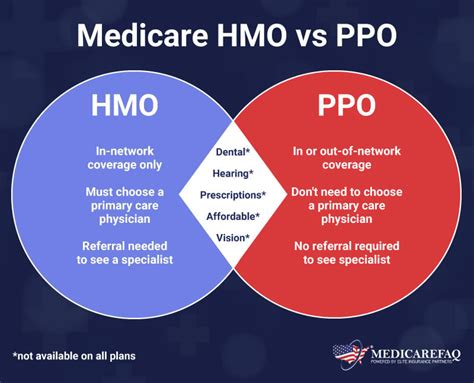

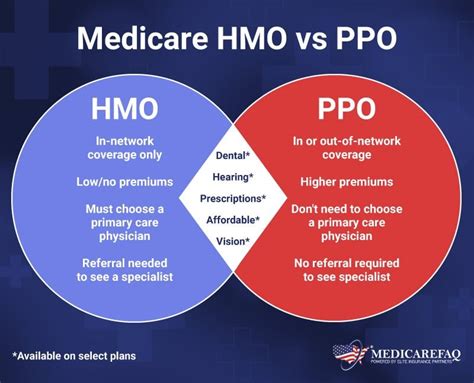

Key Differences Between HMO and PPO Plans

Here are the key differences between HMO and PPO plans:

- Network: HMO plans have a more restrictive network than PPO plans.

- Referrals: HMO plans require referrals to see specialists, while PPO plans do not.

- Out-of-network care: HMO plans usually do not cover out-of-network care, while PPO plans do.

- Cost: HMO plans tend to be more affordable than PPO plans.

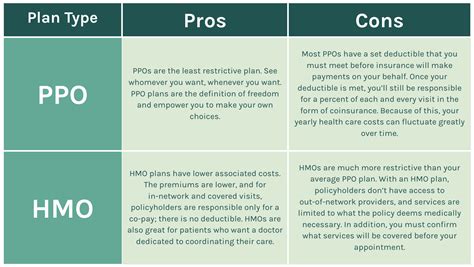

Benefits of HMO Plans

Here are some benefits of HMO plans:

- Lower premiums: HMO plans tend to have lower premiums than PPO plans.

- Predictable costs: HMO plans have predictable costs, as you know what you'll pay for healthcare services.

- Preventive care: HMO plans often cover preventive care services, such as routine check-ups and screenings.

Drawbacks of HMO Plans

Here are some drawbacks of HMO plans:

- Limited network: HMO plans have a limited network of healthcare providers.

- Referrals required: HMO plans require referrals to see specialists.

- Out-of-network care not covered: HMO plans usually do not cover out-of-network care.

Benefits of PPO Plans

Here are some benefits of PPO plans:

- Flexibility: PPO plans offer more flexibility in terms of choosing healthcare providers.

- Out-of-network care covered: PPO plans cover out-of-network care, although at a higher cost.

- No referrals required: PPO plans do not require referrals to see specialists.

Drawbacks of PPO Plans

Here are some drawbacks of PPO plans:

- Higher premiums: PPO plans tend to have higher premiums than HMO plans.

- Higher out-of-network costs: PPO plans have higher out-of-network costs.

- More complex: PPO plans can be more complex to understand and navigate.

Which Plan is Right for You?

Choosing between an HMO and PPO plan depends on your individual needs and preferences. Here are some factors to consider:

- Network: If you have a preferred healthcare provider, check if they are in the network of the plan you're considering.

- Cost: If you're on a tight budget, an HMO plan may be more affordable.

- Flexibility: If you want more flexibility in choosing healthcare providers, a PPO plan may be a better option.

Ultimately, it's essential to carefully review the details of each plan and consider your individual needs before making a decision.

Conclusion

In conclusion, HMO and PPO plans are two popular types of health insurance plans that have their benefits and drawbacks. Understanding the differences between these plans can help you make an informed decision about your health insurance coverage.

If you're looking for a more affordable option with a predictable cost structure, an HMO plan may be the way to go. However, if you want more flexibility in choosing healthcare providers and are willing to pay a higher premium, a PPO plan may be a better option.

We hope this article has provided you with a comprehensive understanding of HMO and PPO plans. If you have any further questions or concerns, please don't hesitate to comment below.

What is the main difference between HMO and PPO plans?

+The main difference between HMO and PPO plans is the level of flexibility in choosing healthcare providers. HMO plans have a more restrictive network and require referrals to see specialists, while PPO plans have a more flexible network and do not require referrals.

Which plan is more affordable?

+HMO plans tend to be more affordable than PPO plans, as they have a more restrictive network and lower premiums.

Can I see out-of-network providers with an HMO plan?

+HMO plans usually do not cover out-of-network care, except in emergency situations. If you see an out-of-network provider, you may be responsible for the full cost of the care.