Intro

Discover the 5 often-overlooked expense accounts that can impact your businesss bottom line. Learn how to identify and manage hidden costs, including credit card fees, bank charges, and more. Optimize your financial records with these expert tips and ensure accurate expense tracking, budgeting, and tax compliance.

As a business owner or employee, it's essential to understand what constitutes an expense account to ensure accurate financial reporting and tax compliance. While many expenses are obvious, such as travel costs or office supplies, there are some items that may not be considered expense accounts. In this article, we'll explore five things that are not typically considered expense accounts.

1. Personal Expenses

Personal expenses are not considered business expense accounts, even if they are incurred while conducting business. For example, if you buy a new suit for a business meeting, the cost of the suit is not deductible as a business expense. However, if you purchase a uniform or specific attire required for your job, it may be considered a business expense.

Why Personal Expenses Are Not Business Expenses

Personal expenses are not considered business expenses because they are not incurred solely for the benefit of the business. The IRS requires that business expenses be "ordinary and necessary" for the business to operate. Personal expenses, on the other hand, are incurred for personal benefit and are not deductible as business expenses.

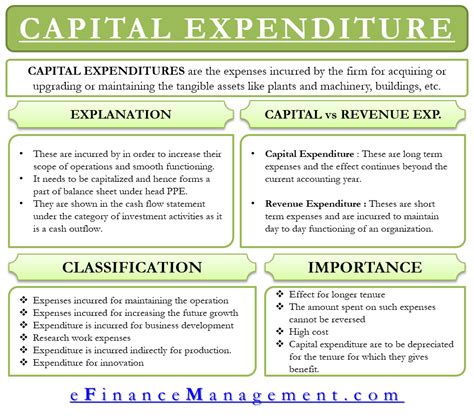

2. Capital Expenditures

Capital expenditures are not considered expense accounts because they are not incurred for the benefit of the current tax year. Capital expenditures are investments in assets that will benefit the business over several years, such as purchasing a new building or equipment.

Why Capital Expenditures Are Not Business Expenses

Capital expenditures are not considered business expenses because they are not deductible in the current tax year. Instead, they are depreciated over their useful life, providing a tax benefit in future years.

3. Fines and Penalties

Fines and penalties are not considered expense accounts because they are not incurred for the benefit of the business. Fines and penalties are incurred as a result of non-compliance with laws or regulations and are not deductible as business expenses.

Why Fines and Penalties Are Not Business Expenses

Fines and penalties are not considered business expenses because they are not incurred for the benefit of the business. The IRS requires that business expenses be "ordinary and necessary" for the business to operate. Fines and penalties do not meet this requirement.

4. Political Contributions

Political contributions are not considered expense accounts because they are not incurred for the benefit of the business. Political contributions are made to support a particular candidate or cause and are not deductible as business expenses.

Why Political Contributions Are Not Business Expenses

Political contributions are not considered business expenses because they are not incurred for the benefit of the business. The IRS requires that business expenses be "ordinary and necessary" for the business to operate. Political contributions do not meet this requirement.

5. Business Gifts

Business gifts are not considered expense accounts because they are not incurred for the benefit of the business. Business gifts are made to promote goodwill or to build relationships with customers or vendors.

Why Business Gifts Are Not Business Expenses

Business gifts are not considered business expenses because they are not incurred for the benefit of the business. The IRS requires that business expenses be "ordinary and necessary" for the business to operate. Business gifts do not meet this requirement.

In conclusion, it's essential to understand what constitutes an expense account to ensure accurate financial reporting and tax compliance. By understanding what is not considered an expense account, businesses can avoid errors and ensure that they are taking advantage of all eligible deductions.

We encourage you to share your thoughts on this topic in the comments below. What other items do you think should not be considered expense accounts? Share your experiences and insights with us!

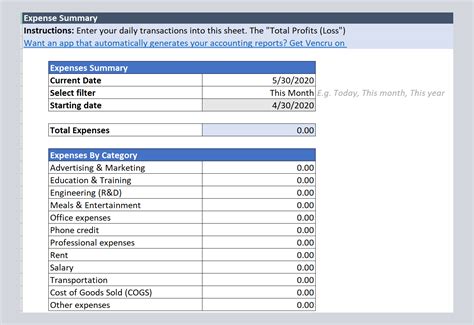

What is an expense account?

+An expense account is a type of account that is used to track and record business expenses. It is a way to separate personal expenses from business expenses and to ensure that business expenses are accurately recorded and reported.

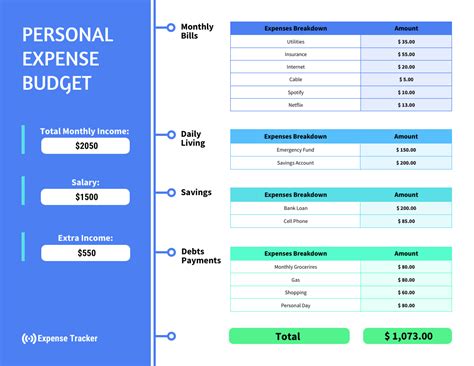

What is the difference between a personal expense and a business expense?

+A personal expense is an expense that is incurred for personal benefit, while a business expense is an expense that is incurred for the benefit of the business. Business expenses are deductible as business expenses, while personal expenses are not.

Can I deduct fines and penalties as business expenses?

+No, fines and penalties are not deductible as business expenses. They are considered personal expenses and are not eligible for deduction.