Intro

Discover the latest Washington D.C. per diem rates and guidelines for government contractors, business travelers, and federal employees. Learn about the General Services Administration (GSA) rates, meal allowances, and lodging expenses. Understand the Federal Travel Regulation (FTR) and how to calculate your per diem for a smooth and compliant trip to the nations capital.

Washington D.C. is a hub for business travelers, government officials, and contractors, with many individuals visiting the nation's capital for work-related purposes. When it comes to reimbursing employees for expenses incurred while traveling, per diem rates play a crucial role. In this article, we'll delve into the world of Washington D.C. per diem rates and guidelines, explaining the ins and outs of this complex topic.

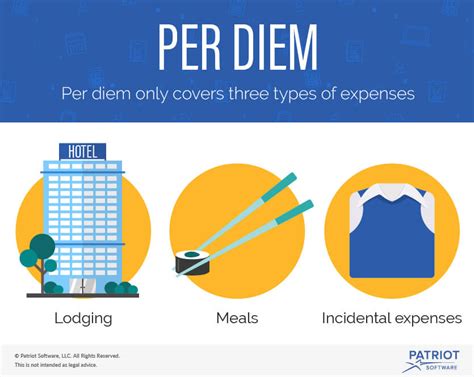

For those unfamiliar with the term, per diem rates refer to the daily allowances provided to employees for expenses such as lodging, meals, and incidentals while traveling on business. These rates are designed to reimburse employees for their out-of-pocket expenses, ensuring they're not out of pocket for work-related costs.

Understanding Per Diem Rates in Washington D.C.

Washington D.C. per diem rates are established by the General Services Administration (GSA), which sets the maximum reimbursement rates for federal employees traveling on official business. These rates are based on the locality and are adjusted annually to reflect changes in costs.

The GSA provides a breakdown of per diem rates for Washington D.C., which includes:

- Lodging: This rate covers the cost of a hotel room or other lodging accommodations.

- Meals and incidentals: This rate includes expenses for food, snacks, and other miscellaneous costs.

Washington D.C. Per Diem Rates for 2022

As of 2022, the Washington D.C. per diem rates are as follows:

- Lodging: $184 per night

- Meals and incidentals: $74 per day

These rates are subject to change, so it's essential to check the GSA website for the most up-to-date information.

Guidelines for Using Per Diem Rates in Washington D.C.

While per diem rates provide a general guideline for reimbursing employees, there are specific rules and regulations to follow. Here are some key guidelines to keep in mind:

- Reimbursement: Employees can be reimbursed for actual expenses incurred while traveling, up to the maximum per diem rate.

- Receipts: Employees must provide receipts for all expenses incurred, including lodging, meals, and incidentals.

- Meal expenses: Meal expenses can be reimbursed at the per diem rate, but employees must provide receipts for all meals.

- Incidentals: Incidentals, such as tips and parking fees, can be reimbursed at the per diem rate.

Special Considerations for Washington D.C. Per Diem Rates

There are some special considerations to keep in mind when using per diem rates in Washington D.C.:

- High-cost areas: Certain areas within Washington D.C., such as Georgetown and Dupont Circle, may have higher per diem rates due to the high cost of living.

- Special events: During special events, such as the Cherry Blossom Festival, per diem rates may be higher due to increased demand for lodging and other services.

- Government contractors: Government contractors may be subject to different per diem rates and guidelines, so it's essential to check with the relevant government agency for specific information.

Benefits of Using Per Diem Rates in Washington D.C.

Using per diem rates in Washington D.C. offers several benefits for employees and employers alike:

- Simplified reimbursement: Per diem rates simplify the reimbursement process, eliminating the need for employees to track and submit individual expenses.

- Increased efficiency: Per diem rates streamline the reimbursement process, reducing administrative time and costs.

- Fair reimbursement: Per diem rates ensure that employees are fairly reimbursed for their expenses, reducing the risk of under- or over-reimbursement.

Challenges and Limitations of Per Diem Rates in Washington D.C.

While per diem rates offer several benefits, there are also some challenges and limitations to consider:

- Inaccurate rates: Per diem rates may not accurately reflect the actual costs of living in Washington D.C., leading to under- or over-reimbursement.

- Complexity: Per diem rates can be complex and difficult to understand, particularly for employees who are new to the system.

- Limited flexibility: Per diem rates may not provide sufficient flexibility for employees who have unique expenses or requirements.

Best Practices for Implementing Per Diem Rates in Washington D.C.

To ensure a smooth and efficient per diem system, here are some best practices to follow:

- Clearly communicate per diem rates: Ensure that employees understand the per diem rates and guidelines.

- Provide receipts and documentation: Require employees to provide receipts and documentation for all expenses.

- Regularly review and update per diem rates: Regularly review and update per diem rates to reflect changes in costs and ensure fairness.

Conclusion

Washington D.C. per diem rates and guidelines play a critical role in reimbursing employees for expenses incurred while traveling on business. By understanding the ins and outs of per diem rates, employers can ensure a fair and efficient reimbursement system that benefits both employees and the organization as a whole.

What are per diem rates in Washington D.C.?

+Per diem rates in Washington D.C. refer to the daily allowances provided to employees for expenses such as lodging, meals, and incidentals while traveling on business.

How are per diem rates in Washington D.C. determined?

+Per diem rates in Washington D.C. are determined by the General Services Administration (GSA), which sets the maximum reimbursement rates for federal employees traveling on official business.

What are the benefits of using per diem rates in Washington D.C.?

+The benefits of using per diem rates in Washington D.C. include simplified reimbursement, increased efficiency, and fair reimbursement for employees.