Intro

Unlock the secrets of pre-adverse action meaning and its implications on employment and lending decisions. Learn the 5 crucial ways to understand this critical concept, including its relation to FCRA, consumer rights, and dispute resolution. Discover how to navigate pre-adverse action letters, notifications, and the importance of accurate reporting.

As an employer, navigating the complexities of the hiring process can be daunting, especially when it comes to ensuring compliance with federal regulations. One crucial aspect of this process is understanding the concept of pre-adverse action, a critical step in the Fair Credit Reporting Act (FCRA) that protects both employers and job applicants. In this article, we will delve into the world of pre-adverse action, exploring its meaning, importance, and the steps involved, providing you with a comprehensive guide to ensure you're making informed decisions.

What is Pre-Adverse Action?

Pre-adverse action refers to the process an employer must follow before taking adverse action against a job applicant based on information obtained from a consumer report. This report can include credit reports, background checks, and other forms of consumer data. The primary purpose of pre-adverse action is to provide the applicant with an opportunity to review the report, dispute any inaccuracies, and understand how the information may affect their employment status.

The Importance of Pre-Adverse Action

Understanding pre-adverse action is crucial for several reasons:

- Compliance with FCRA: The FCRA mandates that employers follow specific procedures before denying employment based on information in a consumer report. Failure to comply can result in legal consequences.

- Protection of Applicants' Rights: Pre-adverse action ensures that applicants are aware of the information being used against them and have a chance to correct any errors.

- Fair Hiring Practices: By providing applicants with an opportunity to dispute information, employers can ensure that hiring decisions are based on accurate data.

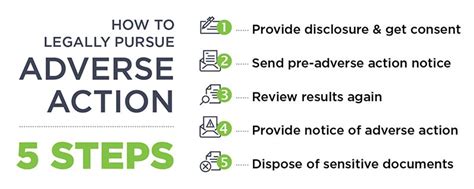

Steps Involved in Pre-Adverse Action

The pre-adverse action process involves several key steps:

- Notification: The employer must provide the applicant with a copy of the consumer report and a summary of their rights under the FCRA.

- Reason for Adverse Action: The employer must inform the applicant of the reason for the potential adverse action, specifically highlighting the information in the report that led to this decision.

- Opportunity to Dispute: The applicant is given a reasonable amount of time (usually 5-7 days) to review the report, dispute any inaccuracies, and provide additional information that may impact the hiring decision.

- Reinvestigation: If the applicant disputes the report, the employer must reinvestigate and verify the information.

- Final Decision: After the reinvestigation, the employer makes a final decision regarding the applicant's employment status.

Best Practices for Employers

To ensure compliance and fairness, employers should:

- Clearly Document the Process: Maintain detailed records of the pre-adverse action process, including notifications, disputes, and final decisions.

- Provide Adequate Time for Dispute: Ensure applicants have sufficient time to review the report and dispute any inaccuracies.

- Train Hiring Managers: Educate hiring managers on the pre-adverse action process and the importance of compliance.

Common Mistakes to Avoid

Employers should be aware of the following common mistakes:

- Failure to Provide Notification: Omitting to notify applicants of their rights and the reason for adverse action can lead to legal issues.

- Insufficient Time for Dispute: Not providing applicants with adequate time to dispute information can result in unfair hiring practices.

Conclusion

Understanding pre-adverse action is a critical component of the hiring process, ensuring compliance with federal regulations and protecting both employers and job applicants. By following the steps outlined and adhering to best practices, employers can navigate this complex process with confidence. Remember, fairness and transparency are key in making informed hiring decisions.

We invite you to share your thoughts on pre-adverse action and its importance in the hiring process. Have you encountered any challenges or successes in implementing this process? Share your experiences in the comments below and help us create a more informed community.

What is the purpose of pre-adverse action?

+The primary purpose of pre-adverse action is to provide the applicant with an opportunity to review the report, dispute any inaccuracies, and understand how the information may affect their employment status.

How long does an applicant have to dispute information in a consumer report?

+Applicants are usually given 5-7 days to review the report and dispute any inaccuracies.

What happens after an applicant disputes information in a consumer report?

+If the applicant disputes the report, the employer must reinvestigate and verify the information before making a final decision regarding the applicant's employment status.