Intro

Discover the latest Per Diem Rates for US State Department travel, covering lodging, meals, and incidentals for federal employees and contractors. Explore the 2023 rates for domestic and foreign travel, including allowances for specific countries and cities. Maximize your reimbursement with our comprehensive guide to State Department per diem rates and regulations.

Traveling for work can be a thrilling experience, but it can also be expensive. To help alleviate some of the financial burdens, the US State Department provides per diem rates for its employees who travel for work. But what exactly are per diem rates, and how do they work?

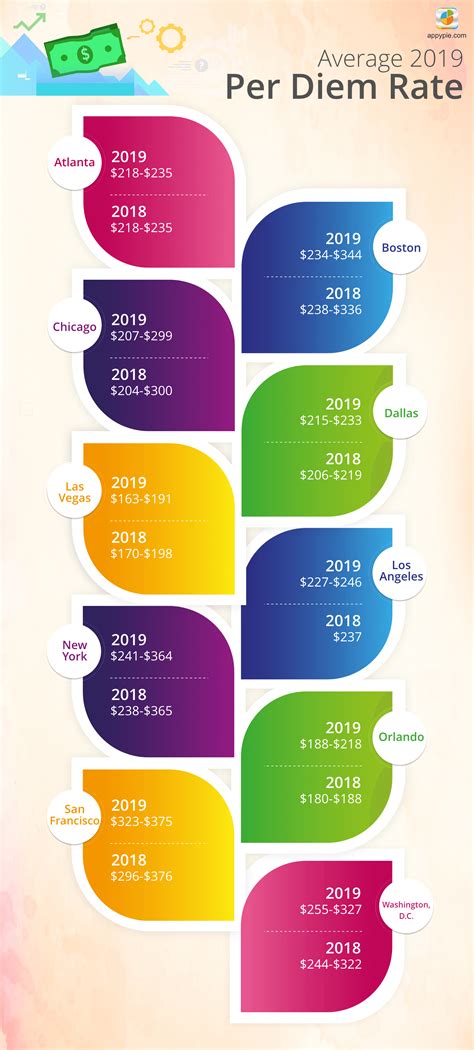

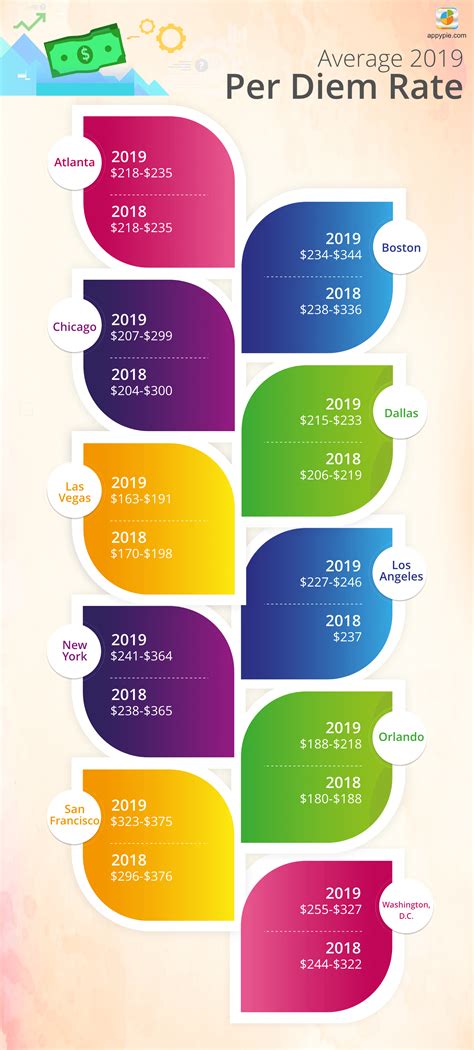

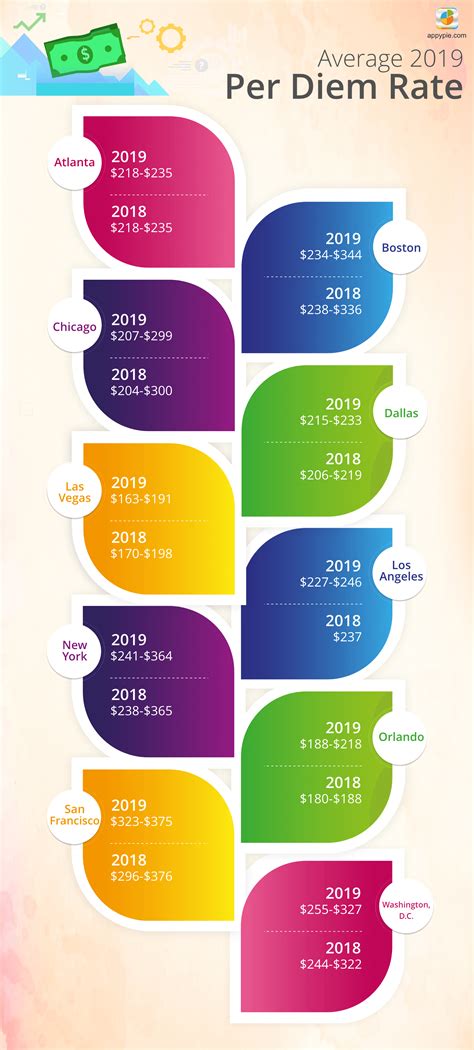

Per diem rates are daily allowances that cover the costs of meals, lodging, and other expenses incurred while traveling for work. The US State Department sets these rates annually, based on the cost of living in different locations around the world. The rates vary depending on the location, with more expensive cities like New York or Tokyo having higher rates than less expensive cities like Omaha or Des Moines.

For US State Department employees, per diem rates are an essential part of their travel reimbursement package. These rates help to ensure that employees are adequately compensated for their expenses while traveling, without having to incur significant out-of-pocket costs.

How Per Diem Rates Work

Per diem rates are calculated based on the location of the travel destination. The US State Department uses a variety of sources to determine the cost of living in different locations, including:

- The Department of Labor's Bureau of Labor Statistics

- The General Services Administration (GSA)

- The Internal Revenue Service (IRS)

These sources provide data on the average cost of meals, lodging, and other expenses in different locations. The US State Department then uses this data to calculate the per diem rates for each location.

Breakdown of Per Diem Rates

Per diem rates typically include three components:

- Lodging: This covers the cost of a hotel room or other accommodation.

- Meals and Incidental Expenses (M&IE): This covers the cost of meals, snacks, and other incidental expenses.

- Transportation: This covers the cost of transportation to and from the destination, as well as any local transportation costs.

The per diem rates for each location are calculated based on the average cost of these expenses. For example, if the average cost of a hotel room in New York City is $200 per night, and the average cost of meals and incidental expenses is $60 per day, the per diem rate for New York City might be $260 per day.

Benefits of Per Diem Rates

Per diem rates provide several benefits for US State Department employees who travel for work. Some of the benefits include:

- Simplified expense reporting: With per diem rates, employees do not need to keep track of every single expense. Instead, they can simply claim the per diem rate for each day of travel.

- Reduced out-of-pocket costs: Per diem rates help to ensure that employees are adequately compensated for their expenses, reducing the need for out-of-pocket costs.

- Increased transparency: Per diem rates provide a clear and transparent way of calculating expenses, making it easier for employees to understand what they are entitled to.

Challenges of Per Diem Rates

While per diem rates provide several benefits, there are also some challenges associated with them. Some of the challenges include:

- Inaccurate rates: If the per diem rates are not accurately calculated, employees may not receive adequate compensation for their expenses.

- Limited flexibility: Per diem rates can be inflexible, making it difficult for employees to adjust their expenses based on individual circumstances.

- Complexity: Per diem rates can be complex to calculate, particularly for international travel.

Per Diem Rates for Specific Locations

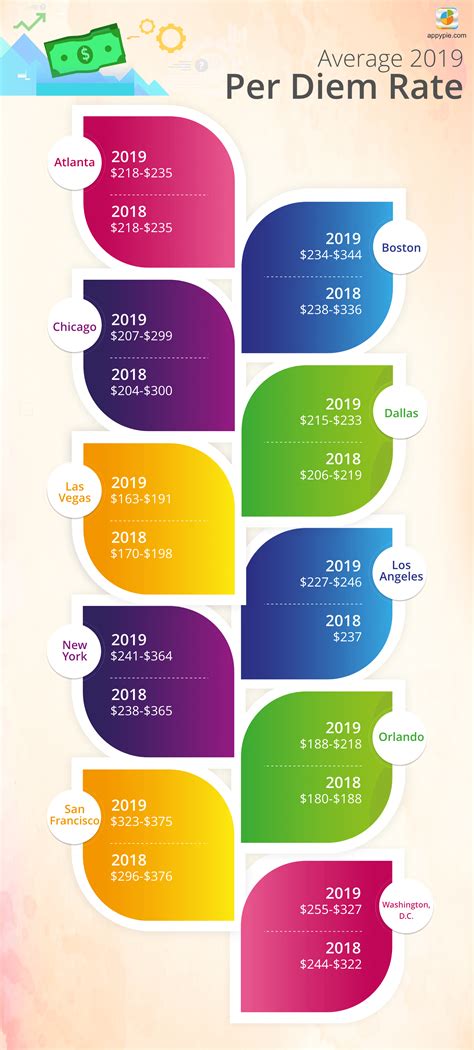

Per diem rates vary depending on the location. Here are some examples of per diem rates for specific locations:

- New York City, NY: $260 per day

- Los Angeles, CA: $220 per day

- Chicago, IL: $200 per day

- London, UK: $280 per day

- Tokyo, Japan: $320 per day

These rates are subject to change, and may vary depending on the specific location within the city.

How to Claim Per Diem Rates

To claim per diem rates, US State Department employees must follow the proper procedures. This typically involves:

- Submitting a travel voucher: Employees must submit a travel voucher to the US State Department, which includes the dates of travel, the location, and the per diem rate.

- Providing receipts: Employees may be required to provide receipts for certain expenses, such as lodging or transportation.

- Completing a travel report: Employees may be required to complete a travel report, which includes information about the trip, including the per diem rate.

Conclusion

Per diem rates are an essential part of the US State Department's travel reimbursement package. By providing a daily allowance for meals, lodging, and other expenses, per diem rates help to ensure that employees are adequately compensated for their expenses while traveling. While there are some challenges associated with per diem rates, the benefits of simplified expense reporting, reduced out-of-pocket costs, and increased transparency make them an important tool for US State Department employees.

We hope this article has provided you with a better understanding of per diem rates for US State Department travel. If you have any questions or comments, please feel free to share them below.

What are per diem rates?

+Per diem rates are daily allowances that cover the costs of meals, lodging, and other expenses incurred while traveling for work.

How are per diem rates calculated?

+Per diem rates are calculated based on the location of the travel destination, using data from sources such as the Department of Labor's Bureau of Labor Statistics, the General Services Administration (GSA), and the Internal Revenue Service (IRS).

What are the benefits of per diem rates?

+The benefits of per diem rates include simplified expense reporting, reduced out-of-pocket costs, and increased transparency.